Accounts receivable for small businesses may be a basic process of accrual accounting, but that doesn’t mean you’re using it to its full potential to maximize cash flow.

Here we’ll offer two levels of knowledge: basic terms for people who are new to accounting and a high-level overview of how you can better use accounts receivable to improve your business.

If you’re new to accounting, read our glossary of accounting term definitions for this article before diving in.

Table of Contents

- What are accounts receivable?

- What are the benefits of a good accounts receivable process?

- What is the ideal accounts receivable process to improve cash flow?

- What is the difference between accounts payable and receivable?

- What is an example of accounts receivable for a small business?

- How do I improve accounts receivable and cash flow for my small business?

- Glossary and definitions of accounting terms

What is accounts receivable?

The definition of accounts receivable is the money owed to your company for any goods or services you provided to a customer.

Accounts receivables are considered assets on your balance sheet because it’s revenue you can expect to see in the near future, usually within 30, 60, or 90 days, depending on your payment terms.

Accounts receivable shouldn’t be confused with revenue. Revenue is the gross amount you’ve actually been paid, and it appears at the top of your income statement — because it’s in your bank account.

Go back to the table of contents.

What are the benefits of a good accounts receivable process for SMBs?

You can’t improve what you don’t measure.

Your accounts receivable process is tied to your company’s ability to collect revenue, which you can then spend on growing your business — this is called cash flow. Healthy cash flow depends on a well-oiled accounts receivable machine that tracks payments based on their terms.

When you offer customers goods and services on credit, you’re trusting them to deliver on your payment terms — but a perfect world in which everyone pays on time doesn’t exist. Here are some of the ways accounts receivable can help you manage the imperfect reality of running a small or medium sized business:

1. Accounts receivable anticipates late payments

After running an accounts receivable process for a certain period of time, you’ll begin to notice some patterns — and certain customers will win the “Most Likely to Pay Late” award.

When you monitor your accounts receivables from a centralized place, you’ll be able to send reminders and get paid on time.

Bonus: Use software that automates invoice payment reminders on their due date.

2. Accounts receivable identifies non-payment

A good accounts receivable process centralizes invoices and sorts them by due date. You work hard running your business, and you deserve to know at a glance when your customers haven’t paid you for your work.

An automated accounts receivable process makes it easy to identify non-payment and work your way down a list of delinquent customers who are hopefully ready to pay after a small nudge.

Bonus: If non-payment is a simple misunderstanding, transform your follow up into a positive customer touchpoint for your SMB.

3. Accounts receivable reduces bad debt

Bad debt happens when you can’t collect on a customer’s receivables. Maybe their business went bankrupt. Maybe they ghosted you and filing a lawsuit would be more trouble than it’s worth.

While you may not want to add too many barriers to doing business, accounts receivable is a gatekeeper that can prevent bad debt because it clarifies payment terms, sends invoices quickly, and allows you to calibrate the credit you extend to future customers based on cash flow.

4. Financial statements are more accurate with accounts receivable

Speaking of bad debt, businesses that have been running an accounts receivable process for a while are able to anticipate their total bad debt in any given year based on precedent.

This is called “allowance for uncollectible accounts.” We’ll get into this when we describe your ideal accounts receivable process, but basically it ensures your accounts receivable aren’t unrealistically high on your financial statements.

5. Accounts receivable reduces your risk of bankruptcy

Accounts receivable is about setting limits on credit to customers.

When you set the right limits on payment terms, you’re protecting your business against so many bad debts that cash flow is disrupted and you need to declare bankruptcy.

Based on the unique circumstances of each customer, accounts receivable allows you to be as flexible as possible in your payment terms — which can grow your business due to appealing terms for some customers, and prevent bankruptcy due to tighter restrictions on payment for others.

Go back to the table of contents.

What is the ideal accounts receivable process to improve cash flow?

The ideal accounts receivable process depends on offering solid credit terms to your customers so your cash flow is, well, flowing.

You can’t always ask your customers to pay you right away. Your customers may have approval processes and financial reconciliation processes that would make it unreasonable to ask them for immediate payment upon delivery of goods or services.

This is why proper invoicing and credit terms are so important. Here’s a step-by-step instruction manual for the ideal accounts receivable process to maximize cash flow:

Step 1: Set your credit terms with your customers

You’ll need two items to set your credit terms with your customers so you can start invoicing them:

✔️ A credit application

✔️ Clear payment terms

Your credit application doesn’t need to be complicated. It should include:

✔️ Basic company information: legal business name, billing address, mailing address, and business type

✔️ Contact information: accounts payable contact information — the person who will receive your invoices

✔️ Currency

✔️ Payment terms: most commonly 30, 60, or 90 days

✔️ Late payment terms: fees associated with late payment

✔️ Payment method

✔️ Any other relevant contact information regarding payment or service delivery

✔️ Signature and date

When you’re setting your payment terms, have a look at your current cash flow.

If your business has been around for a while and you have a good amount of money in the bank, you may consider extending credit for longer than 30 days.

If your business is young or you don’t have a lot of cash to keep running it, you may want to consider extending credit for 10-15 days.

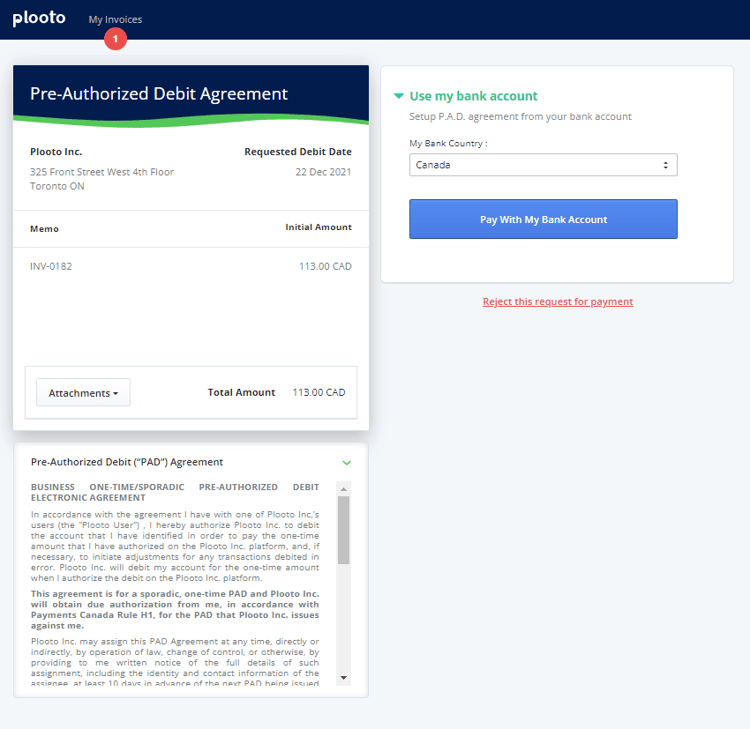

Step 2: Set up a pre-authorized debit (PAD) agreement for recurring payments

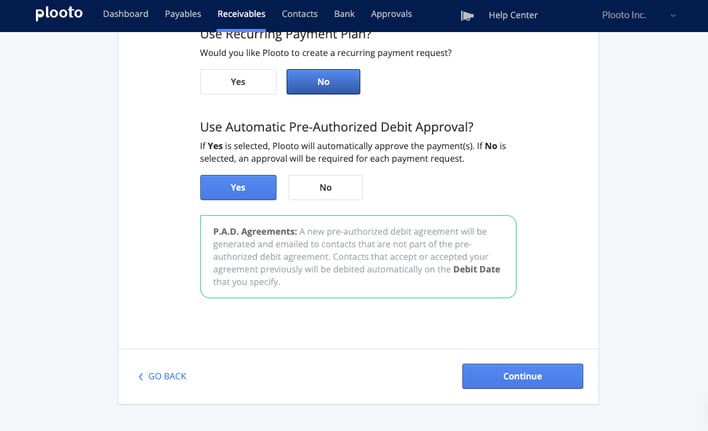

If your customer is amenable to automatic recurring payments, set up a PAD agreement after you’ve agreed on payment terms.

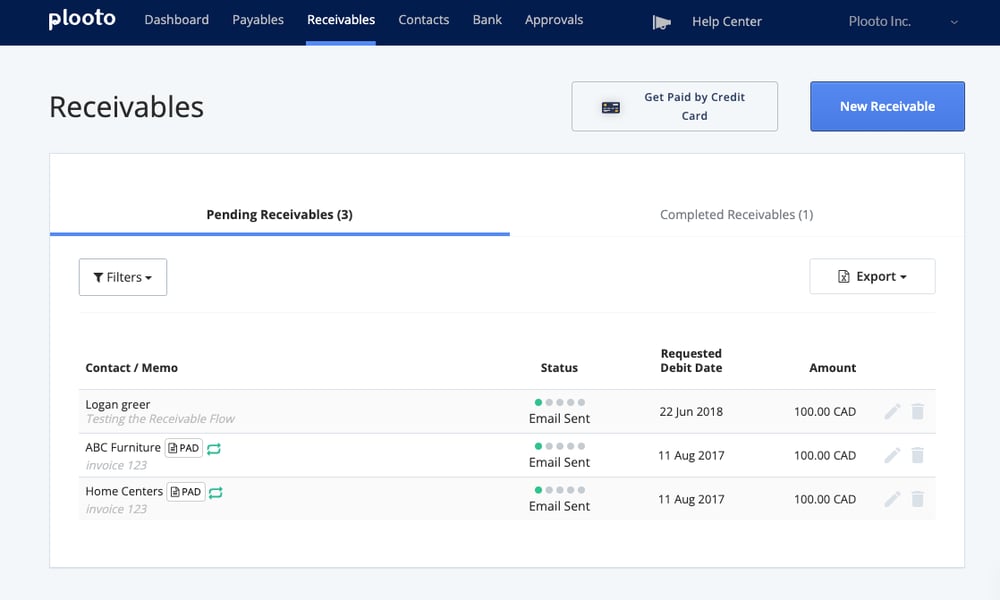

A PAD agreement may be set up within an automated payment platform that allows you to track and receive accounts receivable payments online. When the customer signs the agreement, payments will be taken from their bank account automatically according to your payment terms.

Your PAD payments should sync back to your accounting software for reconciliation so that you don’t need to make a manual entry to record a payment.

Bonus: Encourage customers to sign PAD agreements by offering a discount on goods or services as an incentive.

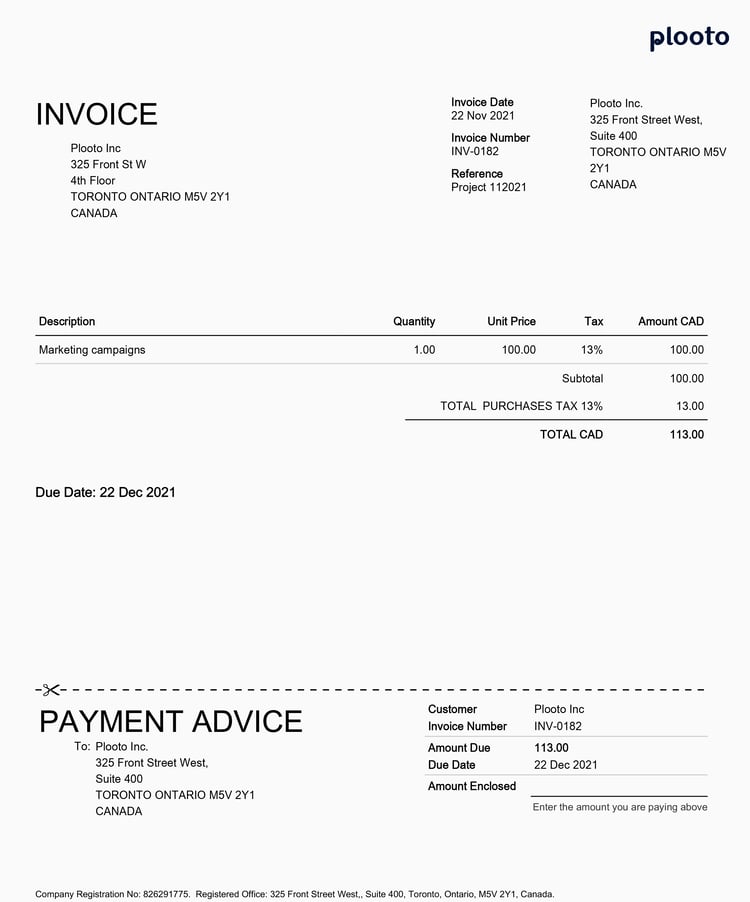

Step 3: Send your customers a clear invoice with automated follow ups

Not all customers will sign PAD agreements, and that’s okay. Either way, you’ll need to send them their first invoice after you agree on credit terms.

Use accounting software like QuickBooks or Xero to create your accounts receivable invoice. Your invoice should include:

✔️ Accounts payable contact information

✔️ Your company’s basic information

✔️ Their company’s basic information

✔️ Balance due, including taxes

✔️ Terms (ex. Net 30)

✔️ Invoice date

✔️ Balance due date

✔️ Product or service line items

Efficiency tip: Use accounting software that automates follow up. The last thing you want to do is spend time manually following up on late payments. People who run SMBs have too much on their plates already!

Many accounting software solutions allow you to write and schedule automated follow ups on the day your invoice is due, three days later, one week later, and two weeks later.

Step 4: Track and analyze your accounts receivables for better cash flow

This is where you’ll be able to maximize cash flow, make better financial projections, and see, over time, how your small to medium sized business can grow.

Accounts receivable tracking is important for getting real about bad debt and cash flow.

Bad debt is considered an expense because it’s lost revenue for services already rendered that customers can’t pay for, either because of miscommunication, bankruptcy, or basic human greed.

Allowance for uncollectible accounts = anticipating bad debt and being prepared

While bad debt is almost inevitable after running a business for a while, you can anticipate it by adopting an “allowance for uncollectible accounts.”

Allowance for uncollectible accounts is the amount of bad debt you estimate your business will see in any given time period.

The formula is simple: Let’s say your business makes an average of $200,000 per year. You’ve also seen that you usually can’t collect 2% of your accounts receivable during that same time period.

To estimate your bad debt expense, you would multiply your total sales by 2% ($200,000 x 0.02). You would then credit $4,000 to allowance for uncollectible accounts, and debit the same amount as bad debt expense.

Accounts receivable turnover ratio = assessing your cash flow for improvement

Next you’ll want to calculate your accounts receivable turnover ratio to find out how fast your customers are paying their invoices.

Start by calculating your average accounts receivable amount.

To get your average accounts receivable amount, look at the accounts receivable you had on January 1 and on December 31 of the same year. Let’s say it was $3,000 and $2,000, respectively.

To get your average accounts receivable amount for that year, use this formula:

$3,000 + $2,000 / 2 = $2,500

To calculate your accounts receivable turnover ratio, divide your net sales ($70,000) by your average accounts receivable amount ($2,500):

$70,000 / $2,500 = 28

This means you have an accounts receivable turnover ratio of 28, which is excellent. The higher the number, the faster customers are paying you.

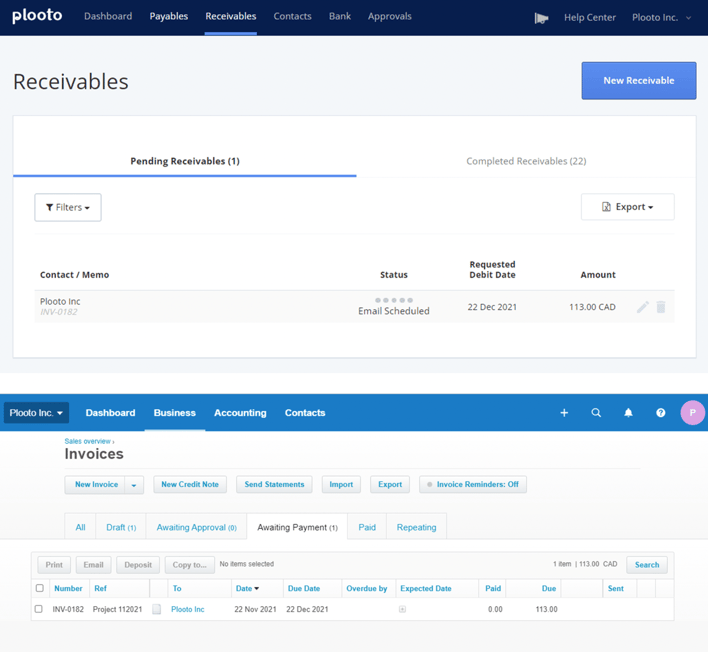

Step 5: Post your customer payments or use software integrations to automatically record payments

The last part of accounts receivable is the best part — getting paid.

Try accepting online payments through an online payment platform that syncs with accounting software. Working with payment software that integrates with accounting software will eliminate the need for you to manually enter a customer payment when it’s made.

Automated payments with accounting software integrations save companies an average of 20-40 hours per week.

Go back to the table of contents.

Get a more in-depth look at the ideal accounts receivable process here.

What is the difference between accounts payable and receivable?

Accounts payable is the money your company owes to vendors and creditors based on payment terms.

Accounts payable represents cash that flows out in due time.

Accounts receivable represents cash that flows in — also in due time.

Go back to the table of contents.

Get a more in-depth look at the difference between accounts payable and receivable here.

What is an example of accounts receivable for a small business?

Treefrog, a small digital agency, is a great example of how a small business uses accounts receivable to track and improve cash flow.

Treefrog offers marketing services to clients, including web design, digital marketing, mobile app development, etc. The company serves many types of clients, like individuals, businesses, not-for-profits, etc.

The company uses accounting software with automated payments to do a few things:

- Offer customers several ways to pay their invoices

- Track all accounts receivables in one place

- Auto-reconcile accounts receivables and payments between accounting software and payment platform

Go back to the table of contents.

How do I improve accounts receivable and cash flow for my small business?

Improving accounts receivable for your small business falls in three categories: monitoring, automating, and acting. Here’s where you can spend some time for the best cash flow results:

1. Create an accounts receivable aging report

When you have a lot of customers, it becomes hard to keep track of who’s paying when, who’s late, etc.

Accounts receivable software can keep track of this for you in one centralized place. When you use a payments software integration with your accounting software, you’ll eliminate the need for what’s called an “accounts receivable aging report”, which lets you know who’s not paying their bills on time.

If you don’t have access to an automated solution, you can create the report like this:

|

Customer name |

1–30 days |

30–60 days |

60–90 days |

Total |

|

Fission Agency |

$500 |

$1,000 |

$2,000 |

$3,500 |

|

Rubicon Video |

$1,000 |

$0 |

$500 |

$1,500 |

|

Zone NFT |

$2,000 |

$200 |

$0 |

$2,200 |

|

Total |

$3,500 |

$1,200 |

$2,500 |

$7,200 |

2. Automate follow ups on past due payments

When customers are late with payments, you’ll need to follow up. Automate this process by using software that will send out a note on the day a payment is due, then three days, one week, and perhaps two weeks later

3. Offer recurring payment incentives

Remember pre-authorized debit (PAD) agreements for recurring payments?

While not every customer will want to sign up for them, you can encourage them to do so with an incentive, such as a small discount. PAD agreements increase cash flow by creating an almost-guaranteed source of recurring revenue without the need to follow up on late payments.

4. Automate your accounts receivable process

Traditional accounts receivable processes involve creating and sending a physical invoice, receiving a check in the mail, and recording the payment manually in multiple places in a physical ledger or accounting software.

Accounts receivable automation eliminates most of this labor. Automation of AR means creating an electronic invoice, offering your customers several ways to pay you, then accepting payment online — which you can then auto-reconcile with an integration with your accounting software.

5. Offer several ways for your customers to pay you

When it comes to payment options, the more, the better. Offer your customers the choice to pay you by credit card, EFT payments, ACH payments, and e-transfers, etc. Bonus if you can make it easy to send payments in multiple currencies.

Go back to the table of contents.

CHAPTERS

01 Accounts Receivables and Assets Explained

02 Accounts Receivable vs. Accounts Payable: What's the Difference?

03 What Is the Accounts Receivable Process?

04 Setting Up an AR Process; Get Paid Faster & Increase Cash Flow

05 Make it Simple to Receive Payments from Your Customers

Glossary and definitions of relevant accounting terms

Accounts payable: The money your company owes, but hasn’t yet paid, to vendors for goods or services.

Accounts receivable: The money owed, but not yet paid, to your company for goods or services.

Accounts receivable aging schedule: A table that shows you all accounts receivables, sorted by due dates.

Accounts receivable turnover ratio: A formula that measures your efficiency in collecting the money owed to your company.

Accrual accounting: An accounting method where revenue and expenses are recorded at the point of transaction, not when payments are received or made. See “cash basis accounting” for alternative.

Allowance for uncollectible accounts: A general ledger account that records the percentage of accounts receivables you can’t collect from customers.

Assets, or asset account: Line items that show the value of what your company owns, whether cash, accounts receivables, investments, etc.

Bad debt expense: When a client doesn’t pay and you can’t collect their receivables.

Balance sheet: A financial statement that shows your company's assets, liabilities, and shareholder equity during a specific time period.

Cash basis accounting: An accounting method that records transactions only when payment is exchanged. See “accrual accounting” for alternative.

Cash flow: The movement of money in and out of your company.

Double-entry accounting: A bookkeeping system that requires a credit entry to one account and a corresponding debit entry to another account.

Liability, or liability account: Line items within your books that show how much your company owes.

Revenue: Assets earned by your company's goods or services.