What is accounts payable? Definition, examples, and how it works

Understanding AP is critical to financial health for any business

Key takeaways

- As more companies plan to use electronic payments, it's very important to have good accounting systems, especially for managing bills and debts.

- Accounts payable shows what a company owes, and is listed as a debt. This is different from accounts receivable, which shows what is owed to the company and is listed as an asset.

- Using modern software for accounts payable helps make managing payments easier, more accurate, and quicker.

- Having good relationships with suppliers and clear communication helps ensure payments are made on time, which is crucial for a company’s smooth operation.

- Effective management of accounts payable helps a business make smarter financial decisions and manage its money better.

With about 64% of organizations planning to increase electronic payments, efficient accounting systems are more crucial than ever. The same is true for every accounting entry on the balance sheet, including accounts payable.

Accounts payable records money owed to vendors for received goods and services. In this comprehensive guide, we will answer some of the most common questions business owners have about accounts payable including what it is, how it works, and how accounts payable software can help improve your current accounting operations.

Accounts payable definition

Accounts payable is an accounting entry that shows how much an organization owes vendors and suppliers. This total includes goods that have already been delivered and services that have already been provided.

Accounts payable vs. accounts receivable

Accounts payable and accounts receivable are complementary but fundamentally represent opposite transactions. Accounts payable tracks what a company owes vendors, while accounts receivable shows what is owed to the company. Because of this, accounts payable are considered a current liability on the balance sheet, while accounts receivable are considered an asset.

Accounts payable vs. trade payables

Trade payables are a specific type of “accounts payable” that account for all money owed on inventory-related goods, which might include day-to-day business supplies, stock, certain types of equipment, and more.

Accounts payable examples

There are many different short-term obligations a business might have to pay and, as a result, there are also many different accounts payable accounting entries you might encounter.

These can include various expenses and items:

Business travel expenses

Business travel expenses are frequently listed as accounts payable, especially because these expenses are sometimes covered by employees while traveling and then reimbursed later. Possible business expenses include airfare, hotels, rental cars, meals, entertainment, conference fees, and more. A well-structured accounting software system will make it easy to track, record, and quickly pay each of these accrued expenses.

Internal payments

Internal payments represent money transfers that are made within the organization itself, such as payments made between different branches or departments. For example, moving the company’s cash from the sales department to the marketing department could be classified as an “internal payment”, even if the total cash-on-hand doesn’t change. Delays in internal payments can cause delays in daily operations, which is why it is important to create a system where all departments can easily collaborate.

These all fall under the responsibility of the AP department.

Vendor payments

To operate smoothly, businesses must pay their vendors fully and on time. Every time a good or service has been distributed by a vendor—and hasn’t yet been paid for—the business receiving the good or service will need to create an accounts payable entry on the balance sheet. This can include subscription payments, one-time payments, recurring payments, international payments, and others. Using an automated vendor payment system can help reduce accounting errors and make it easier to correctly time payments coming in and going out.

Other functions

Different industries may have unique accounts payable requirements. A few examples of industries facing unique accounting challenges include manufacturing, finance, healthcare, and retail. Regardless, it is paramount for all businesses to develop a system that is compliant with government regulations and industry standards, can be effectively managed and reviewed when needed, and is capable of scaling up (or down) in the future.

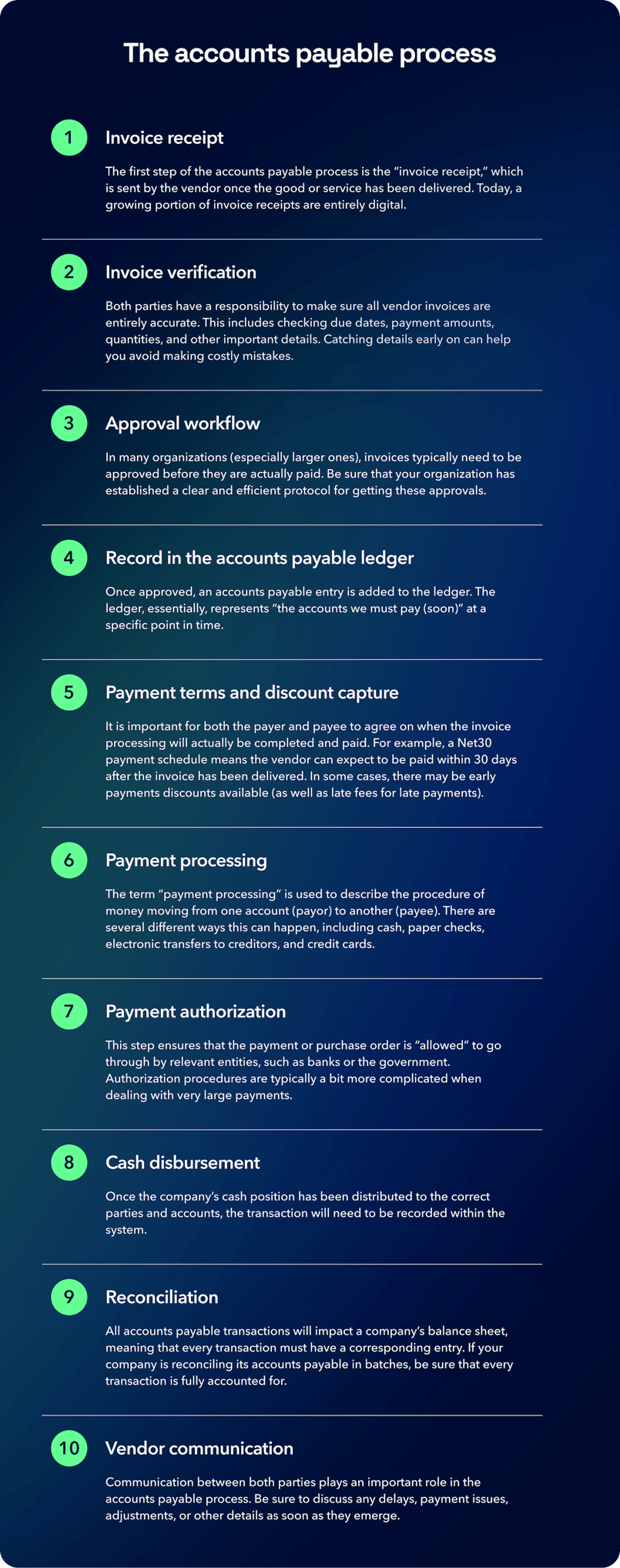

The accounts payable process

Accounts payable appears on the balance sheet, which shows a company's assets and liabilities at a specific time. As a result, managing your accounts payable becomes a very active accounting process, with many important workflow actions occurring over time.

Streamlining each of these steps can help an organization maximize efficiency and improve its financial health.

Invoice receipt

The first step of the accounts payable process is the “invoice receipt”, which is sent by the vendor once the good or service has been delivered.

Today, a growing portion of invoice receipts are entirely digital.

Invoice verification

Both parties have a responsibility to make sure all vendor invoices are entirely accurate. This includes checking due dates, payment amounts, quantities, and other important details.

Catching details early on can help you avoid making costly mistakes, and unpaid invoices can often incur late fees.

Approval workflow

In many organizations (especially larger ones), invoices typically need to be approved before they are actually paid. Be sure that your organization has established a clear and efficient protocol for getting these approvals.

Record in the accounts payable ledger

Once approved, an accounts payable entry is added to the ledger. The ledger represents “the accounts we must pay (soon)” at a specific point in time.

Payment terms and discount capture

Both the payer and payee need to agree on when the invoice management and processing will actually be completed and paid. For example, a Net30 payment schedule means the vendor can expect to be paid 30 days after the invoice has been delivered. In some cases, early payments discounts are available (as well as late fees for late payments).

Payment processing

The term “payment processing” is used to describe the procedure of money moving from one account (payor) to another (payee).

There are many different ways this can happen, including with cash, paper checks, electronic transfers to creditors, and credit cards.

Payment authorization

This step ensures that the payment or purchase order is “allowed” to go through by relevant entities, such as banks or the government. Authorization procedures are typically more complicated when dealing with very large B2B payments.

Cash disbursement

Once the company’s cash position has been distributed to the correct parties and accounts, the transaction needs to be recorded within the system.

Reconciliation

All accounts payable transactions will impact a company’s balance sheet, meaning that every transaction must have a corresponding entry — this is known as double-entry bookkeeping. If your company reconciles its accounts payable in batches, ensure every transaction is fully accounted for.

Vendor communication

Communication between both parties plays an important role in the accounts payable process. Be sure to discuss any delays, payment issues, adjustments, or other details as soon as they emerge.

Maintaining good customer relationships is critical to the success of any business.

The details of a company's given AP process may vary, but generally adhere to to one over-arching structure.

The importance of accounts payable for a business

The AP process is crucial for any business that hopes to operate using any type of credit. Any time a business receives a good or service it has not yet paid for, an accounts payable entry will need to be created.

How this entry's managed after it's been formally entered into the balance sheet is important. With the right accounts payable best practices in place, businesses can better understand their finances, make sure all essential partners are paid correctly, and, ultimately, use real-time data (like payable turnover ratio, etc.) to make better decisions.

Understanding AP outstanding also helps companies forecast future cash flow.

Tips for managing your accounts payable

Effectively managing your AP can have a major impact on your business’s financial well-being. For companies evaluating their AP process, it's important to consider a few best practices.

Establish the AP system

In order to get the most out of your new system, you will want to make sure that everyone involved is on the same page. This means ensuring that all team members are using the same data, working with the same software, and are able to easily collaborate, when needed. Fortunately, modern accounts payable software has helped make this process considerably easier.

Look for discount opportunities

Finding overlooked discounts is one of the best ways for your business—regardless of its size—to improve its profit margins. Even if they have never mentioned it, it is likely that many of your vendors will offer discounts for early payments or using certain platforms.

Set up reminders

While there are many components of the accounts payable process that, with the right software, can be automated, there are still other parts you will need to do yourself. Setting up reminders for deadlines, tasks, communications, and other important details will help ensure your accounts remain fully up-to-date.

Update your contact information

Communication plays a key role in the accounts payable process. Naturally, in order for any of your communications to be effective, you will need to have updated contact information. Make sure to periodically confirm that all vendor, employee, and processor information is current.

Maintain vendor relationships

Businesses that can garner healthy relationships with vendors will be much better equipped to deal with future challenges. In order to do this, be sure to communicate with vendors often (check-ins, follow-ups, etc.), establish reliable points of contact, and review your relationship on a regular basis.

Accounts payable automation software: the future of AP

Over the past few years, the accounts payable process has become significantly more digital. Thanks to the development of software like Plooto, businesses can now manage their accounts payable automation (and AR automation) and generate new general ledger reports with ease.

Functions of AP software

Accounts payable automation software can perform many useful functions, including streamlining approval workflows, organizing records, preparing for audits, visualizing the cash flow statement, and more. Additionally, new customization options, like payable workflow management, make it easy for businesses to find tailored solutions.

Benefits of implementing AP automation software

There are many reasons 41% of businesses—and growing—choose to automate at least a portion of their accounts payable processes. In addition to increasing accuracy (reducing human error), accounts payable automation software can help save time and money, improve reporting standards, and can be easily scaled over time.

As payments become increasingly digitized, AP automation software will become more important than ever.

Potential drawbacks of AP software

The drawbacks of automated accounts payable are relatively limited. However, these systems are only as good as the information being fed into them. It will still be important to make sure that all inputs are accurate.

As long as a company uses AP software that integrates with their accounting software, processes will be relatively seamless and fast.

Accounts payable software options

Unsurprisingly, there are numerous accounts payable software options available to choose from. The one that is right for you will depend on the current needs and structure of your business.

Below are a few options to integrate AP automation software into your AP process:

Plooto

Pros

Ease of use: Plooto is renowned for its user-friendly interface, making it easy for teams to adopt and integrate into their existing workflows. It integrates with the industry's most popular accounting software like NetSuite, Xero, and QuickBooks.

Comprehensive features: Includes features like automatic payment reconciliation, pre-authorized debits, and the ability to manage both domestic and international transactions.

Strong security measures: High-level security protocols to ensure the safety of all transactions.

Bill.com

Bill.com is another options for AP automation that integrates with popular accounting software like NetSuite and Xero.

Tipalti

Like Bill.com, Tipalti offers AP automation and integrates with popular accounting software.

FAQs

Don't see your question answered here? Contact us today.

Is accounts payable an asset?

On the balance sheet, accounts payable are recorded as a liability, not an asset account. This is because accounts payable represents money owed to another party.

Is accounts payable a liability or expense?

For accountants, accounts payable exist as short-term liabilities on the balance sheet, which simply means you owe money to another party.

Expenses, while similar to liabilities, appear only on the income statement.

Is accounts payable a debit or credit entry?

“Accounts Payable” is a liability, and all liabilities are considered credit accounts on the balance sheet.

What is GAAP for accounts payable?

The term GAAP stands for “Generally Accepted Accounting Principles”, which helps establish a basis for accounting rules and norms. GAAP indicates that any accounts payable entries need to be included on the company’s balance sheet and remain there until the account has been paid.

Furthermore, GAAP also establishes that trade payables and non-trade payables need to be recorded separately.

What is another name for accounts payable?

“Accounts Payable” is the term you are, by far, most likely to encounter. However, you might also hear these accounts called AP, balance due, bills, short-term debt, liabilities, tabs, or simply payables.

Further reading about AP

Learn more about accounts payable and its importance.

Table of contents

Accounts payable definition

Accounts payable definition

Examples

Examples

The AP process

The AP process

Why AP is so important

Why AP is so important

Tips for managing AP

Tips for managing AP

AP automation software benefits

AP automation software benefits

AP automation options

AP automation options

FAQs

FAQs

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialAutomate your accounts payable process entirely — for free

Get started with a Plooto free trial and unlock efficient, accurate, and easy accounts payable.

Start free trial