What's accounts receivable automation? How it works and why it’s important

More and more companies are automating their AR process to increase accuracy and efficiency

Key takeaways

- The shift towards AR automation is growing, with 64% of firms moving away from physical invoices.

- AR automation speeds up and simplifies invoicing and payments using technology

- Adopting AR automation boosts customer satisfaction with more payment options and easier dispute handling

- Automated systems show live financial data, helping make better decisions and increasing accuracy.

- Integrating AR automation with current technology is key to making operations smoother and more scalable

- Implementing AR automation requires careful planning, including choosing the right platform, integrating with current systems, and getting buy-in from stakeholders.

- AR automation software offers unique features to support businesses in streamlining their AR processes.

Many businesses still manually send invoices and process payments, which is slow and often leads to mistakes. But relying on a manual accounts receivable process isn’t just tedious and time-consuming — it also risks leaving you behind as more businesses switch to accounts receivable automation.

According to a recent report, “64% of firms are shifting away from physical invoices, and 67% are receiving more payments digitally as a result of the COVID-19 pandemic.” AR automation software makes invoicing and collections easier, helping your AR team work more efficiently.

In other words, AR automation is the future of AR — and AP — and businesses of all sizes should consider adopting automated software.

Here’s what you need to know about AR automation, and how finance teams can use it to encourage faster B2B payments and increase customer satisfaction.

What is AR automation?

Accounts receivable (AR) automation is the practice of using technology to automate the processes involved in managing a company's incoming payments. The goal is to replace many of the components done manually in the past, therefore making the accounting process faster, more precise, and less time-intensive.

This includes using technology to track payments, send reminders, reconcile transactions, and create invoices. For example, you can use automated payment reminders to follow-up on outstanding invoices without having to do it manually.

More advanced AR automation solutions include customer portals so customers can self-service their own accounts. They also offer automated reconciliation so invoices and payment transactions are automatically matched.

Another goal for automation is to free up time for accounting and finance teams, letting them focus on customer satisfaction, data analysis, palnning, or innovation.

Many companies who automate AR processes see improved operational funds and cash flow.

What is accounts payable automation?

Accounts payable (AP) automation applies the same principles to outgoing payments. It manages outgoing payments to vendors, unlike automations that handle incoming payments. For example, instead of generating an invoice for services rendered, you may need to digitize an incoming invoice.

AR and AP automation provide many of the same benefits when it comes to accuracy and efficiency, and some automation platforms allow you to integrate both processes. By using the same platform to handle your ingoing and outgoing cash flows, you can take a more comprehensive approach to managing your financial operations.

How does AR automation work?

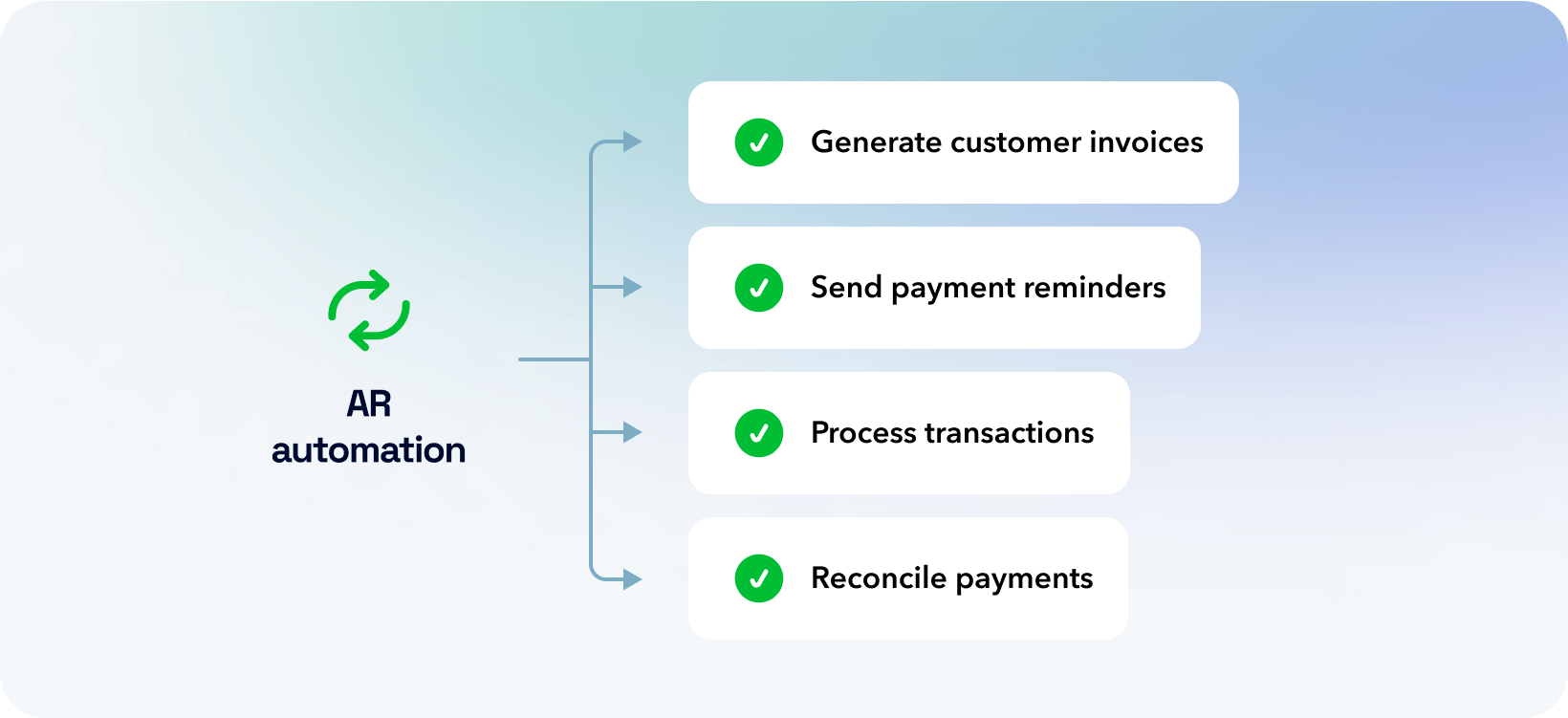

AR automation works by using software to perform tasks in your accounts receivable workflow that would otherwise need to be done by hand. These include:

- Generating customer invoices from electronic invoice templates

- Sending out payment reminders for late or upcoming payments

- Processing ACH transfers and credit card transactions

- Automatically reconciling incoming payments with invoices

When you use accounts receivable automation software, you can reduce the amount of paperwork involved in AR processing and cut down on manual data entry. Modern AR automation software can also apply artificial intelligence (AI) and machine learning to your AR processes, helping you make payment predictions and identify fraud.

AR automation isn’t just about streamlining manual AR processes, but improving the customer experience. By digitizing your payment process, you can provide additional payment options, simplify dispute resolution, and even give customers the option to manage their own accounts online using a self-service portal.

Most importantly, your automated AR platform can integrate with other software, like QuickBooks, Xero, and NetSuite, so you can sync information across multiple platforms and maintain a centralized record of your cash flow.

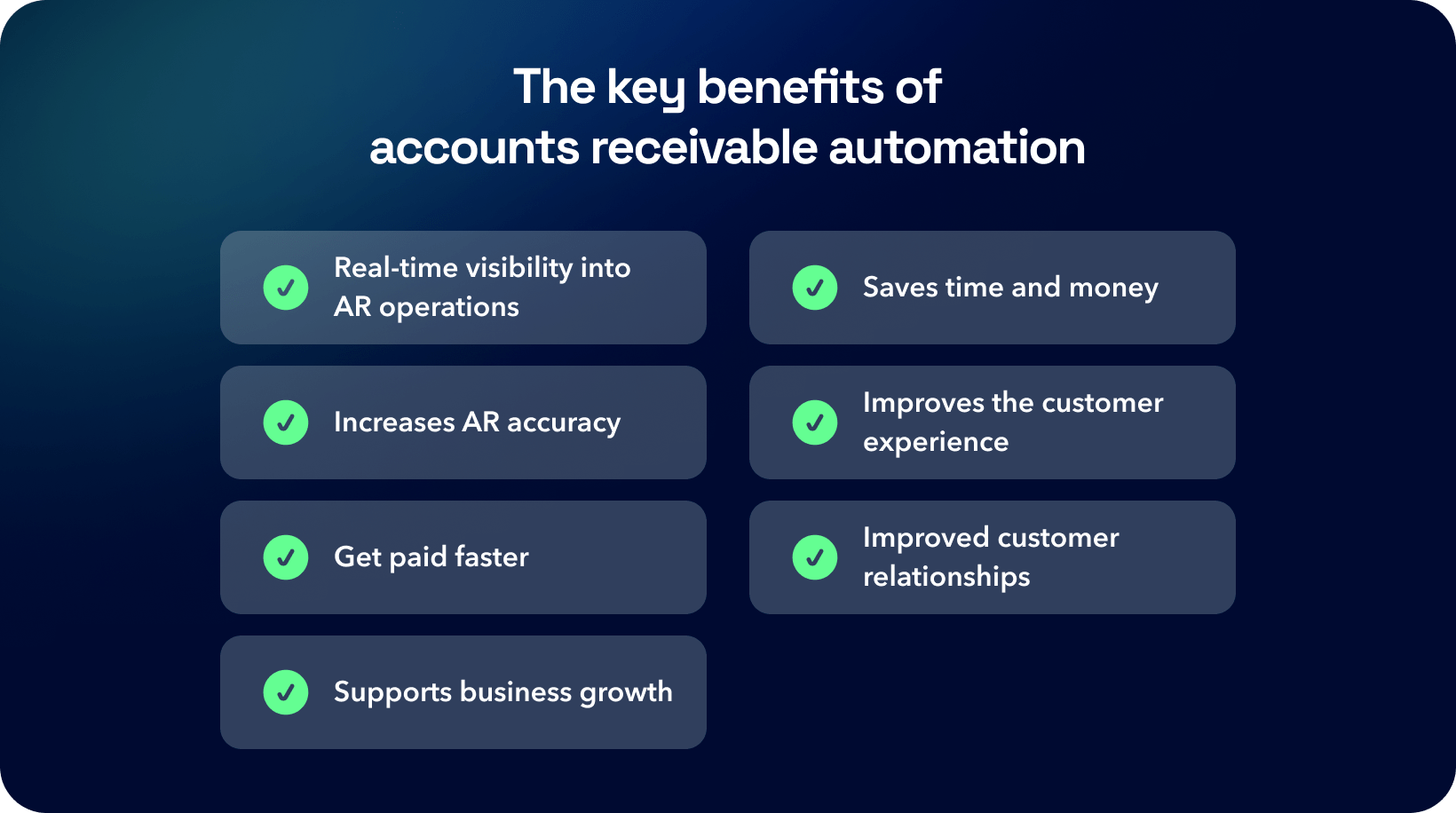

Key benefits of AR automation

The global AR automation market is expected to grow by 14.2% over five years to a value of $6.5 billion by 2027. But what’s driving the fast adoption of AR automation? Let’s take a look at seven benefits of AR automation for any type of business:

Real-time visibility into AR operations

Automated AR platforms provide immediate access to all your financial data, from invoices to international payments. Sync your data with other accounting tools to see the big picture and improve your financial decision-making.

AR dashboards give you real-time insights into your financial operations, and you can generate transaction reports for more accurate bookkeeping. With improved visibility into your AR operations, it’s easier to hit your KPIs and avoid surprises.

Saves time and money

AI and automation aren’t going to take over your accounting department, but they will make it easier for your AR team to get things done. Automating processes cuts down on mistakes by reducing manual data entry and paperwork.

Plus, it frees your team up to focus their efforts on strategic aspects of your business, instead of getting overwhelmed with tedious manual tasks.

Increases AR accuracy

Accounting errors open your business up to compliance issues and can damage trust and customer satisfaction. Using AR automation can ensure consistency across your invoices and other business records and maintain a transparent paper trail.

By standardizing the invoicing process, you minimize the opportunity for mistakes, and ensure that every invoice is accurate and gets sent to your customer on time.

Improves your customer experience

Customers now expect smooth online payments and more payment choices. Fortunately, AR automation platforms support various payment methods — from credit cards to EFT transfers — and track them on one platform for quick payment collection and reconciliation.

Customers enjoy online invoice access, payment reminders, and personalized communication.They can also make billing inquiries online so you can more easily resolve disputed charges.

Get paid faster

Electronic invoices, various payment methods, and automatic reminders improve cash flow. From pre-authorized debits to recurring payments, you can reduce the time it takes to get paid and see shorter payment cycles.

Some AR platforms handle multiple currencies and offer instant payments for quicker payouts — often quick than the typical 1–5 business days.

AR automation often has a direct impact on your AR turnover ratio (just like AP automation helps AP turnover), which is crucial for cash flow and working capital.

Closer customer relationships

According to Atradius, businesses can lose as much as 51.9% of the value of invoices that aren’t paid within three months. But chasing down customers for late payments or failing to resolve a billing dispute can quickly sour customer relationships, even with otherwise satisfied customers.

Online invoices and automatic reminders are less intrusive than calls or mail, helping maintain good customer relations.

Supports business growth

AR automation lets you expand your business without overloading your AR team.

Accountants and bookkeepers can then use AR automation to offer more value to B2B clients, working together with their clients to improve cash flow and help their businesses grow.

AR automation offers a secure way to manage client accounts with customizable rules and recurring payment options.

Why you should automate AR

With the average business writing off 4% of their accounts receivable as bad debt, it’s no surprise that many businesses are turning to accounts receivable automation.

AR automation boosts profits and equips your business for the future with AI and machine learning.

With the implementation of automation tools, you can:

- Save time by reducing manual processes

- Increase the precision of your invoices and financial records

- Increase customer satisfaction with convenient self-service portals

- Gain immediate insight into your cash flow and financial health

AR tools let you monitor key metrics like day sales outstanding (DSO) and help improve cash flow.

Use payment predictions for better timing on payments, and set up pre-authorized debits to speed up the payment cycle.

AR automation simplifies everything from creating invoices to applying payments, freeing up time for other business areas.

AR automation best practices

AR automation can introduce key benefits to the financial side of your business, but the implementation process requires some planning. Follow these best practices to ensure you choose the right tool for the job and roll it out effectively:

Integrate with your existing tech stack

In most cases, you won’t be creating your AR workflow from scratch. Chances are you already use accounting tools like QuickBooks or Xero, or enterprise resource planning (ERP) software to handle the day-to-day operations of your business.

When choosing AR automation software, look for a platform that will integrate with the tools you’re currently using so you can build an operational tech stack that’s ready to scale with your business.

Your AR automation should integrate smoothly with other tools to streamline your process and avoid time-intensive steps like data entry.

Find ways to speed up payment times

Speed up payments by offering early-payment discounts and easy payment options.

With electronic invoices and a self-service portal, customers can see how much they owe and choose how they pay, giving them more control over the process and improving customer satisfaction.

Giving them the tools and incentives to pay early will increase the chances of that actually happening.

You can also use AR automation tools to enable the following:

- Online checks

- Credit card payments

- International payments

- Pre-authorized debits (PAD)

- ACH and EFT transfers

Get stakeholder buy-in

Implementing a new AR automation solution can be a big change for your AR team, not to mention other teams that work closely with your finance department.

Before starting, review your current AR processes to see what's working or not, and discuss urgent needs with key stakeholders. Carefully introduce the new AR solution with thorough documentation and training for employees.

-min.png?width=668&height=1036&name=Accounts%20receivable%20automation%20best%20practices%20(2)-min.png)

How to automate AR processes

The best way to automate the AR process will depend on where you’re currently at in terms of digitizing your business. If you’re just starting out with AR automation, you’ll have a little more flexibility than if you’re locked into an existing workflow.

Either way, follow these six steps to get started:

1. Choose your platform

Compare your options and choose a platform that integrates with any tools you already use and aligns with your existing workflow. Consider whether it offers features such as payment processing and automatic reconciliation if those features apply to you.

Some other factors to consider are price, whether or not the platform offers tutorials or an onboarding process, and which other platforms it integrates with.

2. Integrate it with your accounting software

Next, link your new AR platform with your existing tools, such as Quickbooks or Xero. Ideally, your platform will make it easy to sync your accounts, so all of your tools can share information with each other and ensure accurate record-keeping.

3. Set up payment reminders

A key feature of automation is its automatic reminders for due, nearly due, or late payments. Determine how frequently you’ll send out these reminders in order to encourage early payments without harassing customers.

You may need to reconfigure your reminder settings over time, and set up a different cadence for early, late, and on-time payers.

4. Link your payment gateways

Now, connect your platform to your payment gateways so you can easily accept online payments. Depending on which payment methods you offer, this might include linking your bank account to accept ACH transfers or setting up credit card processing.

5. Reconcile transactions

Your AR automation platform should be configured to automatically match payments to invoices and reconcile incoming transactions. Before you start, make sure your existing records are up-to-date to avoid sending out duplicate invoices or payment reminders that have already been recorded in your previous system.

6. Monitor the results

Reassess your AR automation process on an ongoing basis to ensure that it’s meeting your goals. If your KPIs haven’t improved, consider making changes to your payment methods, the frequency of automatic payment reminders, and other variables.

Automating your AR process is generally straightforward, with the best software options going to great lengths to make it as seamless for users as possible.

The best AR automation software options

There are plenty of AR automation software options out there, but some tools offer more comprehensive features than others. Compare your options to find the right platform for you. Here are just a few examples of AR automation platforms on the market:

Plooto

Plooto is an online platform that allows businesses and accounting firms to automate and integrate their AR and AP processes. Use it to generate invoices, accept online payments, and sync your transactions with NetSuite, QuickBooks, Freshbooks, Zoho, and Xero.

Plooto supports international payments, and offers an instant payment option so you can get paid faster and stay ahead of your bills and outgoing payments.

It also helps business accept eChecks, credit card payments, and international payments, make CRA payments, and more.

Pricing starts at $32/month for businesses, and $9/month for accounting firms, with a 30-day free trial available for any plan. Plooto also offers a free trial.

Bill.com

Bill.com is an AR and AP automation platform that integrates popular accounting software. It’s suitable for small and mid-size businesses.

You can use Bill.com to generate online invoices and send them by mail or email, as well as generate recurring invoices or schedule them in advance.

Paystand

Paystand is an AR automation platform aimed at B2B customers. It connects with Xero and other accounting platforms, and it supports enterprise blockchain.

Like other AR platforms, it supports recurring payments and ACH transactions.

FAQs

Don't see your question answered here? Contact us today.

How can I encourage faster payments with AR automation?

To get faster payments from your customers you can use features like electronic invoices, multiple payment methods, automated reminders, and self-service portals to incentivize quicker customer payments.

Choosing the right AR automation software — do you have any tips?

Consider factors like integration capabilities with your current tools, the features you need, pricing, ease of use, and available support and training.

Further reading

Learn more about accounts receivable

Table of contents

What is AR automation? How does AR automation work? Benefits of AR automation Why you should automate AR AR automation best practices How to automate AR processes AR automation software FAQs

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialAutomate your account receivables today

Plooto offers an easy and efficient solution for all your AR needs. Get started for free today.

Start free trial

.png)