What is 3-way matching in accounts payable?

How three-way matching improves payment accuracy and how automation streamlines the process, reducing labor, errors, and expenses.

Nearly half of small businesses fear taking on new clients due to billing fraud, which cost merchants over $38 billion in 2023 alone. In response, modern businesses must refine their account control workflows to combat fraud and minimize human error.

One effective method is three-way matching, which enhances payment accuracy and detects fraudulent invoices. However, manual 3-way matching is both costly and labor-intensive.

Accounts payable automation allows businesses to reap the benefits of 3-way matching while saving labor for more critical tasks.

Below, we discuss what 3-way matchin is and how automation technology helps industry leaders centralize and upscale their account control workflows.

Key takeaways

- In three-way matching, the purchase order, goods received note (GRN), and supplier invoice are compared to ensure the accuracy of the transaction.

- Manual three-way matching is time-consuming and often delays payments.

- Automating three-way matching improves efficiency and reduces errors.

- Automation centralizes and scales account control workflows.

- Automated three-way matching protects businesses from fraud and enhances financial accuracy.

What is a 3-way match?

Three-way matching is a process that tracks purchase details to ensure consistency among three key factors.

Conventionally, businesses only use two factors to verify purchases — the supplier invoice and the purchase order (PO). Unfortunately, this method lacks an internal verification step to detect fraud or ensure the final cost matches the agreement.

By comparing the invoice and PO to the buyer’s goods received note (GRN), 3-way matching creates a more reliable method to detect fraud and verify transactions.

What is 3-way matching in accounts payable?

Three-way matching in accounts payable is a crucial step in accurate account control. Businesses using the 3-way matching system only pay invoices that have been verified against their purchase orders and order receipts. This accounts not only for the cost of the items and the quantity purchased but also for the verified condition of the goods delivered.

While both large and small businesses can fall victim to fake invoices, small businesses may not have the resources to recover their assets. Since 38% of businesses reported a fraud attack in 2022, 3-way matching represents a vital strategy to spot discrepancies before they become costly.

What is the 'concept' of 3-way matching?

The concept of 3-way matching includes the buyer’s receipt record, unlike two-way matching, which helps verify payments. By factoring in the PO, 3-way matching confirms that the goods accounted for match the ones received.

When to use a 3-way match

Three-way matching is crucial in any accounting situation where a discrepancy can leave a business susceptible to fraud or payment delays. High-value purchases are especially vulnerable since they represent the greatest potential losses from fraudulent billing schemes.

By employing 3-way matching, businesses can prioritize accurate bookkeeping without incurring additional security expenses. This accomplishes three vital points:

- Organizing and verifying the auditing process

- Strengthening relationships with suppliers

- Saving time and money on payment resolution

For modern businesses locked into outdated payment workflows, 3-way matching enables their payable process to manage large numbers of transactions safely and efficiently.

How the 3-way matching process works

The 3-way matching process follows simple steps that take a business from procurement to invoice processing and payment release:

Step #1: The buyer creates a purchase order

The PO, which includes crucial information like the quantity and price of the goods purchased, must be created by the buyer and delivered to the vendor.

POs serve as the preliminary agreement between the accounts payable team and the supplier.

Step #2: The buyer creates a goods received note

The buyer’s AP team creates the GRN to verify that they received the shipment of goods in the quantity specified by the packing slip and purchase order.

For businesses that sell and receive services rather than products, the buyer would instead manually verify that the services were rendered.

Step #3: The supplier creates an invoice

Once the GRN is received, the supplier issues an invoice for payment.

This invoice references the PO number so the information can be cross-referenced in the manual invoice matching process.

Step #4: The invoice is compared to the purchase order

The buyer’s AP department must compare the vendor’s invoice with the original PO to ensure they match, which is known as the invoice approval process. Notably, this would be the last step of the two-way matching process.

Step #5: The buyer creates a receiving report

If the invoice matches the PO, the buyer sends a receiving report or GRN to the supplier to verify that the order has been completed.

Step #6: The three documents are compared

Using 3-way match processes, the buyer compares the PO, GRN, and invoice to ensure they line up. The invoice is then approved so payment can be confirmed.

Three-way matching components

To recap, the main components of the 3-way matching method are purchase orders, goods received notes, and vendor invoices. They each play a unique role in verifying the purchase, which can be simplified this way:

- The purchase order verifies what the buyer bought and in what quantities

- The goods received note verifies what the buyer received

- The invoice verifies what the vendor accounted for

Each of these documents is crucial in the 3-way matching process. The more documents that can be verified, the less likely the purchase contains errors.

Who is responsible for a 3-way match?

The buyer is responsible for verifying the purchase using a 3-way match before payment is released to the supplier. This ensures that each step aligns with the last from when the buyer creates the purchase order to when the payment schedule is finalized.

An example of 3-way matching

To demonstrate 3-way matching in action, let’s look at a hypothetical example of a real-world transaction.

-

A train-manufacturing company, GoTrainGo, wants to offer more remote positions to employees, a common demand post-pandemic. To do so, they plan to order 150 headset microphones at $200 each.

-

GoTrainGo creates a purchase order that includes the quantity and price per item of the headsets and sends it to GoHeadsetGo Inc., which ships the headsets.

-

After their receiving department inspects the shipment, GoTrainGo creates a goods received note verifying that the number and condition of the headsets match the PO.

-

GoHeadsetGo receives the GRN and creates an invoice verifying the payment amount.

-

GoTrainGo compares the information on the PO, GRN, and invoice.

-

GoTrainGo either approves the payment on the invoice or begins investigating any discrepancies, depending on the result of the 3-way match.

These discrepancies could indicate fraud, but they could also indicate human accounting errors. For example, the seller’s invoice may state a higher price than the buyer’s purchase order because someone miscalculated or misentered the information.

The advantages and disadvantages of 3-way matching

Three-way matching provides numerous benefits to businesses that deploy it effectively. However, manual processing can impede these benefits and lead businesses to seek other account control methods.

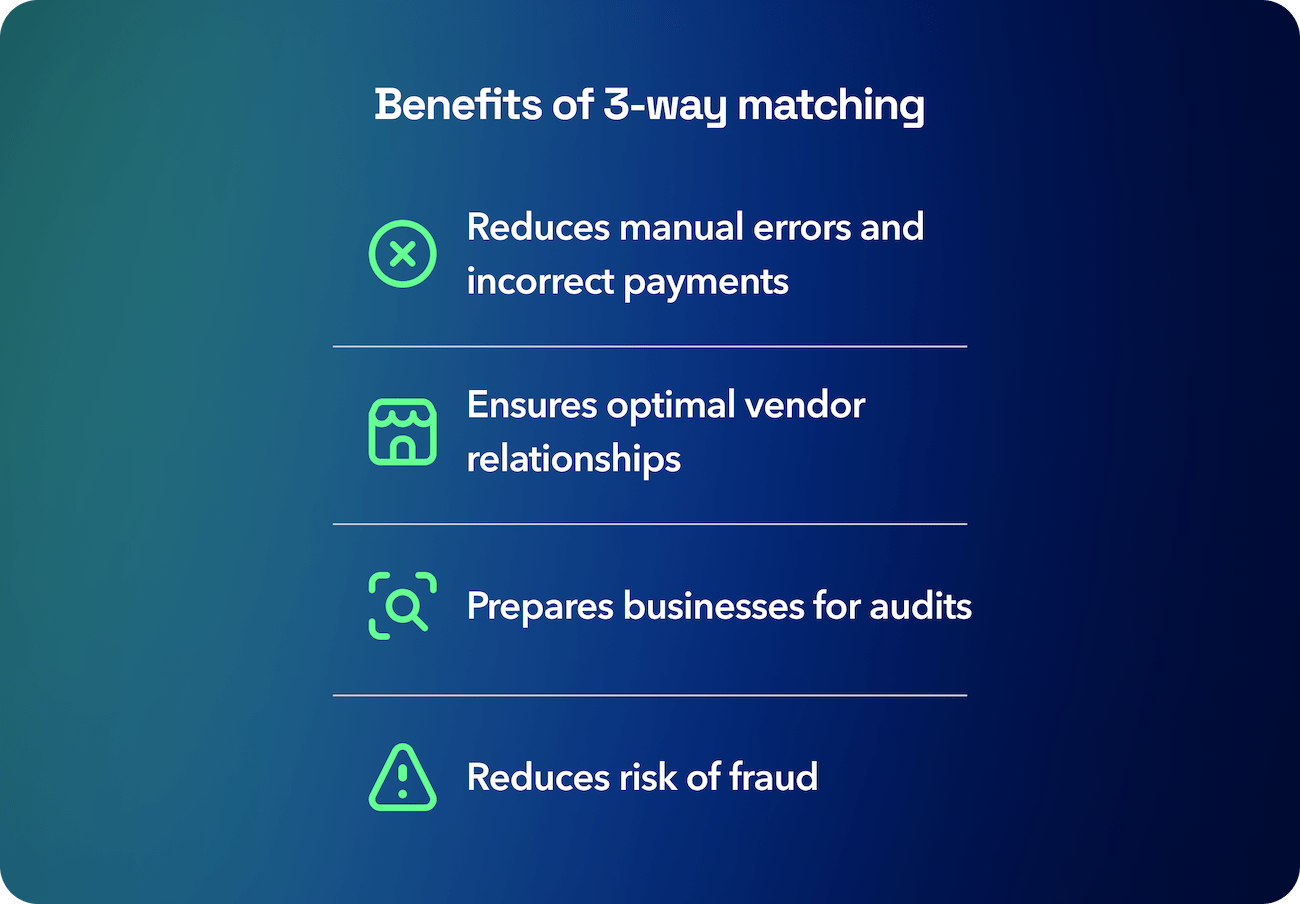

Benefits of 3-way matching

The benefits of an efficient 3-way matching system include:

-

An improved payment process. With 3-way matching, businesses can verify purchases more accurately, saving their account control workflow from costly inaccuracies.

-

Billing fraud prevention. By verifying invoices against purchase orders and goods received, businesses can issue payments without worrying about billing fraud.

-

Increased savings. Three-way matching saves businesses money by preventing billing fraud while reconciling discrepancies in legitimate invoices, which can lead to overpayment. Suppliers may even offer discounts to businesses that can release payments quickly.

-

Preparation for business audits. Three-way matching collects and verifies purchase documents, making internal and external audits easier.

-

Improved customer relationships. Suppliers reward businesses that conduct accurate and efficient account control, which includes creating accurate purchase orders and releasing payments quickly.

Disadvantages of the manually executing the 3-way matching process

As with any new workflow, 3-way matching presents unique challenges, especially when businesses attempt a manual matching process. These include:

-

A labor-intensive system: Manually performing 3-way matching is labor-intensive and time-consuming. When discrepancies arise, resolving them delays payment processing and requires additional labor.

-

Strained supplier relationships: These delays can result in some suppliers penalizing your business for late payments, eating into the profit margins you hoped to improve with 3-way matching.

-

Human error: Manual 3-way matching can cause as many discrepancies as it solves. By misreading, misinterpreting, or misplacing important figures, your staff could make 3-way matching more costly than it’s worth.

Notably, these disadvantages only apply to the manual matching process. By deploying an AP automation platform, businesses can avoid the pitfalls of manual matching while reaping the benefits.

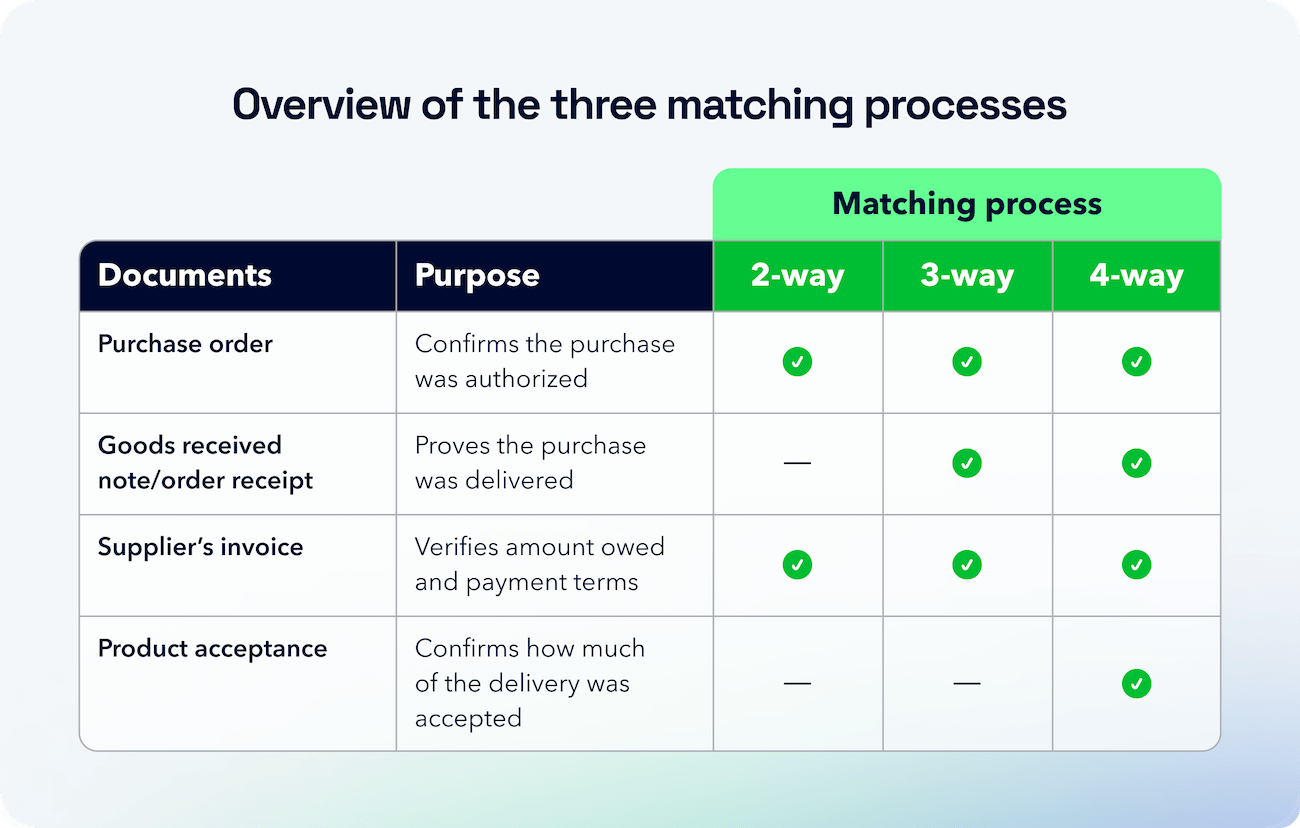

2-way vs 3-way vs 4-way matching

Two-way, 3-way, and 4-way matching cross-reference different documents to verify purchases. While 3-way matching is the optimal solution for most businesses, all three methods have ideal use cases.

-

2-way matching only compares the purchase order and invoice. It prioritizes speed over accuracy, which may not be optimal for high-value purchases.

-

3-way matching adds the GRN to ensure that the quantity and condition purchased match what your business received.

-

4-way matching adds the manual inspection report for another layer of verification, making it the most time-consuming and labor-intensive matching method. It is also the most accurate.

When should you use two-way matching instead?

Businesses that conduct numerous small transactions or regularly make the same transactions might benefit from the efficiency of 2-way matching.

For example, if your business makes the same supply purchases every month, your AP team will likely be familiar enough with the cost to spot accounting errors.

This helps improve working capital and increase metrics like AP turnover ratio.

When should you use 4-way matching instead?

Oppositely, four-way matching may be optimal for businesses in industries where quality compliance is more significant, like the healthcare equipment industry.

In that case, lengthier verification might be more cost-effective in the long run because discrepancies in equipment condition or quantity would be far more costly.

What is invoice matching?

Invoice matching is a critical part of invoice management. It uses supporting documentation to verify an invoice. It’s a vital component of accurate account control since it ensures that transactions are performed and recorded accurately.

A typical invoice contains six crucial pieces of information that provide the basis for the match, including:

- The name of the vendor

- The name of the buyer

- The good or service purchased

- The quantity and condition purchased

- The value of the purchase

- The purchase date

Automated AP software expedites this process by automatically reconciling errors in a company’s internal records and flagging inconsistencies between buyer and vendor documents.

Since every invoice costs an average of $9.25 to process, businesses need to take control of their purchases with a customized account control workflow that spots errors before they become costly.

What documents are needed for 3-way matching?

Three-way matching requires two documents from the buyer – the purchase order and the goods received note – and the seller’s invoice. These are compared to spot discrepancies in the quantity, condition, or price of the goods received.

Benefits of automating the matching process

In an age defined by technological evolution, many businesses are wary of changing their workflows for the “next big thing.” However, automated matching comes with numerous benefits for businesses of all sizes.

Custom workflows. Automated matching can tailor your AP and AR workflows to your team’s needs, including managing payments accurately without labor-intensive confirmation processes.

Centralized control. With a centralized hub that controls your AP and AR workflows, you can route your accounting software, bank accounts, and automated workflow through the same system, giving you greater account access and control.

Invoice efficiency. According to Ardent Partners, 57% of AP departments listed lengthy payment approvals as their number one hurdle in 2022. Automated matching improves invoice efficiency by cutting time-intensive labor.

Cash flow management. Automated matching centralizes your finances to ensure that the money is always in the right place at the right time to complete your transactions.

Scalable systems. Automated matching fixes common scalability pain points such as labor-intensive paperwork changes and inefficient data entry. Your team can use their time more wisely on tasks that require human input.

The best software for automating the 3-way matching process

The best software for automating the matching process tailors its functions to your business’s AP and AR workflows.

In other words, it augments your infrastructure rather than upheaving it.

Plooto offers customizable workflows that can deploy effective 3-way matching in any business looking to harness and centralize its AP management in one system.

It integrates with your accounting software to streamline and automate three-way matching, improving efficiency and reducing the risk of errors in accounts payable.

FAQs

Don't see your question answered here? Contact us today.

What is 3-way match in Oracle NetSuite?

The accounting software, Oracle NetSuite, offers 3-way matching that verifies the accuracy of the supplier’s invoice against the business’s original purchase order and order receipt. Plooto integrates with NetSuite and other common accounting systems to move your AP and AR account workflows to one convenient hub.

What is 3-way match in SAP?

In SAP, a 3-way match is based on each PO line item by comparing the PO to the goods received (GR) and invoice received (IR).

How do you test a 3-way match?

You test a 3-way match by comparing the contents of the invoice to the PO and GRN to verify that the quantity and condition of the goods ordered match those that the business received. This can be done manually by allocating staff to check each detail or automatically by using AP management software.

Further reading

Learn more about popular accounting terms and practices to ensure you're at the top of your game.

Table of contents

What is a 3-way match?

What is a 3-way match?

When to use a 3-way match

When to use a 3-way match

How the 3-way matching process works

How the 3-way matching process works

An example of 3-way matching

An example of 3-way matching

The advantages and disadvantages of 3-way matching

The advantages and disadvantages of 3-way matching

2-way vs 3-way vs 4-way matching

2-way vs 3-way vs 4-way matching

What is invoice matching?

What is invoice matching?

Benefits of automating the matching process

Benefits of automating the matching process

The best software for automating the 3-way matching process

The best software for automating the 3-way matching process

FAQs

FAQs

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialSpeed up and simplify your B2B payments with Plooto — entirely free.

Learn if Plooto is right for you as you scale your business.

Start free trial