Businesses need to generate healthy cash flow to grow. Managing a company's finances requires more than just making and collecting payments. Implementing and ensuring a good invoice management system is essential for financial management for a positive cash flow.

However, when invoice management is done manually, it becomes the ultimate pain that drains the energy and time away from your business.

We've all heard, "if you can't avoid it, enjoy it," and since there is no way to avoid invoice management for your accounts payable, it's time to find a way to make the process as simple and effective as possible.

- What is invoice management?

- What is the connection between invoices and accounts payable?

- Invoice management: Manual vs. automated

- How to process an invoice

- What are the benefits of automated accounts payable with invoice management?

- What are the benefits of automated accounts payable with invoice management on a personal level?

- A complete checklist for invoice auditing

- Get started with accounts payable automation

What is invoice management?

Well, first of all, what is an invoice? An invoice is a pre-receipt, a document, including details of a transaction: order date, type of product or service, quantity, price, and payment deadline, issued to an individual or a company to collect money owed.

Now, invoice management, also known as invoice processing, includes responsibilities from receiving, managing, and then processing to validate the legitimacy and accuracy of the invoice issued to the company before the payments are processed.

What is the connection between invoices and accounts payable?

Certainly, invoice management is an inseparable process for any business type as invoices are an integral component of accounts payable (AP).

Any kind of business payment involves some form of an invoice. Ultimately invoice management is the first part of the accounts payable process. This implies that high transaction volumes for a company automatically translates to a high volume of invoices that need to be processed. Here, accounts payable refer to the vital function responsible for managing and processing these invoices, highlighting its significance in maintaining a smooth financial workflow.

As more and more businesses shift towards partial or complete remote work environments and as accounts payable and invoice management are inseparable, it's wise for a company to adopt a cloud-based accounts payable and accounts receivable (AR) solution to centralize the process and handle everything in a single place. Plus, an invoice processing system (IPS) will empower your business to promptly clear payments on received invoices, streamlining the finance process.

Invoice management: Manual vs. automated

Making accounts payable invoice management quick and straightforward, doesn't that sound ideal?

There are far more steps and processes involved in manual invoice management, seizing valuable time away from your finance team to do tedious, mundane work. Besides, for small and medium-sized businesses (SMBs), owners or upper management may be the ones handling this long process while also required to stay on top of more critical business tasks. These are the steps required for manual invoice management and the accounts payable process.

- Verify the accuracy of the invoice received.

- Print check. If the business runs out of check, then

2-2. Order check and have to hold payment until checks get restocked. - Write the check.

- Verify the details written on the check.

- Chase after authorized signatories to get the check signed.

- Buy the postage stamp.

- Mail the check.

- Manually record payment on the book.

- Manually file the invoice in a secure location.

- Ensure the payee receives the check.

- Ensure the payee processes the check.

- Manually reconcile the payment when the bank completely processes it.

That is one overwhelmingly long list for a single invoice and payment. Doesn't that look like an inefficient and horrifying process for any company?

With automation, the invoice management process for accounts payable becomes simple:

- Import invoice.

- Verify the auto-filled information from the original invoice along with the invoice audit.

- Initiate the payment or payment approval.

- Payment is processed and auto reconciled with the connected accounting software.

Numerous hours are saved on managing both invoice management and accounts payable. Now there are more benefits to adopting accounts payable software with invoice management for your company.

How to process an invoice

1. Receive the invoice

Collect the invoice you need to pay directly from a vendor or the departments that are responsible for creating purchase orders.

2. Review the invoice

Verify the accuracy of the invoice by doing a three-way match between the purchase order, the goods and services that were delivered and the invoice itself.

3. Record the invoice into your system

Whether you do this manually or use an accounts payable automation software, keep a record of the invoice in your chart of accounts to track all your payables in one place. Mark down information including the vendor, date of invoice and payment terms.

4. Approve the invoice

Send the invoice to any authorized signatories to reject or approve the invoice. Build time into your payable workflow if there are multiple approvals needed so that you don’t risk paying late.

5. Pay your vendors and suppliers

Process payment in the terms stated on the invoice, typically done through check or wire transfer.

6. Reconcile the invoice in your accounting software

Once paid, sync the details of the payment with your accounting records software so that you have an accurate recording of your balance sheet. Many accounts payable automation platforms have native integrations with common accounting services like Quickbooks and Xero.

What are the benefits of automated accounts payable with invoice management?

Businesses are moving away from manual invoice management and accounts payable. Research by PYMNTS and American Express stated, "63.5 percent of firms are now shifting away from physical invoices." These shifts have led to the accounts payable automation market projected to reach USD 4 billion by 2025. Accounts payable solutions offer several benefits, but the most evident benefits are the increase in cash flow, security, productivity, and time and cost saved.

1. Increase cash flow while saving cost

It's a simple equation. Good invoice management is vital to ensure free cash flow. About 82% of SMBs experienced cash flow problems, with 29% running out of cash resulting in business failure.

Plus, research from Everest Group found that a business with nonautomated invoicing pays an average of $10 per invoice, while automated invoicing averages only $2.07 per invoice. Manual invoicing costs 5x more for your business, plus the long hours required for the manual process, creating the cost of overtime. It's definitely not worth paying the price, and wise for a business to adopt a payments solution with IPS invoice management.

Invoice management with automated accounts payable software will increase the speed of processing invoices preventing late payments, under-payments, over-payments, or missing payments, and save cost by circumventing unnecessary late or penalty fees.

Additionally, automating invoice processing will make it possible for your company to take advantage of early payment discounts. Reclaim all the lost discounts from the maxed-out bandwidth of manual invoice management that made it hard to process invoices in advance. You can now start taking advantage of early payment discounts provided by the payee.

That's not it! Invoice management automation will help identify errors on received invoices and stop your business from making incorrect payments. Moreover, automation will help prevent duplicated payments as all payments are organized on a single platform. These transactions clog the cash flow by tying up free cash until the payment errors are resolved. Hence, automate and streamline the entire process to strengthen your organization's financial position and ensure a positive cash flow for your business.

2. Save time

Benjamin Franklin once said, "time is money," and we all know that this is true. By modernizing the slow manual invoice management with automated invoice processing, businesses can save an immense amount of time, which at the end of the day is money. This enables employees to use the time saved towards completing more complex work and focus on growing the company.

Through automation, your businesses can save time on printing, writing, chasing approvals and signatures, making time to visit the bank, going back and forth manually reconciling payments to the book.

3. Increase security

Fraudsters are known to wield the power of the invoice. Indeed, fraudulent invoicing is one of the top fraud risks for SMBs. Forbes Financial Council recommends businesses to set up multiple layers for reviewing invoices and regularly review accounting records. The recommended steps are more complex and complicated when invoice management is performed manually.

With automation, redundant work is eliminated, increasing the time to complete a thorough invoice review. Additionally, invoice data for each transaction is stored securely on the cloud, making it easier to relocate the invoices in time of the audit, and demolishing the risk of losing an invoice.

4. Increase productivity

As shown above, manual invoice management and payments are profoundly labor-intensive for such tedious tasks. Businesses need to realize the importance that employee empowerment is crucial for any organization's success.

Wasting time working on tedious routine work affects the productivity of employees. Asana's "The Anatomy of Work Index" report found that, on average, 60% of employees' time is spent on mundane assignments instead of quality work that is motivational for employees and beneficial for the company. Why choose to drain highly talented employees' time and effort on a process that could be automated to increase accuracy and speed.

As one solution, businesses need to automate their accounts payable processes and reassess their invoice processing to improve efficiency and allow employees to perform at their full capabilities.

What are the benefits of automated accounts payable with invoice management on a personal level?

Now we all understand the different benefits of invoice management automation from a corporate perspective. Let's explore the benefits on a personal level.

1. Reduce stress

How many of you are sick of the unending loop of chasing and asking for approval for payments? Save yourself from the anxiety that comes with waiting to receive approval to avoid missing the payment deadline.

Likewise, manual invoice management delays processing the invoices and likely creates last-minute payments. On top of that, when manual payment approval is also in place, it is not easy to process the last-minute payment on time.

Talk about the stress level here! Request to implement Plooto and forever say goodbye to the stress and pains of last-minute payments with a fast payment approval process that upper management can confirm from anywhere at any time.

2. Be confident about your work

Escape from tedious, mundane manual data entry and reconciliation!

Forbes found that "for many companies, their top pain point is around the whole process of manual data entry, where AP reps tediously type in each invoice by hand and match the data line for line from the physical invoice into their systems."

Automating invoices that auto-captures the data from invoices will complete this unavoidable task in a fraction of time, saving time, reducing error, and helping lower the chance of fraud.

3. Reduce health risks

What does invoice management have to do with an individual's health? Time is limited. As clearly explained above, manual invoice management consumes a lot of employees' time. Accordingly, employees must work overtime to compensate for the lost time to complete all assigned work. As invoice management is not a one-time-only task, it naturally exposes the employees to repeatedly overwork.

Numerous studies all state that "overwork and the resulting stress can lead to all sorts of health problems, including impaired sleep, depression, heavy drinking, diabetes, impaired memory, and heart disease."

Don't put anyone at risk of developing health problems. Reduce the chance of health risk by utilizing automation.

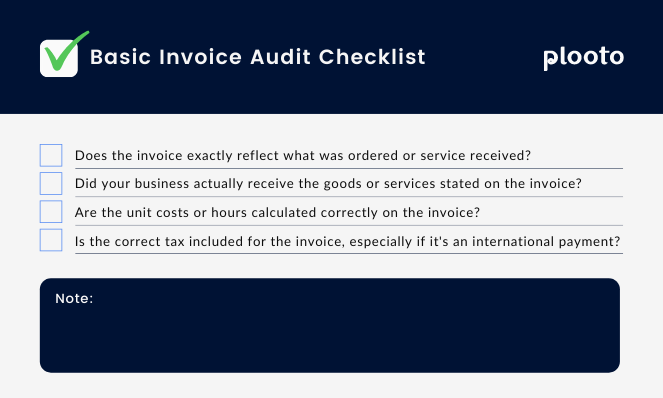

A complete checklist for invoice auditing

Invoice management requires an invoice audit to validate the accuracy of the invoice sent from the payee. Save the checklist and ensure that your vendor or supplier sent an accurate invoice to protect your business from making incorrect payments and even fraud.

- Does the invoice exactly reflect what was ordered or service received?

- Did your business actually receive the goods or services stated on the invoice?

- Are the unit costs or hours calculated correctly on the invoice?

- Is the correct tax included for the invoice, especially if it's an international payment?

Back to Shortcuts

Get started with accounts payable automation

As a first step in automating your accounts payable process, start with introducing your business to an accounts payable and accounts receivable solution. Accounts payable and receivable automation will help reduce stress and enhance visibility, productivity, accuracy, security, and cost-effectiveness. Eliminate manual tasks to increase time spent for meaningful knowledge work that can drive business growth.

Read more: Why AP and AR Automation are Essential for the Long Run

Are you looking for the best software for your business?  will help your business clear all pain points! Plooto, an ultimate accounts payable and accounts receivable solution.

will help your business clear all pain points! Plooto, an ultimate accounts payable and accounts receivable solution.

Adopting Plooto to automate accounts payable has additional benefits like:

with competitive exchange rate with a flat fee that's cheaper than wire transfer cost

with competitive exchange rate with a flat fee that's cheaper than wire transfer cost- easy payment approval workflow

- auto reconciliation with popular accounting software like

and

and  .

. - certified with

, a certificate for an international standard for information security.

, a certificate for an international standard for information security.

With Plooto, all businesses can manage accounts payable and accounts receivable from anywhere at any time. Start with a  and experience the power of modernizing your business!

and experience the power of modernizing your business!

Back to Shortcuts

CHAPTERS

01 Is accounts payable an asset or liability?

02 Accounts Receivables vs. Accounts Payables: What’s the Difference?

03 How to Set Up a Full Cycle Accounts Payable Process and Workflow

04 How can accounts payable automation help your small business