Thank you for choosing Plooto for your AP/AR automation needs. Plooto’s payment processing features have helped many businesses like yours streamline their credit card processing, cut costs, and save time.

You may be wondering how all of this works, and that’s where this article comes in. In this article, we will discuss the simple steps your business needs to take to use credit cards for your account receivables.

Sign up for a Free Trial today

SHORTCUTS

- Part 1. Features of Credit Card Receivables

- Part 2. Additional verification step before creating your very first credit card receivable

- Part 3. How to create credit card receivables

- Part 4. How to create a PAD for credit card receivables

- Part 5. How to create recurring payment plans for credit card receivables

- Part 6. How to delete credit card receivables

- Part 7. How to delete a PAD for credit card receivables

- Part 8. How to delete recurring payment plans for credit cards

- Part 9. Pricing for credit card receivables

- Part 10. Refunds for credit card receivables

Let's first discuss how our credit card receivables offering works.

Part 1. Features of credit card receivables

Plooto enables you to create payment requests that will allow your contacts to use their credit cards to send funds to you. Here are the main features:

- Credit card receivables can be sent to contacts based in Canada and the US and they can link their credit cards that are issued by countries that are covered by Plooto’s international payments.

- Any major credit card can be used by your contact: Visa, Mastercard, and American Express.

- Funds will be deposited into your bank account between 2-3 business days

- Receivables can be manually created on Plooto or imported from QBO, QBD, or Xero.

- The Maximum limit per receivable is $ 10,000.

- Pre-Authorized Debit’s (PAD’s) and recurring payment plans can be created.

- The fee is 2.9% + $0.30 per completed receivable, to be charged to the Plooto customer who created the receivable on Plooto.

Now that we’ve covered some of the features for credit card receivables, let’s get into what you need to do before you start using our offering.

Part 2. Additional verification step before creating your very first credit card receivable

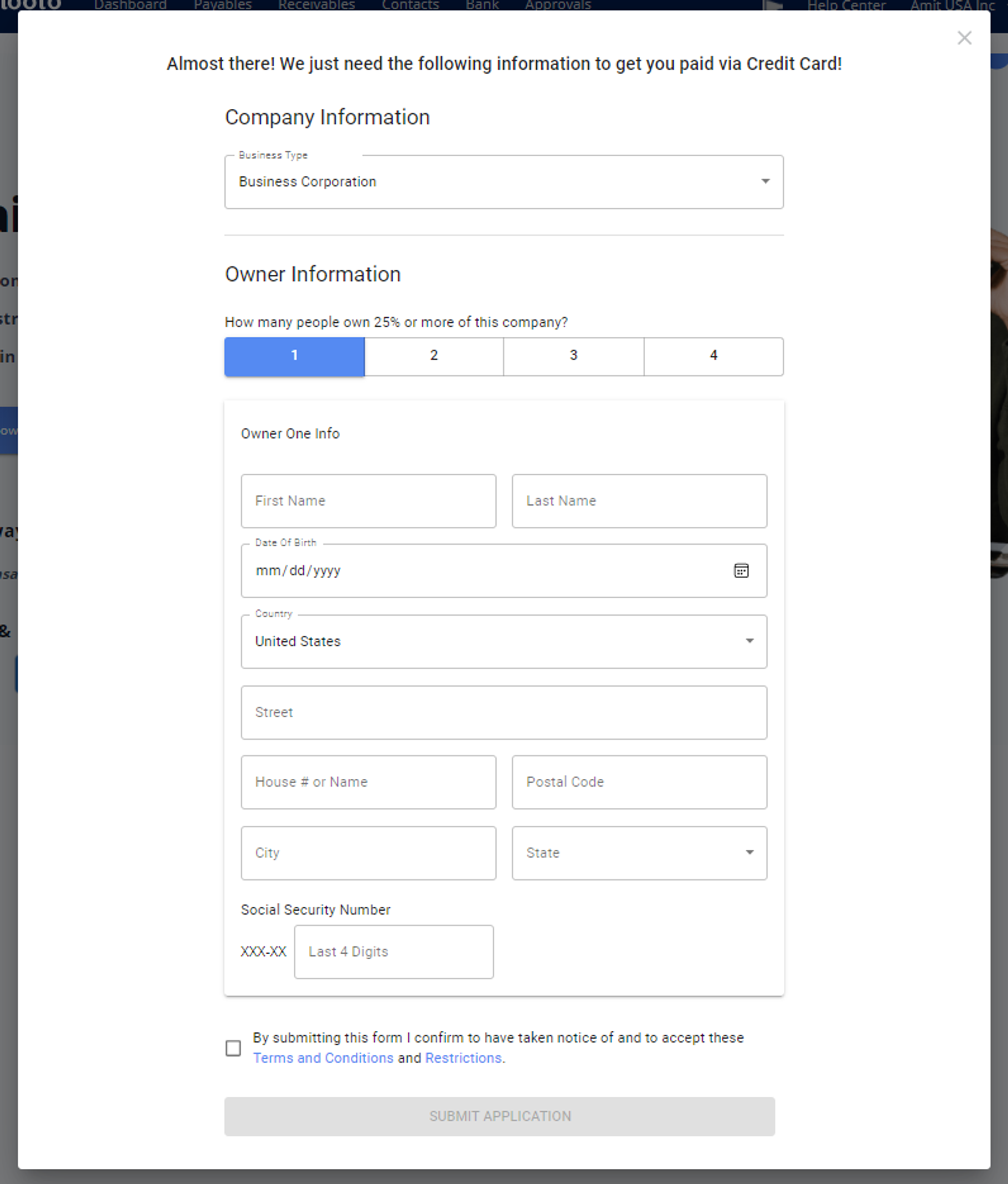

In creating a credit card receivable for the first time, there is an additional verification process that must be completed. This involves answering a few questions about your company and uploading certain documents, as required by our compliance team and our credit card service provider.

The types of questions and required documents will depend on the nature of your business. As you go through these steps, the specific requirements will be displayed on the screen to guide you on what to submit.

As for the Social Security Number at the bottom of the page, this is only a requirement for US-based Plooto customers.

Here is a screenshot of what the additional verification process looks like for credit card receivables:

Once the additional verification step is completed, our Compliance Team will review your submissions and you will get your credit card capabilities after 1-2 business days.

Now that you’re all set on how to pass the verifications steps, let’s get into how you can create credit card receivables in Plooto!

Part 3. How to create credit card receivables

- Go to the Receivables tab and click on New Receivable.

- Choose between manual receivables or imported from accounting software receivables.

- Fill out all required information.

- Under the Recurring Payment Plan Section, click Yes if you want to create one. Otherwise, click No.

- Under the PAD Agreement section, click Yes if you want to create one or use your existing PAD. Otherwise, click No.

- Click Yes under Allow Credit Card section.

- Click the Continue button.

- Review the details of your payment request, then click the Request Payments button.

Let’s now go into ways you can get collect funds faster and on a recurring basis.

Part 4. How to create PAD’s for credit card receivables

PAD’s on credit card receivables can be created to make collecting funds faster and easier. Please click YES under the PAD Agreement section on the Receivables tab to use this feature.

Your contact will then get an email from Plooto and they can accept your payment request by linking their credit card with your PAD. Once linked, the PAD gets created and you can use this PAD to debit your contact’s credit card anytime.

On the subsequent payment requests, the credit card linking process gets skipped when you use the existing PAD, thus allowing you to collect funds faster.

Here are the steps on how to create a PAD for credit card receivables:

- Go to the Receivables tab and click on New Receivable.

- Choose between manual receivables or imported from accounting software receivables.

- Fill up all required information.

- Under the Recurring Payment Plan Section, click Yes if you want to create one. Otherwise, click No.

- Under the PAD Agreement section, click Yes.

- Click Yes under Allow Credit Card section

- Click Continue button

- Review the details of your payment request, then click the Request Payments button.

Part 5. How to create recurring payment plans for credit card receivables

Recurring payment plans can also be created, but they will be manual entries on Plooto just like bank account recurring payment plans, and will therefore not post back to QBO, QBD, or Xero.

Here are the steps on how to create a recurring payment plan:

- Go to the Receivables tab and click on New Receivable.

- Choose manual receivables.

- Fill up all required information.

- Under the Recurring Payment Plan Section, click Yes and fill up all required fields.

- Under the PAD Agreement section, click Yes if you want to create one or use your existing PAD. Otherwise, click No.

- Click Yes under Allow Credit Card section

- Click Continue button

- Review the details of your payment request, then click the Request Payments button.

We know that there can be many situations where a credit card receivable, PAD, or a recurring payment, let’s go through those three scenarios one by one.

Part 6. How to delete credit card receivables

If a credit card receivable hasn’t started processing yet and is still on Pending status, then you can delete it by doing these steps:

- Click on Receivables

- Click the bin icon next to the payment request for deletion

- Click Yes to confirm

Please note that if a credit card receivable is still awaiting acceptance from your contact, then we won't mark it as paid yet.

If it was already marked as paid and it was deleted, then please manually void it on your accounting software. Once it’s voided, it will show up as outstanding again after about 30 minutes and you can select it again for payment.

A payment request by credit card that is rejected by a contact should also be voided on accounting software. Please click on the invoice payment and there will be an option to void it.

Part 7. How to delete a PAD for credit card receivables

There are two scenarios that require PAD deletion: (1) When the credit card that is linked with a PAD has changed; and (2) when your contact does not want their credit card to be debited anymore using the existing PAD.

To delete an existing PAD, please do these steps:

- Go to the Receivables tab and click on the name of the contact.

- Click on the option to cancel the PAD near the contact name.

Once the PAD is canceled, then the PAD Status under the contact’s name on the Receivables tab will say “None”. This will erase the old credit card information that is linked with the PAD. You can then create a new PAD and your contact can accept it by linking their new credit card to it.

Part 8. How to delete recurring payment plans for credit cards

If you and/or your contact do not want to continue with the recurring payment plan, it should be canceled or deleted. If the $ amount, banks involved and the debit date of a payment request under the recurring payment plan needs changes, the recurring payment plan must be deleted as well. Here are the steps:

- Click on Receivables.

- Select the payment request for deletion.

- On the Status Line under Recurring Plan Details, click on Cancel Recurring Plan for Payer.

- Click Confirm.

The contact will then receive an e-mail notification of the canceled recurring payment request and the status will no longer be marked as Active.

Now that we’ve covered all features, benefits, and ways you can use our credit card receivables let's discuss how pricing works for these receivables.

Part 9. Pricing for credit card receivables

Credit card receivables have their own pricing that is separate from payables and bank account receivables. The fee is 2.9% + $0.30 for each receivable by credit card that gets completed. It will be the receivable amount less the fee that will get deposited into your bank account once the receivable is completed.

There won’t be any additional billing item that will be charged to you for credit card receivables, because the amount that gets deposited into your bank account is already net of the incurred fees.

If you are under the Grow Unlimited Plan, then each credit card receivable is not included in your unlimited domestic transactions, and will therefore be charged according to credit card pricing.

If you are under the Grow Plan, then each credit card receivable will be charged according to credit card pricing. There won’t be an extra $ 0.50 transaction fee for your credit card receivables.

If your credit card receivable is a cross-border transaction, then there won’t be any $ 9.99 international fees as well.

The amount that gets deposited to your bank account after the completion of each credit card receivable is minus all credit card fees, and the amount will be batched together. You may run the Completed Receivables report on the Receivables tab to determine the credit card fees that were charged to you.

Please note that the issuing bank for your contact’s credit card may charge foreign exchange fees or currency conversion fees related to making cross-border transactions. These fees are not charged by Plooto and are not controlled by Plooto. Plooto’s fees for credit card payments are only incurred by our customers and are deducted before the receivable payments are paid out to our customers.

Lastly, there may be situations in which you need to refund your receivable, here’s how to do it.

Part 10. Refunds for credit card receivables

Our team can process credit card refunds on your behalf. Please reach out to our Support Team by live chat, email, or phone call to submit your refund request. Please provide the exact amount and the email address of the contact to whom you sent the credit card payment request.

Once a refund is issued to you, then you will be notified by email. The refund will then appear in your bank account after about 7 business days.

It’s as simple as that. Now you and your business are all set up to use Plooto’s credit card receivables feature. Use Plooto today, cut costs, save time and increase your revenue.