Change is difficult for any business looking to grow, but AP automation can help make those changes smoother. Traditional accounts payable has relied heavily on paper-based invoices, manual data entry and a process that was prone to errors, costing companies valuable time and profit.

Change is difficult for any business looking to grow, but AP automation can help make those changes smoother. Traditional accounts payable has relied heavily on paper-based invoices, manual data entry and a process that was prone to errors, costing companies valuable time and profit.

But many modern organizations are abandoning the old guard of accounts payable in favor of using automation to help them eliminate resource waste and clear the runway for sustainable growth – and having the right automation tool is imperative to doing so.

Even if you have some elements of your accounts payable process automated right now, you may be reaching a point where it’s time to go from partial automation to full scaling.

In this article, we’ll go over the accounts payable automation process, why it’s an integral tool for scaling your business in the long term and what to look for from a software solution.

Sign up for a Free Trial today.

SHORTCUTS

- How to know when it’s time to level-up your AP process

- Challenges with the current accounts payable process

- What is accounts payable automation?

- How AP automation can help scale your business

- Benefits of AP automation and scaling

- How to prepare yourself for scaling with AP automation

- What to look for in an AP automation software for scaling your business

- How Plooto can help

How to know when it’s time to level-up your AP process

It’s inevitable that as your business grows, so too will the inputs – like data and money – that your financial systems will need to successfully manage.

In some cases, it may make sense to increase your headcount so that you have the staff to handle fluctuations in your invoice volume, but manual processes have a finite point to which they can scale and are known for being inefficient and inaccurate.

This is where implementing a smart accounts payable automation platform can help. That said, be sure to do your research – implementing the wrong solution could limit how much your business can scale.

Here are the signs it’s time to think about scaling up with AP automation:

- Data inaccuracies are increasing

- More time is being devoted to manual data analysis

- There’s a lack of transparency in your financial data; you’re missing the big picture

- Billing cycles are being extended

- Your operations currently lack the scale to match your changing needs

- You’re spending too much time taking care of the financial systems, instead of securing new revenue channels

Challenges with the current accounts payable process

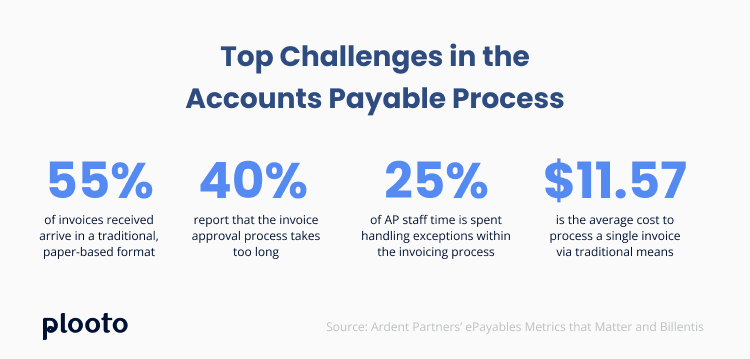

In order to improve the AP process, the first step is to identify why it’s not working for you. There are several big limitations of processing invoices and payments manually, with a real impact to the business.

Non-standardized invoices

While a little over half of invoices are received electronically, 45% of invoices continue to be received manually – and in multiple formats, such as paper documents, faxes, PDF files in emails and more.

With so many different formats to bring under one roof, the AP team has to sift through the many different details of each invoice in order to properly begin processing them.

Disorganized and inconsistent data

Speaking of processing invoices, now that the invoice has been received, the AP team must manually transfer each data point to your existing system and format them for consistency. This type of manual data entry is time consuming and can lead to careless errors.

Discrepancies

Speaking of careless errors, this leads the AP team to manually having to identify and correct discrepancies in invoicing. It’s up to them to match up PO numbers with invoices, ensure payment dates and amounts are correct, and more.

When discrepancies happen, they stall the entire accounts payable process, losing valuable time and resources to sifting through details to find the solution.

What is accounts payable automation?

No matter what kind of business you manage, you likely have vendors, contractors, creditors and employees that will need to get paid and, until now, you may have been processing these payments manually.

Automation is the process in which a software solution helps you streamline each step of your accounts payable process and automatically action invoice payments, tax calculation and vendor management.

Setting up automation requires an up-front investment in time and money, but the benefits far outweigh any potential bumps in onboarding since it will make each function of accounts payable easier and faster.

Most importantly, the benefits gained from implementing accounts payable automation software will allow you the time you need to begin scaling your business for the future.

How AP automation can help scale your business

Improved invoice processing times

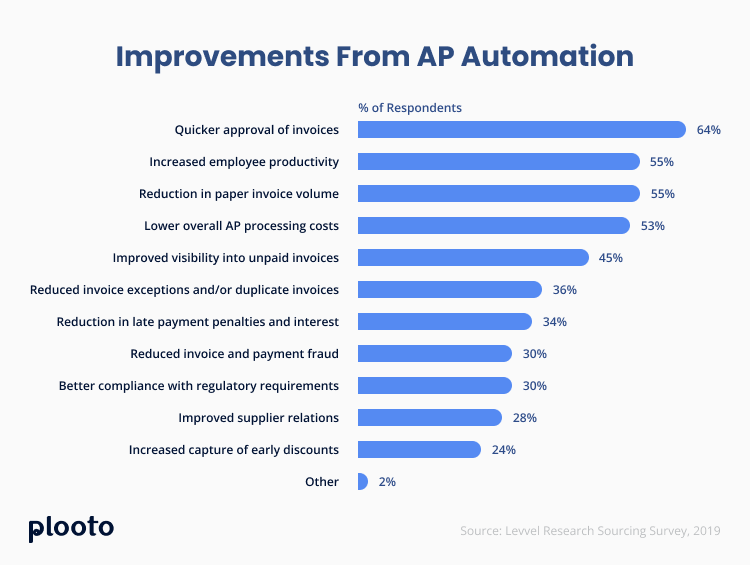

After all, time is money. With an automated solution, everything in the AP process will get smoother and faster – from receiving and cataloging incoming invoices, to approvals from multiple stakeholders, to sending payments in bulk. This means your payment processing cycle times will decrease and so will your overall invoicing backlog, leaving you more time to focus on other areas to grow within the business.

Reduced errors

Every error not only consumes the time it took to make it, it then consumes significant time and resources to correct it. With some thoughtful front-loading of data when implementing an automated solution, the automations will take care of multiple steps within the accounts payable process without issue.

It’ll identify invoice duplicates, exceptions and payments, cross-check data points like POs and, simply by virtue of eliminating manual data inputs, will reduce the number of manual errors entered into the system.

Increased cash flow and data visibility

When processing a low volume of invoices, it’s easier to stay on top of cash flow projections, but as volume increases, it could become difficult having the bird’s-eye view of your balance sheet needed to make informed decisions.

AP automation software stores everything in one place, is searchable and filterable, improving your overall visibility into unpaid invoices, upcoming due dates, account records and more.

Increased cost savings

The reduction in paper invoice volume alone will save you time – and thus, money – on invoice processing. Each transaction cost is also reduced, depending on which software solution you choose, because of economies of scale and the ability to process payments in bulk, versus printing and mailing paper checks.

Being able to see all your upcoming payment due dates at a glance and processing your payments instantly could also save you in late payment fees and interest. This frees up additional cash to expand your business into new products, locations and more.

Improved reporting

As advances to financial tech continue, accounts payable automation tools are including more powerful reporting functions and robust analytics to better understand what your current payment cycles look like, especially in relation to your cash flow and future projections.

Benefits of AP automation and scaling

While there are tangible benefits of scaling with an AP automation platform in the form of time- and cost-savings, there are also several intangible, long-term benefits to your business by implementing an automated solution.

Your AP department’s productivity will go up

Every member of your team gets exponentially more productive when you empower them with automation tools to help make their jobs faster and more efficient. This allows your staff to focus on goals a little more strategically, instead of running from one task to the next.

Improved relationships with your vendors

Automation stores and manages all your vendor account records and invoices in one place. It can also help by setting up automated notifications to your vendors, as well as reminders for you when invoices are coming up for payment.

This helps potentially reduce the number of vendor inquiries on when they can expect payment, and if you pay earlier than the due date, could leave you open to early-payment discounts, reduce disruption to service and the supply chain, that will also improve your relationship.

Fraud risk reduction

No business is exempt from the risk of payment fraud and even the smallest of accuracy errors could lead to costly remediation. AP automation can cross-check invoices to their originating documents to ensure everything is accurate and help you overcome careless errors in vendor invoices.

And when there is an error, you’ll be notified immediately so that you can tend to it as needed. Software that is updated regularly will also remain in compliance with any changing regulatory requirements to ensure everything in your AP process is running above board.

Setting you up for long-term growth

Automation is meant to scale with you, no matter how much business you’re conducting. This means setting up systems that require little more than an up-front investment in time to set up, so that any increases in billing volume can be managed with ease.

Your tool should also allow you to effectively integrate new hires into the process, meant to be an easy onboarding process so that every member of your team is performing to an optimal level with the tools you’ve provided them.

How to prepare yourself for scaling with AP automation

1. Audit your current AP process

You’ll need to start by understanding how your current financial systems work and what potential future needs you’ll have to solve for. Take a look at each step of your current accounts payable process and ask yourself whether each step could benefit from automation, and how.

2. Create a strategy for automation and implementation

Once you’ve looked at your current process, you’ll need to come up with a plan on how to properly implement an AP automation solution. Most will come with self-serve resources and customer knowledge bases you can use to better plan how you’ll get everyone on your team up to speed.

Depending on the size of your current operation, onboarding for a new solution could take as little as a few weeks, to as long as several months, so knowing what you’re getting into with a vendor will help you plan for a seamless transition from your current process to the new one.

It’s helpful to designate specific people on your team to project manage the implementation process and be the stewards of that new solution for the rest of the organization.

3. Create a shortlist of AP automation vendors to consider

Once you have an idea of how you’re going to implement your automation strategy, it’s time to shop for the solution that will get you there. Take the time to properly research and meet with several vendors, to get a better understanding of which ones are the right fit. While many will boast a similar set of key features, only a few will truly resonate with you and match up to exactly what you need from your automation solution.

What to look for in an AP automation software for scaling your business

Scalability

It may sound redundant, but not every solution is built equal. Some have a finite limit to how much they can scale as a solution and it will entirely depend on what you believe your business will reasonably need.

Some solutions are better suited for small or mid-market businesses, while some are built specifically for the enterprise. It all depends on where you are now and where you think you’ll go. Find a solution that you know can grow with you and at the pace you need.

Degree of automation

Will your new solution automate everything in your accounts payable process? Only some of the tasks? What’s the balance of automated to manual tasks that your team will need to take on? Knowing exactly what an AP automation solution can do and to what extent will help you understand how useful the tool will be.

If it only does some of what you need it to, while leaving the bulk of tasks in the hands of your AP team, it may not be the right solution for you.

User-friendliness

Any solution you implement should be easy to implement, easy to understand, easy to navigate, and easy to teach. If the dashboard is bloated with data that you don’t find immediately useful, or if the navigation is clunky and slow, this may not be something you’d consider implementing across your organization.

If possible, make use of any free trials available to you and have multiple staff try to navigate and coach each other through the solution to see if this is a platform that will easily integrate with your existing workflows.

Compliance

Most software stays current with automatic updates, including compliance and regulatory updates. Your automated AP solution should by default keep your business compliant and reduce the risk of any errors that could harm your business.

Mobility and compatibility

Is your new potential platform optimized for mobile? Does it have a native app you can download or can you access and use it easily on your mobile devices? Is it in a format that your entire staff can use at any time, from anywhere?

In a digital-first age, it’s important you empower your staff with a tool that can be taken with them. Anything less than a tool that can be accessed on just about any device will likely not make your short list.

Integration with your existing tech stack

What good is AP automation if you’re still stuck manually transferring data to all your other digital solutions? Look for platforms that integrate with the tools you and your team are already using every day. Integrations should be seamless, easy to implement, and keep all your tools up to date in real time.

Most importantly, ensure your AP automation tool syncs with your existing accounting software so that your balance sheet is always up to date.

Support

The best solutions can fail if they don’t offer the right amount of support. Every organization is different and prefers to navigate a new tool in their own way, so ensure your plan includes exactly the support you need – whether that’s self serve through an online knowledge base, or the use of a dedicated Customer Success Manager.

Cost

The bottom line will likely be the biggest decision maker when it comes to purchasing an AP automation solution to help you scale your business. While prices and plans will vary from monthly and annual subscriptions, pay-per-use and freemium models, be sure to treat this as a sound investment in your future.

You can’t scale your organization without spending capital up front to fuel its growth. No matter which solution you land on, it will require that up-front investment of cash and time to get it working the way you need it to. Again, many will offer up free trials lasting a few weeks to a month or two, so take advantage of these where possible, to better understand which tool makes the most sense.

How Plooto can help

The businesses looking to grow and most likely to succeed are the ones that take full advantage of the incredible advancements available to them in technology. AP automation is a cost-effective way to modernize your business, help set it up for scaling success and Plooto has the AP automation tool to help get you there.

It will eliminate manual processes and inefficiencies within your accounts payable process, leading to significant savings in time and money so that you can reallocate those resources to other projects that will help you grow.

Sign up for a Free Trial today

CHAPTERS

00 Considering Online Payment Software? Payment automation explained

01 Accounts payable software: A guide for strategies, benefits, and solutions

02 Accounts receivable software: A guide for strategies, benefits, and solutions

03 What is the future of Accounts Payable?

04 Comparing the best AR automation software solutions

05 What’s the best AP software for your business? 5 Top vendors compared

06 Scaling for growth with AP automation