What's an EFT payment? And when should I use one?

Understanding the benefits, pros and cons, and processes behind the increasingly popular transaction type.

If you’ve ever used a debit card or set up a direct deposit transaction, then you’ve made or received an electronic funds transfer (EFT). These transactions move money between bank accounts without paperwork or a bank employee's help.

EFTs are handy, but types differ in speed, cost, and security, especially for B2B payments.

Here’s what you need to know about EFT payments, including how they work, when to use them, and how to set up EFT payments for your business.

Key takeaways

- EFT payments transfer funds electronically between banks, reducing the need for checks and cash.

- These payments can be processed through many methods, including direct deposits, online bill pays, and peer-to-peer platforms.

- EFTs are widely secure, using encryption and tokenization, but users should still watch for fraud.

- You can make international EFTs, but they may have higher fees and must follow international regulations.

- For businesses, EFT payments offer significant advantages like improved cash flow, reduced processing costs, and seamless integration with accounting systems.

What is an electronic funds transfer (EFT)?

An electronic funds transfer (EFT) is a way of transferring money directly between bank accounts without the need for paper checks or other physical paperwork. EFT payments have been around for decades but are becoming increasingly popular — non-cash payments have been increasing by 9.5% per year.

EFTs transfer money between accounts within the same or different banks, even internationally.

Various EFT types exist, each with its own pros and cons, but all have the same basic parts:

- Electronic devices: An electronic funds transfer needs to be initiated from an electronic device, such as a computer, automated teller machine (ATM), or a point-of-sale (POS) terminal.

- End users: An EFT requires a sender and receiver, and either party can initiate the transaction with appropriate authorization and account details.

- Financial institutions: Financial institutions process electronic transfers, often through a third-party clearinghouse or payment network.

EFTs can be used to withdraw cash, pay bills, send money to a friend or family member, receive payment from an employer, or make a purchase using a debit or credit card. An EFT transfer can take anywhere from a few seconds to a few days to process.

What is an EFT payment?

EFT is an umbrella term that encompasses several different types of payment methods. An electronic transfer used to pay for goods or services is called an EFT payment.

Some of the most common types of EFT payments include:

- Online bill pay

- Online tax payments

- Direct deposit (payroll)

- Automated clearing house (ACH) transfers

- Peer-to-peer payments, like Cash App or Venmo

EFTs are usually faster, more convenient, and cheaper than traditional payments. EFTs can start anytime, even outside bank hours, but transfers can indeed take days.

How EFT payments work

EFT processing mostly happens behind the scenes. When you send or receive an EFT payment, it goes through the following steps:

- Initiation: First, the sender initiates a transfer by providing the recipient’s bank account information and routing number. Sometimes, the recipient may initiate the transaction, as in the case of a pre-authorized debit (PAD) payment.

- Verification: Next, the sender’s financial institution verifies that the funds are available and that the payment was authorized.

- Settlement: The sender’s bank contacts the recipient’s bank with the details of the transaction and initiates a transfer of funds.

- Crediting: The recipient’s bank credits the money to the correct bank account, and may send out a confirmation message to the recipient.

The EFT process varies by transaction type. ACH transfers go through a third-party ACH network, and are usually processed in batches.

Credit and debit card payments go through a card network like Visa or Mastercard, and may also involve a payment processor like Stripe, PayPal, or Plooto.

7 common types of EFT payments

There are different types of EFT payments for different use cases. Let’s take a look at some of the most common examples:

Electronic checks

Electronic checks, or eChecks, are the digital equivalent of a paper check. They use your bank account and routing number to transfer money to the recipient. If you’re a business, then accepting check payments online means you don’t have to wait for a check to arrive in the mail or go through the hassle of depositing it.

Direct deposit

A direct deposit is a type of EFT transfer in which a paycheck is deposited directly into an employee’s bank account, usually on a recurring basis. Direct deposits cut down on administrative work, and allow the employee to receive their paycheck faster.

ATM withdrawals

Automated teller machines (ATMs) allow customers to access their funds or make a deposit outside of banking hours. ATM transactions are a type of EFT transfer.

Credit card transactions

Credit and debit card transactions are electronic transfers processed by a credit card network. The payment processor draws funds from the recipient’s bank account or line of credit and credits it to the recipients’ bank account. This is one of the most secure forms of EFT due to the rise of virtual credit cards and chip technology.

Internet transactions

With more online banking, customers can pay without credit or debit cards. Customers can store money in a mobile wallet, initiate peer-to-peer transfers, and schedule online bill payments.

Phone payments

Phone payments are less common with the rise of online payments, but they’re still an option for consumers who don’t have access to a computer. Some pay-by-phone systems use interactive voice response, or IVR, to guide customers through the process.

Wire transfers

Wire transfers are primarily used for B2B payments because they can transfer large sums of money more quickly than other types of EFT payments. However, they also tend to have higher fees than other payment methods.

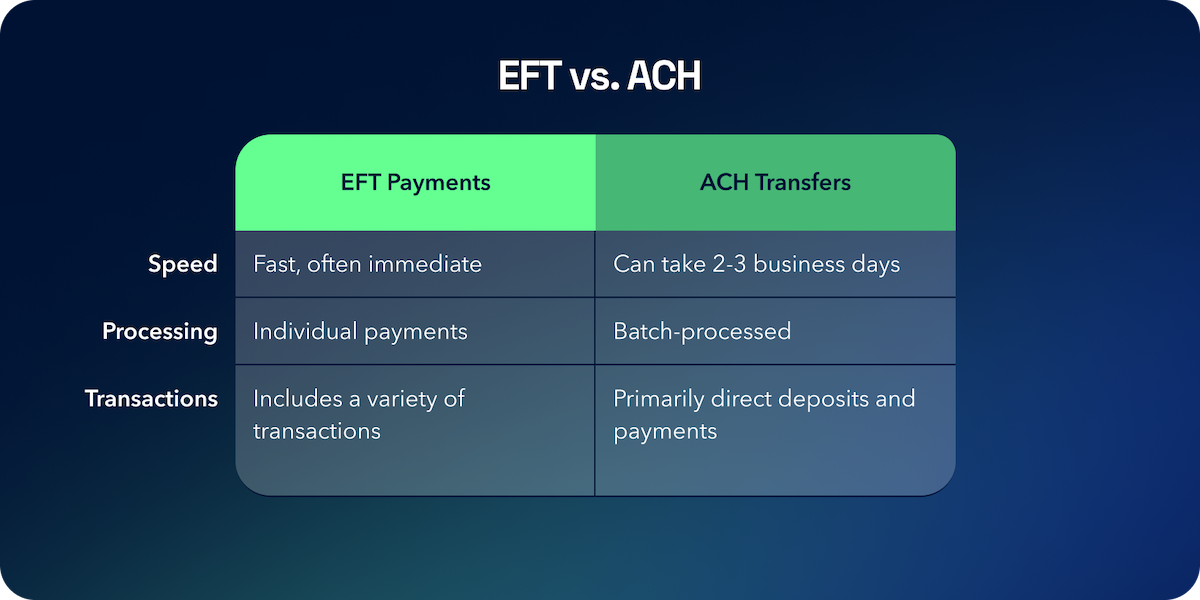

ACH transfers are a type of EFT payment processed by an automated clearing house, or ACH network. ACH payments are processed in batches, usually overnight, so they take longer to clear than other types of EFT payments.

ACH transactions are best for recurring payments, such as payroll. For large sums or one-time transfers, other payment methods provide more speed and flexibility.

Pros and cons of EFT payments

EFT payments are here to stay. According to the Federal Reserve, ACH transactions alone accounted for $91.85 trillion in non-cash payments in 2021. But EFT payments have their pros and cons. Here are just a few of them:

Pros of EFT payments

- Efficient: Electronic payments are processed more quickly than paper checks and other payment methods, so the recipient gets their money faster.

- Cost-effective: EFT payments, especially ACH transfers, have lower fees than traditional payment methods and involve fewer administrative costs.

- Convenient: EFT payments can be initiated at any time of day, and don’t require the sender or recipient to be physically present.

Cons of EFT payments

- Potential security risks: EFTs can be vulnerable to fraud and data breaches — but new technologies and smart security practices can reduce the risk.

- Technological dependence: If the WiFi goes out or if a point-of-sale system is down, it can be difficult for businesses to accept customer payments.

Using EFTs to improve cash flow: A real life example

One notable example of the benefits of EFT payments is The Influence Agency, a leading digital marketing firm that leverages Plooto to automate their accounts receivable process. Before adopting Plooto, The Influence Agency faced significant challenges with manual payment processing, such as time-consuming reconciliation tasks and high processing fees for international transactions.

Benefits experienced by The Influence Agency:

- By automating their payment collection process with Plooto, The Influence Agency eliminated the inefficiencies of manual check payments. This streamlined process ensured timely and accurate receipt of funds, drastically reducing the time spent on administrative tasks.

- The agency saved over $1,000 per month by reducing credit card processing fees and avoiding high international transaction costs. Plooto's flat-rate international payments and competitive exchange rates provided substantial financial benefits.

- The automated system allowed The Influence Agency to manage payments to hundreds of recipients effortlessly. This newfound efficiency freed up valuable time, enabling the team to focus on creative projects and client campaigns.

By implementing Plooto's EFT solutions, The Influence Agency not only optimized their financial operations but also significantly improved their overall business efficiency and cost-effectiveness.

Table of contents

What's an EFT?

What's an EFT?

What's an EFT payment?

What's an EFT payment?

How EFTs work

How EFTs work

The different types of EFTs

The different types of EFTs

Are EFTs safe?

Are EFTs safe?

EFT vs. ACH payments

EFT vs. ACH payments

Pros & cons of EFTs

Pros & cons of EFTs

EFTs and international payments

EFTs and international payments

Real-life example

Real-life example

EFTs in B2B payments

EFTs in B2B payments

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialReady to offer your customers more ways to pay?

Increase cash flow with Plooto's AP and AR automation tools, as well as streamlined international payments, instant payments, and more. All while still accepting online checks, too.

Start free trial