Receipts in shoe boxes, running around town to deliver a check, sending e-Transfers daily to make payments.

Sound familiar? You’re not alone. Financial operations are a real headache for many businesses. One secret to smoothing out the process is simple: automating tasks instead of doing them manually.

So why do businesses hesitate to adopt automation solutions that will make their lives easier? Some don’t have the time to research the best solutions, they don’t realize they have a problem, or they may be too busy with other tasks.

Regardless of your hesitations, investing in technology can save you and your team a lot of unnecessary headaches. If you’re on the fence, read these five key reasons why payment automation is worth the investment.

1) Time savings

Manually processing payments wastes unnecessary time that could be used to focus on higher-value tasks.

When you adopt a payment automation platform, you can send, receive, and automatically reconcile payments in just a few clicks. You can also set up custom workflows or with specific approval rules for each payment.

Get more tips on how to leverage AI and automation to streamline your workflows.

StartupTNT, a nonprofit organization, was collecting and sending capital by wire transfers, checks, or e-Transfers — each of which demanded a lot of time from the team. By implementing Plooto, StartupTNT eliminated the need to manually process and reconcile each payment, saving the team valuable time they could put back into connecting startups with the capital they need.

2) Money savings

Conventional banks and payment methods can be very costly for businesses. With payment automation, you not only save on high transaction costs but also save on all the hours your in-house team or accounting firm is spending on manual and repetitive tasks.

Greenhouse, an organic beverage company, was able to save $4,000 per month with payment automation. Before Plooto, employees sat in a room, reviewed each check, attached it to supporting invoices, and then gathered, sorted, and sent the checks to the CEO for a manual check run. By automating this tedious and expensive process, Plooto helped Greenhouse eliminate all costs associated with the manual processes — especially the expense of paper checks.

3) Better financial visibility

When you’re manually processing payments, keeping your books and your finances up to date becomes increasingly difficult to manage across platforms — especially as your transaction volumes increase. This makes it nearly impossible to get a complete picture of your finances, so you never know exactly where your business stands.

With integrated automation solutions, your accounting software and payment platform are always up to date. This enables you to have an accurate picture of your business’s performance.

Learn about the best practices you should adopt for your business chart of accounts from CPA Jami Monte.

4) Cash flow control — and confidence

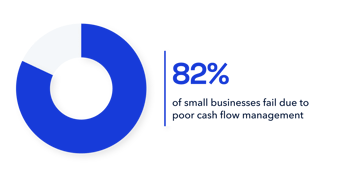

If you’re waiting for checks in the mail and sending e-Transfers every day, it can be difficult to get a clear sense of your cash inflows and outflows. This problem is prevalent especially when a company is in its early stages. In fact, 82 % of small businesses fail due to poor cash flow management.

Take a deep dive into how you can future-proof your small businesses cash flow.

An easy way to get control of cash is to incorporate an AP/AR automation tool and bring a new layer of efficiency into your day-to-day operations. If you choose a platform like Plooto, you can also manage both payables and receivables in one place, no switching between apps necessary.

An automation tool will also instantly reconcile with your accounting software and ensure that you always know how much cash you have on hand today, and how much you will have tomorrow. This will bring you peace of mind so you can focus on what's important to you.

Learn how you can use cash flow forecasting to avoid financial issues.

5) Sustainable growth

Managing your finances manually can only take you so far. There comes a time when the shoeboxes overflow, the payment requests keep on coming, and you spend your weekends writing checks. If you don’t automate your processes, you’ll only be able to grow as fast as your team can keep up with the workload.

On the other hand, Freightzy, a freight brokerage, was able to scale rapidly with payment automation. Before Plooto, the Freightzy team was making payments by printing physical checks and mailing them to their vendors. These checks would get lost, cashed twice, and sometimes duplicated — issues that wasted time and money and limited the company's growth.

When Freightzy integrated Plooto with their accounting software and transportation management system, they were able to grow at an intentional rate and used all the time previously spent on manual tasks scaling the business.

Hear Freightzy Founder and President Sean Freedman’s advice on growing at the right pace.

At the end of the day, automating manual, repetitive tasks is worth the investment of time and money because it ultimately creates efficiencies, improves visibility, and gives you peace of mind.

See why automation is worth the investment

Try Plooto to see for yourself the return on your investment that's possible when you automate the work that's holding you back.

Start free trial