Accounts payable represents the money you owe. Managing your AP becomes a process of receiving and recording invoices all while preparing and ensuring payment.

The AP process can quickly become overwhelming. The solution? Automation software catered to your business needs.

Keep reading to learn about the AP process and benefits to automating it.

Key takeaways

- Accounts payable represent your short-term debts.

- The accounts payable process covers the steps from purchasing goods/services to paying.

- Accounts payable management is vital to your overall financial health.

- Accounts payable management challenges include: time delays, human errors, fraud, and missing documents.

- Managing your AP can be aided by automation and clear policies, procedures, and controls.

- Automation offers many benefits to your AP process, including: automatic matching, reconciliation, centralized location for invoices, and ridding manual processes that contribute to human error.

- There are many options for financial software that can automate your AP process.

What is the full cycle accounts payable process?

Put simply, the accounts payable (AP) process covers the steps from purchasing goods/services to paying the vendor.

The full cycle accounts payable process, or the accounts payable cycle, is one part of the Procure to Pay, or P2P cycle.

|

Steps of the accounts payable process |

| 1. A purchase order (PO), a document that details requested product, quantity and price, is issued to a vendor to create an order. |

| 2. The supplier will send an invoice for the goods/services ordered. |

| 3. The purchase order is cross referenced with the vendor invoice to ensure accuracy and updated in the accounting journal. |

| 4. Goods/services are received with receipt. |

| 5. A three-way matching is done to ensure accuracy between the PO, invoice, and receipt. |

| 6. Payment is authorized to the seller. |

| 7. Once payment is received on the vendor’s end, the accounting journal is updated. |

The AR team is responsible for paying vendors, receiving invoices, obtaining payment approval, scheduling B2B payments, ensuring accuracy, and updating the books.

Why is accounts payable management important?

Accounts payable management is important because it’s a fundamental part of your company’s finances and mismanagement can cause various issues.

Without proper management you are leaving your business finances vulnerable to cash flow issues, fraud, and inaccurate accounting books.

By ensuring accuracy in the AP process you can: Keep your money flowing in a healthy way, avoid late fees and strained vendor relationships, and reduce financial malpractices.

Accounts payable vs. accounts receivable

What’s the difference between accounts payable and accounts receivable anyway?

Accounts payable (AP) are the amount of money your business currently owes.

Accounts receivable (AR) are money owed from customers for goods or services already provided.

In the AP process, the purchase you ordered is payable to you, and a receivable to the seller. AP and AR show up on your balance sheet, with AP as a liability and AR as an asset.

Contrast this with the accounts receivable process.

What are the challenges faced by accounts payable?

Time delays

Time delays can occur in all the steps of the AP process, creating time wasted, missed due dates, and late fees.

Manual processes create time delays and difficulty tracking the status of payments. This issue is only exacerbated as the business grows and more expenses are added to the AP pile.

Matching errors

During the AP process, you encounter many steps that require matching — which is simply cross-referencing one document with another (or others) to ensure accuracy.

For example, once goods are received, you would do a three-way matching with the PO, invoice, and receipt to ensure all the details across the three documents are accurate.

Exception management

Exceptions occur when an invoice is incorrect or incomplete and discrepancies during matching checks. Managing exceptions adds additional time to your AP process, and causes delays in sending payment.

Unnecessary purchases

An AP process with inadequate controls can exacerbate problems of unauthorized and unnecessary purchases. Having clear policies and procedures around invoice approval reduces the amount of money spent inappropriately by credit cards or to unauthorized suppliers.

Fraud and theft

Fraud and theft is a challenge in all financial processes. Without clear policies and an overwhelmed manual AP process, check fraud and email scams can waste money.

According to a report done by Association for Financial Professionals, AFD, 58% of respondents noted that their AP department was compromised through email scams. This report indicates that AP teams continue to be most susceptible to email scams.

Missing documents

Missing documents can be challenging to manage, especially if your AP process is manual. Lost documents lead to unpaid invoices and/or inaccurate matching, which inevitably creates inaccurate financial statements.

Double payment

It can be challenging to stay on top of paid invoices and unpaid ones — especially if you are using a manual process for your AP, or you are using multiple accounting softwares that don’t sync in a central system. Duplicate payments lead to wasted capital and confusion.

Manual processes might work for small businesses with limited invoices, but to grow sustainably, AP automation software allows you to stay on top of your AP process without creating errors from an inefficient process.

Blind spots

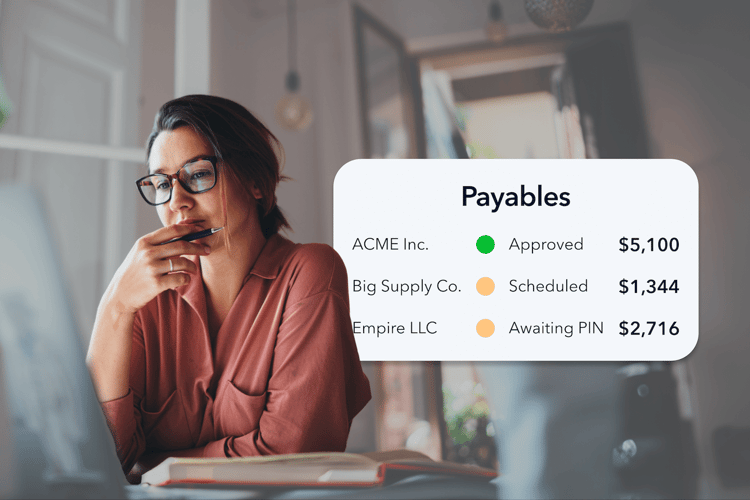

If your AP process is reliant on manual processes, you might encounter blind spots due to the lack of visibility on your AP process, such as the status of invoices and payments.

This lack of visibility increases the risk of late payments, as it’s complicated to keep track of the statuses and schedules of many payments.

Managing the accounts payable process

The most important thing: accuracy

Accuracy is the most vital part of sustainably managing your accounts payable process. Accuracy can be improved by implementing financial software into your process which removes manual data entry and thus decreases the susceptibility of human error.

Key steps in the AP process flow

Key steps in the AP process are:

- Maintaining accuracy across all documents.

- 2- or 3- way matching to ensure accuracy.

- Authorizing the payment through approvals.

- Scheduling and keeping track of the payment.

Centralize your invoice payments

To effectively manage your AP process, it’s helpful to have a centralized platform. Set up standards and common practices with a shared service.

Track every due payment clearly

Create a payment schedule based on your cash flow needs and vendor terms. Adhering to this schedule will determine your AP turnover ratio.

Know exactly who authorizes payments

Set up clear policies for approvals. Implementing automation can speed up payment authorization.

Automation: How to perfect your AP process

With payable automation you improve the efficiency and accuracy of how you process invoices.

Overall, AP software creates efficiency in your process and reduces the effort needed. Here are the benefits of implementing AP automation:

- Automated 3-way matching

- Software can quickly determine if details between documents are correct once documents are uploaded.

- Paying electronically

- Makes payments easier to automate and less error-prone.

- Optical character recognition

- Allows details on documents to be automatically captured, reducing the need for manual data entry. Invoice capture is especially helpful for maintain accuracy.

- Automated approval flows

- Software allows custom approval flows, where approvers can sign off with a click.

- Reporting tools

- AP automation and software gives you capabilities to see the whole picture of your AP process, and can create custom dashboards and reports.

- Integrates with other softwares

- With integration, you can spend less time reconciling your books and can see your AP process in the context of your business finances.

- Timely payments

- Automation speeds up your process leading to getting payments to vendors faster. This way it's possible to take advantage of early payment discounts.

Accounting software for your accounts payable process

Quickbooks pros/cons

Pros

- Has your bills all in one place

- Easy to learn and user-friendly

- Integrates with other software

- Easily track and manage outstanding bills

- Can create and print reports

- Bills paid by check or direct deposit are automatically recorded

Cons

- Lacks invoice design tools

- Limits on number of users

- Lack of industry and business-specific features

- Lack of direct professional support

Xero pros/cons

Pros:

- Cloud-based system

- User-friendly and easy to navigate

- Integrates with other softwares

- Cost-effective

- Real time bank feeds and reconciliation

- Unlimited users

Cons:

- Has a learning curve which takes time to grasp

- Pricing changes as software changes and improves

- No outstanding invoice chaser, must manually follow up

NetSuite pros/cons

Pros:

- Strong financial management capabilities

- Can be customized to business needs

- All-in-one solution that supports growth from SMB to large enterprises

- Supports integration

Cons:

- Pricing changes as software changes and improves

- Additional support at an extra cost

- Custom reports might be challenging to create

- Might have to pay for bundles of functionality even if you only require one function

Payment software to complete your accounts payable process

Plooto pros/cons

Pros:

- Scalable workflow and eliminates AP/AR complexities

- Easy to use and reliable

- Lower transaction fees and fair pricing

- Custom approvals

- Integrates with other software

- Saves time through automation

- Great for tracking payments

Cons:

- Simple onboarding but onboarding is still required

Tipalti

Pros:

- Easy to view status of payments and invoices

- Customer and vendor payment processing

- Advanced reporting

- 3-way matching capabilities

Cons:

- Lacking detail on error reports

- No live support

- Takes time to explore functionality

- Lack of immediate check images

Stampli

Pros:

- Smooth set up

- Duplicate bill detection

- Good customer support

- Automatic sync with integrations

- Custom approval politics

Cons:

- Data entry can be clunky

- No option to edit invoice once assigned to approvers

- Expensive and can be too pricey for smaller businesses

- Hard to delete an invoice from system if error or duplicate

Overall, the AP process can get complicated as your business grows. Adding payable automation software can save you countless hours and simplify your finances.