Both accounts receivable and accounts payable are essential to your company’s finances and cash flow.

These accounts are fundamental components of your company's balance sheet and give insight into your company's financial health.

Key takeaways

- Accounts payables are the short-term debts your company owes to others

- Accounts receivable are unpaid money from customers for goods/services sold

- AP and AR are closely intertwined: Every invoice is a payable to one party, and a receivable to the other

- Both accounts payables and accounts receivables are short-term obligations

- Common challenges for managing AP: Late payments, human error, complex processes, and approval bottlenecks

- Common challenges for managing AR: Slow-paying customers, slow manual process, and maintaining good relationships

What is accounts payable (AP)?

Accounts payable (AP), or payables, are the short-term debts or obligations your company owes to suppliers, vendors, or creditors.

Simply put, accounts payable are the amount of money your business currently owes. These are temporary obligations, for as long as a year.

Your accounts payable will appear on your balance sheet as a current liability, and on the business's cash flow statement under operating activities. Your AP statements can give you important insight into the financial state of your company, for example: An increase in your AP usually means your company is purchasing more things on credit than cash.

Accounts payable example

How might you recognize an accounts payable transaction in your daily business transactions? Here's an example:

Let's say you own a business called Nexo, and you go out and purchase some office supplies on credit from a seller, Suppliez. As you didn't purchase these supplies with cash, this transaction is essentially an I.O.U from Nexo to Suppliez. As such, this transaction would appear in your accounts payable in your books.

How to record accounts payable

If a transaction for accounts payable is made, how do you record it in your accounting book?

When using double-entry bookkeeping, an accounting method that offsets debit and credit for all entries, here is how it is recorded:

- When the invoice is received, the amount is credited to AP, while the same amount is debited to an expense account.

- Let's pull from the previous example, where your company bought office supplies: The amount of money spent on credit would be credited to your AP account, while debited to, let's say, an office expenses account.

- When the bill is paid, the AP account is debited to remove the amount from the account and your cash account is credited to decrease the amount of cash used.

The accounts payable process

The accounts payable process can vary, but generally follows a similar structure:

- Receiving the receipt and invoice of a purchase, manually or uploading to a financial management software

- Cross-listing the receipt and invoice to ensure accurate amounts and avoid duplicates and errors

- Recording the transactions, either through a journal entry (recording into your accounting books), and/or through a software program

- Obtaining approval to authorize payment to the vendor

- Once payment is made, the records must be updated accurately

You should aim for this process to be efficient and as accurate as possible — as having too high of an AP can quickly cause cash flow issues in your business and increase your risk.

While this cycle is going on, other administrative tasks also happen: Responding to vendors and negotiating terms, maintaining the vendor file, limiting errors, and keeping up with payment schedules to ensure things are paid on time.

Are accounts payable business expenses?

Though it seems like accounts payable would be a business expense, AP is not a business expense. AP may reflect business expenses made on credit, but it is not representative of all your routine business expenses. For example, if you purchase supplies with cash, it will not show up as AP.

Your business expenses show up as expenses on your income statement, whereas your company's accounts payable show up on your balance sheet as a liability account.

What is accounts receivable (AR)?

Accounts Receivable (AR) is the money owed to your business from other parties.

Simply put, AR is unpaid money from customers for goods or services already provided.

Accounts receivable show up on your balance sheet as an asset account. AR boosts working capital, a short-term asset ideally collected within days to a year.

Accounts receivable example

How might you recognize a transaction that falls under accounts receivable in your daily business transactions? Here's an example:

Let's say you are a business owner of a utility company. Every month you provide utilities to households, and once the month is over and the utilities have been used, you bill the customer for the amount of utilities they consumed. The amount they owe you would show up under your accounts receivable until a payment is issued.

How to record accounts receivable

If a transaction for accounts receivable is made, how do you record it in your accounting book? When using double-entry bookkeeping, here is how it is recorded:

- Once you've sent an invoice to the buyer, in your books you would take the monetary amount and debit the accounts receivable then credit the revenue account with the same amount.

- When you receive payment for the invoice, you will credit the accounts receivable and debit the cash account with the amount.

The accounts receivable process

The accounts receivable process covers the steps of selling goods and services to receiving payments from customers. The process intends to get cash back as quickly as possible for the business for goods/services sold. Here are the process steps:

- Goods and services are sold to another party.

- Invoice is sent to the customer and accounting records are updated, either by hand or with financial software.

- Once the customer pays, a journal entry is made to update the accounting books.

While this process is underway, other factors might affect the process. You might want to do a risk assessment of the other party to evaluate payment history. You might also be able to negotiate favourable payment terms.

To protect your cash flow and investment ability, it's important to avoid late or missing payments in this process. Ideally, your process should encourage an early payment from customers.

Some companies even go as far as giving incentives to customers by offering an early discount for prompt payment.

How does AR affect your cash flow statements?

Accounts receivable directly affect your cash flow statement through an inverse relationship.

This means that when AR increases, your cash inflow decreases.

This demonstrates that if you have too high of a receivable balance, it can hinder your ability to meet your financial obligations and invest in your business.

To increase your cash flow, get customers to pay quickly and make sure your process is accurate and efficient.

Impact of late payments on your business

- Can cause issues in funding business activities

- Wastes time chasing down payments

- Can exacerbate existing cash flow difficulties

- Reduces opportunities to invest in growth

- Makes it difficult to accurately predict cash flow

What’s the relationship between accounts payable and accounts receivable?

As mentioned, accounts receivable and payable have a negative relationship.

AP and AR are closely intertwined: Every invoice is a payable to one party, and a receivable to the other.

Both AR and AP give insight into a company's cash flow, and for finance teams, can aid in cash flow forecasting, risk management, and cost reduction. When AR and AP are managed efficiently, it can have a positive impact on liquidity and profits.

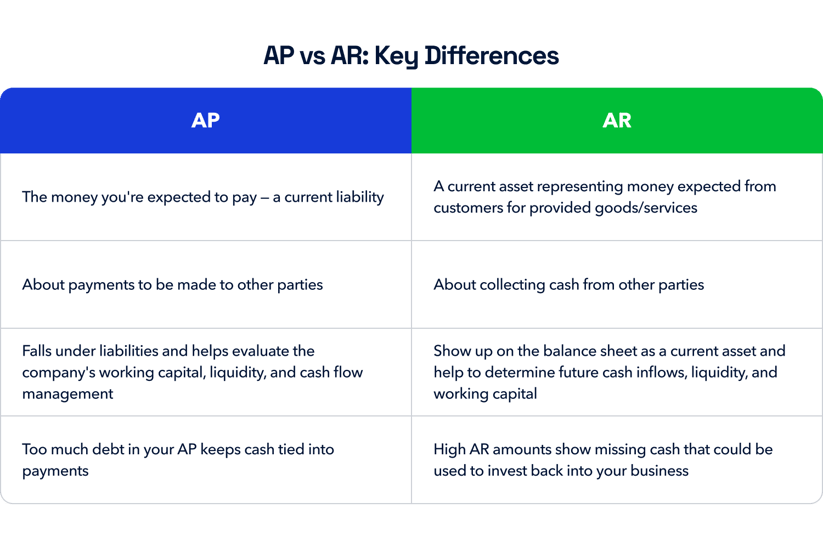

AP vs AR: Key differences

Definition and nature of account

Accounts payable: Accounts payable is the money you're expected to pay—a current liability.

Accounts receivable: Accounts receivable is a current asset representing money expected from customers for provided goods/services.

Direction and impact on cash flow

Accounts payable: Indicate a future negative cash flow as payments are made. This impacts cash outflow and can forecast future withdrawal of cash.

Accounts receivable: Indicate a future positive influx of cash as payments are received. This impacts cash in-flow and can aid in forecasting incoming cash increases.

Collection versus payment

Accounts payable: AP is focused on payments to be made.

Accounts receivable: AR is about collecting cash from other parties.

Impact on financial statements

Accounts payable: Show up on the balance sheet and the cash flow statement. Impacts the liabilities section of the balance sheet and shows cash out-flows. AP helps evaluate the company's working capital, liquidity, and cash flow management.

Accounts receivable: Show up on the balance sheet as a current asset and help to determine future cash inflows, liquidity, and working capital.

Risks

Accounts payable: Too much debt in your AP keeps cash tied into payments

Accounts receivable: High AR amounts show missing cash that could be used to invest back into your business

Is billing AP or AR?

Billing is related to AP as it's the amount of money owed by you to another party, and you send bills to other companies to notify them of their payment amount.

Is invoicing accounts payable or receivable?

AR is invoicing as you send out invoices to other companies for the goods or services you've given.

What do accounts payable and accounts receivable have in common?

Both AR and AP:

- Are short term — from days to a year

- Are processes tied into your cash flow

- Can inform cash forecasting

- Are helpful for auditing

- Involve two parties

- Can be automated by financial software

Common challenges and solutions for accounts payable

Late payments — If you find a pattern of late payments to suppliers, you may need to reassess your cash management so late payments don't lead to long-term debt. Late payments can strain relationships with other companies. You might also be missing out on early payment discounts.

- To keep up with payments, assess the speed of your invoice processing, keep an organized schedule, set up payment schedules, and consider utilizing accounting software to make payments easier.

Invoice processing complexities — If your AP process is weighed down by complexity, it can create delays to payments and risks more human error.

- To create a simpler AP process, consider implementing software that does AP automation. This can speed up your process, minimize manual work, and reduce human errors.

Human error — Human errors during the AP process can lead to missed payments, duplicate payments, increasing your risk of fraud, or missed payments.

- To minimize the impact of human error on your AP process, consider setting clear policies and procedures to follow. Manual data entry can be the key culprit to errors, so use financial software that captures and uploads invoice data for you.

Approval bottlenecks — Sometimes getting approvals from the right team member can add time to your AP process, and add frustration as you track down approvals.

- To reduce frustration and time spent chasing approvals, implement financial software that tracks and monitors approvals — all digitally — so team members get real-time updates and approvals happen faster.

What are the challenges and solutions in managing accounts receivable?

Slow-paying customers — Did you know that small businesses are losing 15 days every year chasing late invoice payments? Chasing customers wastes time and can lead to bad debt.

-

To get early and on-time payments make sure you send invoices early and your invoices are easy to understand. Using AR automation gives you data capturing tools to ensure accuracy and enables you to send digital invoices from one central place — meaning less errors and no missing invoices. Learn more about accounts payable automation best practices.

Slow manual processes — If your AR process is manual, you might be adding additional time to receiving payments. Manual processes also create more opportunities for human error to occur.

-

Consider using financial automation software to speed up your AR process and minimize human error. For example, implement automation tools into your AR process to automate data capture from invoices so you can spend less time uploading and sending invoices.

Maintaining good relationships — Sometimes it can be difficult to maintain good relationships with customers who are late on their payments. According to a Versapay study, unresolved disputes are a source of ongoing struggle for your AR team.

-

To foster good relationships with customers, keep up communication and consider implementing software that can notify customers of payment dates without you having to initiate the messages. Eliminate barriers to communication by setting up direct lines between customers and your team.