So you’ve started the almighty accrual accounting process of tracking accounts receivables. Congratulations?

It’s almost inevitable you would now be searching for “accounts receivables problems” (or some such variation) to help you prevent or avoid some of the most common small business cash flow issues.

Accounts receivable management is the infrastructure that supports every business’ cash flow. If you’re concerned about cash flow, you’re not alone — when Canadian businesses were surveyed by the Government of Canada at the end of 2021, 45% of businesses that could not take on more debt cited cash flow as the reason they couldn’t.

Keep reading for the account receivables solutions to your problems, including opportunities for automation that prevent problems before they drop out of the sky.

Sign up for a Free Trial today.

SHORTCUTS

-

How can accounts receivable automation help accounts receivable management?

-

How can you overcome accounts receivable processing pain points with Plooto?

- 3 Ways to reduce accounts receivable errors

What are the top accounts receivable challenges?

Top accounts receivables challenges are collecting late payments, correcting data and reporting errors, anticipating bad debt in your financial statements, and wasting time on manual processes.

What is the best solution for accounts receivable problems?

The best solution for accounts receivable problems is a combination of policies and technologies. Clear credit and collections policies prevent late payments and make it easier to collect them when they happen. Technologies can automate your accounts receivables process with payment reminders and data accuracy.

What tasks can accounts receivable software automate?

Accounts receivable software can automate electronic invoicing and payments, payment reminders, data reconciliation, and reporting financial statements to your leadership team.

How can accounts receivable automation help accounts receivable management?

Accounts receivable automation helps businesses maintain cash flow and data accuracy in their financial reporting while eliminating manual processes and error correction.

How to reduce manual accounts receivable management

Weaning your business off a manual and paper-based accounts receivable process requires some upfront time investment, but you’ll end up gaining that time back in the long run. Here we’ll walk you through the steps to set up your automated accounts receivable process:

1. Gather your financial documents.

Start with clean data by gathering and auditing your financial statements, customer contracts (including credit and payment terms), and outstanding payments. You’ll need to gather this information so you can input the data into your accounting software.

2. Invest in an accounting software solution like Quickbooks or Xero.

Most businesses use accounting software like Quickbooks or Xero to manage their bookkeeping. Start by trialing a few options and choosing one that works for the needs of your business.

3. Make it easy for customers to pay you.

Automate invoicing and payment with software that integrates with your accounting solution. Offer your customers multiple options to pay you by credit card, EFT payments, ACH payments, e-transfers, etc. If your customers are in more than one country, make it easy to send payments in multiple currencies.

4. Connect your accounting software to your payments software.

Software integrations are where you’ll see most of the benefits of automation. Make sure your accounting solution reports back to your payments solution, and vice versa. This will come in handy later when you want to reconcile data between your payments and your books (no more manual data entry!).

5. Create your customer contacts.

Now that your software is set up, create your customer contacts with key information, like their legal business name, billing address, mailing address, currency, payment terms, payment method, and latest invoice — noting whether or not you need to send a reminder about late payment.

6. Set up pre-authorized debit (PAD) agreements for recurring payments.

This step is optional but can go a long way to “setting and forgetting” recurring payments. You can set up a PAD agreement through an automated payment platform, through which the customer authorizes payments to be taken from their bank account automatically based on your credit terms. When a payment is made, the record will sync back to your accounting software.

7. Start sending invoices with automated reminders and messages.

Now you’re ready to start sending invoices! Your invoice should include your contact information, the company’s contact information, the balance due, payment terms, balance due dates, and line items describing products and services rendered. As a last step, write and schedule automated reminders to customers upon due date, three days later, one week later, etc.

8. Set up auto-reconciliation for data syncing.

Before payments start to come in, make sure the data from your payment processing software is flowing back to your accounting software. This will eliminate manual data entry when your business records a payment. Automated payments with accounting software integrations save companies an average of 20-40 hours per week.

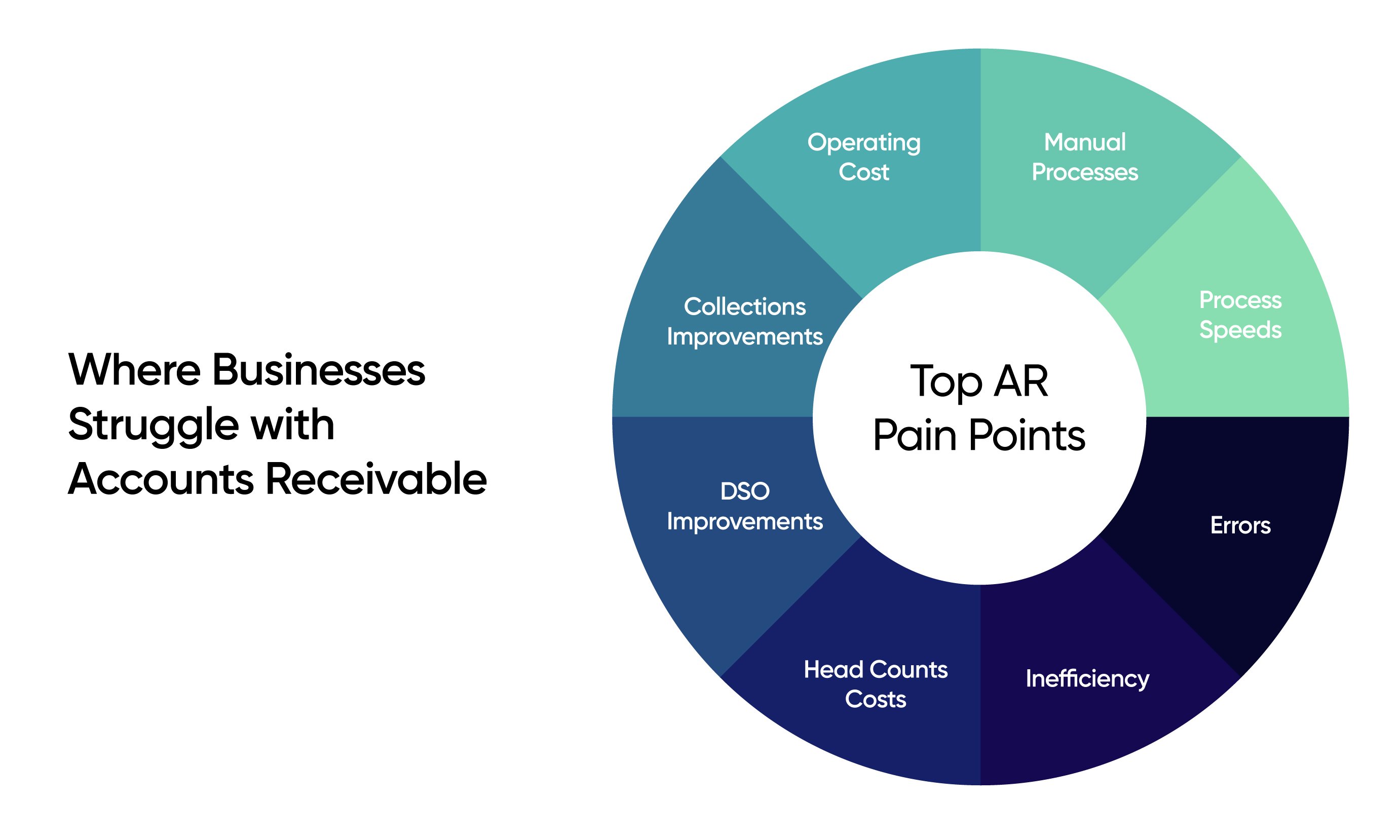

Top accounts receivable processing problems

-

Operating costs

-

Manual processes

-

Process speeds

-

Errors

-

Inefficiency

-

Head counts costs

-

DSO improvement

-

Collections improvements

Before you start to solve problems, you’ll need to first diagnose them. Here we’ll break down the most common accounts receivable processing pain points into specific problems your business may be facing, so you can focus on solving the ones affecting your business at this time.

Operating costs

Accounts receivables are recorded on your balance sheet in a couple of ways.

The first is straightforward: Accounts receivables are recorded as assets on your balance sheet. Because accounts receivables are revenue your business expects to see in a certain period of time, accrual accounting counts them as revenue.

But then there’s allowance for uncollectible accounts, otherwise known as bad debt. Bad debt is what your business can’t collect on, or accounts receivables that will never be received. Your bad debt is recorded as an operating cost, which means you have that much less money to operate your business.

Solutions: Conduct credit checks on all customers before entering into agreements. Set up clear payment terms in an enforceable written contract with every customer. Use payment reminders to prevent late payment. When possible, set up PAD agreements for all recurring payments.

Manual processes

Most organizations use double-entry accounting, which is a bookkeeping system that requires a credit entry to one account and a corresponding debit entry to another account. When this process is manual over many years and across several staff members with varying levels of skill and experience, errors are bound to happen.

Manual invoicing comes with its own set of challenges. When you’re sending paper invoices and receiving payments by check, you increase the risk of late payment because you don’t have a process to remind customers to pay.

Solutions: Set up an integrated accounting and payments software solution that allows you to auto-reconcile accounts with one click. Send electronic invoice reminders automatically when payment is late.

Process speeds

The accounts receivable process can be broken down into several steps: setting up customer records, sending invoices, receiving payments, chasing down payments, and reconciling accounts.

Each step is admin time that instead could be spent on growing and improving your business. Chasing late payments, for example, could take a staff member one or several days, depending on the size of your customer base. But data reconciliation is really where your team is taking a hit on speed: According to a PWC report, finance teams spend 30% of their time collecting data and reconciling it between systems.

Solution: Automate your accounting and payment processes. Automated payments with accounting software integrations save companies an average of 20-40 hours per week.

Errors

Reporting errors lead to an inaccurate view of your business. Some of the most common accounts receivable errors are:

- Invoice errors: dollar amount, quantity of goods, payment due date, tax rate, etc.

- Remittance matching errors: matching full, partial, or advance payment receipts with invoicing

- Reconciliation errors: keeping your balance sheet up to date when payments are made

Data errors lead to inaccurate reporting, which could lead to uninformed business decisions. If you think you have more cash flow than you do, you could be spending money you don’t have. On the flip side, if you think your cash flow is worse than it is, you could be holding back on expenses that could grow your business.

Solution: Use accounting software integrated with payments software to centralize data across channels and get accurate reporting everywhere.

Inefficiency

Did you know you can measure the efficiency of your accounts receivables with a formula?

The accounts receivable turnover ratio measures how efficiently your business collects payment. Specifically, the formula measures the number of times you collect your average accounts receivable within a certain period of time. Here’s the formula:

Net Credit Sales (Sales on credit – Sales returns – Sales allowances) / Average Accounts Receivable (Sum of starting and ending accounts receivable / 2)

The higher the number, the more efficiently your business is collecting payment from customers. If your number is low, it could mean you don’t have good credit or payment policies in place or that you have a lot of bad debt.

Solutions: Use PAD agreements for recurring payments. Use automated payment reminders to send messages when payments are late.

Head counts costs

If you haven’t automated your accounts receivable process with electronic invoicing, odds are a human or several humans are doing the job of sending invoices and chasing payments.

While there’s another discussion to be had about technology replacing jobs, your business may be spending more than it needs to on staff. With automated payment reminders, auto-reconciliation of data between records, and electronic payment, some things no longer need to be done by humans. You may find that your employees could be working on other tasks to help grow your business.

Solution: Identify staff members who spend the most time on manual invoicing and reconciliation. Calculate hours spent on such tasks multiplied by their hourly rate. Find an accounting solution and payment solution that costs less than this number.

DSO improvement

Days Sales Outstanding (DSO) measures cash flow by calculating the number of days it takes your business to convert accounts receivables into cash (in other words, how long it takes you to get paid).

You can calculate DSO with this formula:

(Accounts receivables / Total sales) * number of days

So what number should you be looking for? Well, a 2019 survey by Allianz Trade found that it takes U.S. businesses an average of 51 days to collect payment. In Canada, the average DSO was 52 days.

If you can lower this number, it means you’re collecting payment faster.

Solutions: Reassess customer credit risk criteria. Review payment terms and include shorter terms for new customers when it makes sense. Automate payment reminders.

Collections improvements

The most painful accounts receivable pain point is not being able to collect payment. Oftentimes, it’s not that your customers can’t pay — it may be that your process could use some improvement.

When you’ve reached the point where you need to contact a customer to collect on a past due payment, there’s always the concern that your relationship with that customer will suffer. Collections are awkward — but you can get around this by being proactive instead.

Proactive payment reminders with friendly, personalized messages can go a long way to making sure you get paid on time. But when you do need to collect on a past due payment, it’s better to act fast with reminders that kick in after one day or one week — not one month later when the awkwardness is palpable.

Other solutions: Offer an early payment discount when your cash flow is suffering. Offer payment plans when otherwise good customers are having a hard time paying you. More options often lead to at least some improvement in cash flow.

Accounts receivable management best practices

Now that you know how to solve common accounts receivables pain points, here are some overall best practices to fortify your process after you’re done putting out fires.

Automate invoicing

Manual and paper-based accounts receivable processes involve creating and sending a physical invoice, receiving a check in the mail, and recording the payment manually in multiple places in a physical ledger or accounting software.

Electronic invoices eliminate a lot of these steps and speed up the process of getting paid. When you send invoices through email and receive payment electronically, you’ll get paid much faster even for those customers who pay on time after they receive a physical invoice.

Send and track multi-channel reminders

If you want to get paid on time, you’ll need to remind your customers of their payment due date. Email and text reminders, written and scheduled in advance through automation software, do wonders for making sure customers remember to pay you.

When customers are late with payments, you’ll need to follow up. Similar to reminders, you should be able to write and schedule a standard note that can go out on the day a payment is due, then three days, one week, and maybe two weeks later.

Make paying easier

When you make payment easier for your customers, you’re removing what’s called “friction”, which is anything that’s considered a barrier to making the payment. An example of friction is going to the mailbox or post office to mail a check—this is a time-consuming task that takes time out of someone’s day, as opposed to making a payment online from the comfort of their desk chair.

When it comes to getting paid, the more options, the better. Offer your customers the choice to pay you by credit card, EFT payments, ACH payments, and e-transfers, etc. If you have customers in other countries, make it easy for them to send payments in multiple currencies.

How can you overcome accounts receivable processing pain points with Plooto?

Plooto helps businesses manage their invoices and payments from a centralized place. With accounting software integrations, Plooto’s auto-reconciliation feature keeps your financial records up to date — when you get paid, your books are updated automatically.

Getting paid on time is easier when you’re using Plooto’s automated reminders to communicate with customers. When Plooto customers combine the time they’re saving on reconciling their books with the time it usually takes to follow up with customers on payment, they’re saving between 20-40 hours per week.

3 ways to reduce accounts receivable errors

- Eliminate data entry.

- Store all invoices, related documents, and payment history in one place.

- Incentivize faster payments by letting customers pay online.

Here are three ways you can avoid some of the most common accounts receivable processing pain points with Plooto:

1. Eliminate data entry.

Plooto “talks to” accounting software like Quickbooks and Xero. When you get paid through Plooto, that payment is recorded in your financial records on Quickbooks, for example, so you don’t have to worry about manually entering the payment. You’ll still see the outcomes of double-entry accounting in your books without any of the manual entry.

2. Store all invoices, related documents, and payment history in one place.

Payments create quite the paper trail. Contact records, banking information, payment agreements, invoices, receipt records … the documentation required just to get paid can seem overwhelming. Plooto centralizes all payment documentation in one place, all associated with the proper contacts — so you’re never left wondering how to access a document you need quickly.

3. Incentivize faster payments by letting customers pay online.

Remember when we mentioned that more options are better for getting paid? Plooto removes all the friction by making it as easy as possible for your customers to pay you. Accept payments in multiple currencies to grow a global business, or let your customers pay you by credit card and receive payment in as little as two days. Even better, let some customers set up recurring bank transactions so that paying is taken off their to-do list entirely.

Accounts receivables don’t need to be painful. Your business can gain a lot from automating a process that was once time-consuming, tedious, and not-so-fun for everyone. With Plooto, you’ll see a smooth accounts receivable process, which looks like:

- Better overall cash flow

- Higher accounts receivable turnover ratio

- Lower day sales outstanding (DSO)

- Reduction in labor costs

- Accurate reporting across multiple financial reports

- Decrease in data errors

Sign up for a Free Trial today

CHAPTERS

00 Everything you need to know about today's B2B payments

01 Rethinking B2B payment processing

02 From pain to gain: Solutions for Accounts Receivable problems