"Since switching to Plooto, we’ve cut the amount of time we spend on bill payments

by around 70%. It’s a massive difference.

Now everything is digital, streamlined,

and secure.”

Learn more >

Accounts payable

software that will change your business

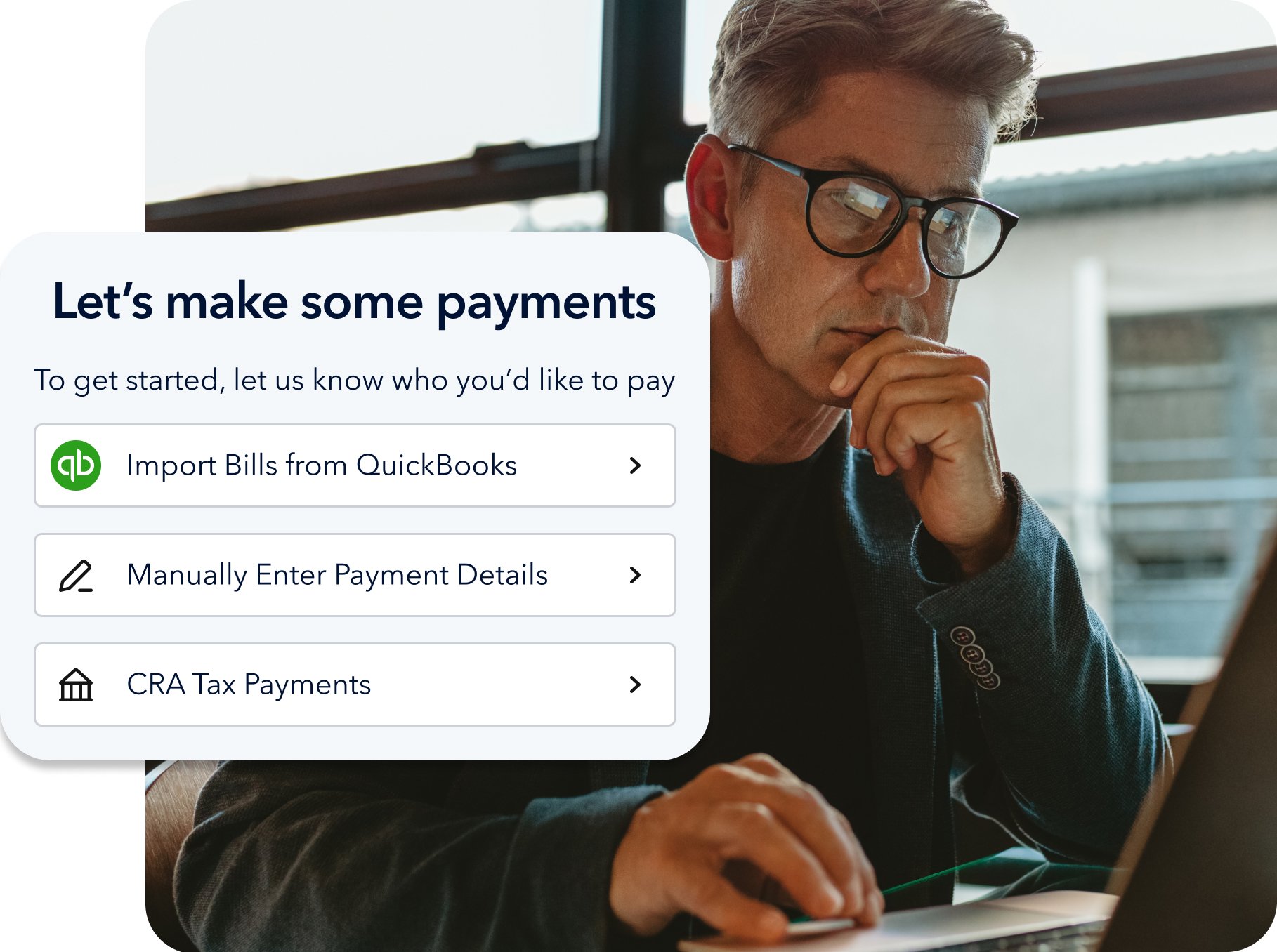

Customize, automate, and schedule your payments with ease using Plooto’s all-in-one accounts payable automation software.

Our powerful AP automation software helps businesses and accounting firms streamline their accounts payable workflows, reduce manual data entry, and improve payment accuracy.

Manage your entire accounts payable process from a single, secure platform—so you can take control of your cash flow and scale with confidence.

Stay on top of your cash. And get ahead—way ahead.

Whether you're an SMB navigating growth or an accounting firm managing multiple clients, Plooto’s intuitive accounts payable software gives you full visibility into your cash flow. Gain the control you need to make confident financial decisions, reduce operational inefficiencies, and grow faster with streamlined AP automation.

Customize your workflow, your way

Build custom approval workflows that match your business or client needs. Plooto’s flexible accounts payable automation software lets you automate, route, and customize every stage of the accounts payable process—ensuring the right people review and approve payments at the right time, without delays or confusion.

Focus on what matters most: Your business and your clients

Manual data entry, paper-based invoicing, and approval chasing drain valuable time. With Plooto, you eliminate those tedious tasks and free up your team to focus on higher-value work—like advisory services, financial planning, or strategic growth.

Get smart about your money and your timing

Plan ahead by scheduling one-time or recurring payments and gain better control over cash flow for your business or your clients. Plooto’s smart AP automation software helps you avoid late fees, capture early-payment discounts, and maintain healthy vendor relationships.

![]() Do it all with seamless, full-system integration

Do it all with seamless, full-system integration

Connect Plooto with your accounting software, your financial institutions, and your internal workflows. This end-to-end solution keeps everything in sync—reducing errors, reconciling faster, and creating one source of truth across your finance operations.

.png)

Make the most of accounts payable automation with:

Still have questions?

Plooto supports thousands of businesses and firms like yours

.png?width=64&height=64&name=Tanis%20(1).png)

Tanis Young

Maven Bookkeeping

Jonathan Tebeka

Founder & CEO

ShelvingMate

“Plooto automates supplier payments and automatically reconciles them with our accounting software. This saves me and our team a lot of time, prevents errors, and helps us focus on higher-value tasks.”

Learn more >

Sean Freedman

President and Founder

Freightzy

“With Plooto, I now have clarity on cash flow, and it has allowed us to make more informed decisions for the business.”

Learn more >

Fast, easy payments with Plooto Instant

Our accounts payable software cuts the time your payable processes take by half, and never worry about running late on bills and invoices again.

Pre-fund your account

-2.svg)

Select Plooto Instant

-1.svg)

Send Payments Faster

Even more options. Even more payment flexibility.

Pay by Card

Make payments with your credit card, and your vendors get paid via EFT, ACH, or cheque. Free up cash flow, earn rewards, and capitalize on discounts.

Online checks

Skip the in-person signatures and approvals when you pay via check. Full-service includes printing and mailing.

International payments

Make payments around the world and enjoy competitive exchange rates without the transfer fees*.

Learn more >

*Excludes fees on non foreign exchange, check, and same-currency transactions. Industry and discretionary rates apply, and are subject to change. A complete conversion cost estimate is viewable when payment is created or via our foreign exchange calculator.

12,000+ businesses trust Plooto

FAQs

Don't see your question answered here? Contact us today.

How does Plooto streamline accounts payable processes for businesses?

Plooto simplifies the accounts payable process through centralized automation, consolidating bills and invoices with ease. Our user-friendly accounts payable automation software enhances workflows for finance teams by enabling efficient scheduling, tracking, insights, and payments. This powerful AP automation software reduces the need for manual tasks, improving overall productivity in managing accounts payable operations.

Can Plooto assist in efficient bill and invoice management?

Yes, Plooto efficiently manages multiple bills and invoices through its robust accounts payable software and invoice capture system. This AP automation software streamlines accounts payable management by organizing payables, simplifying invoicing needs, and minimizing manual processes associated with invoice tracking and entry.

What payment options does Plooto's AP automation software offer for settling accounts payable?

Plooto's AP automation software provides diverse payment options for settling accounts payable, including secure bank transfers and electronic payments. This flexible approach allows users to choose their preferred methods while reducing errors and enhancing accuracy across the workflow.

How does Plooto ensure secure and reliable payments for accounts payable processes?

Plooto ensures secure accounts payable transactions by using industry-standard encryption and stringent security protocols. Our accounts payable automation software minimizes risks linked to manual errors while providing users with a trustworthy solution for handling high-volume accounts payable activities with confidence.

Can I automate recurring payments for regular bills using Plooto's AP automation software?

Yes, Plooto's advanced AP automation software allows users to automate recurring payments for ongoing bills and invoices. This convenient accounts payable automation capability saves time, reduces manual tasks, and helps prevent late payments in your company’s accounts payable process.

What makes Plooto’s accounts payable software ideal for small and mid-sized businesses?

Plooto’s accounts payable software is designed to meet the needs of growing businesses by offering intuitive AP automation features. It reduces manual data entry, improves accuracy, and ensures fast, secure payments, making accounts payable automation both scalable and cost-effective.

Is Plooto considered an all-in-one accounts payable automation software?

Yes, Plooto functions as an all-in-one accounts payable automation software solution by integrating bill capture, approvals, and payments into one streamlined workflow. Businesses benefit from centralized control and automation of the full accounts payable lifecycle.

How does Plooto benefit finance teams?

With Plooto’s accounts payable automation software, finance teams save hours of manual processing and gain real-time visibility into cash flow and payables. This AP automation software enhances decision-making and strengthens internal controls within the accounts payable process.

What industries benefit most from using Plooto’s AP automation software?

Plooto’s AP automation software serves a wide range of industries, including professional services, nonprofits, and accounting firms. Its versatile capabilities help streamline payment workflows, improve financial operations, and reduce errors across diverse sectors.