Latest Blog Posts

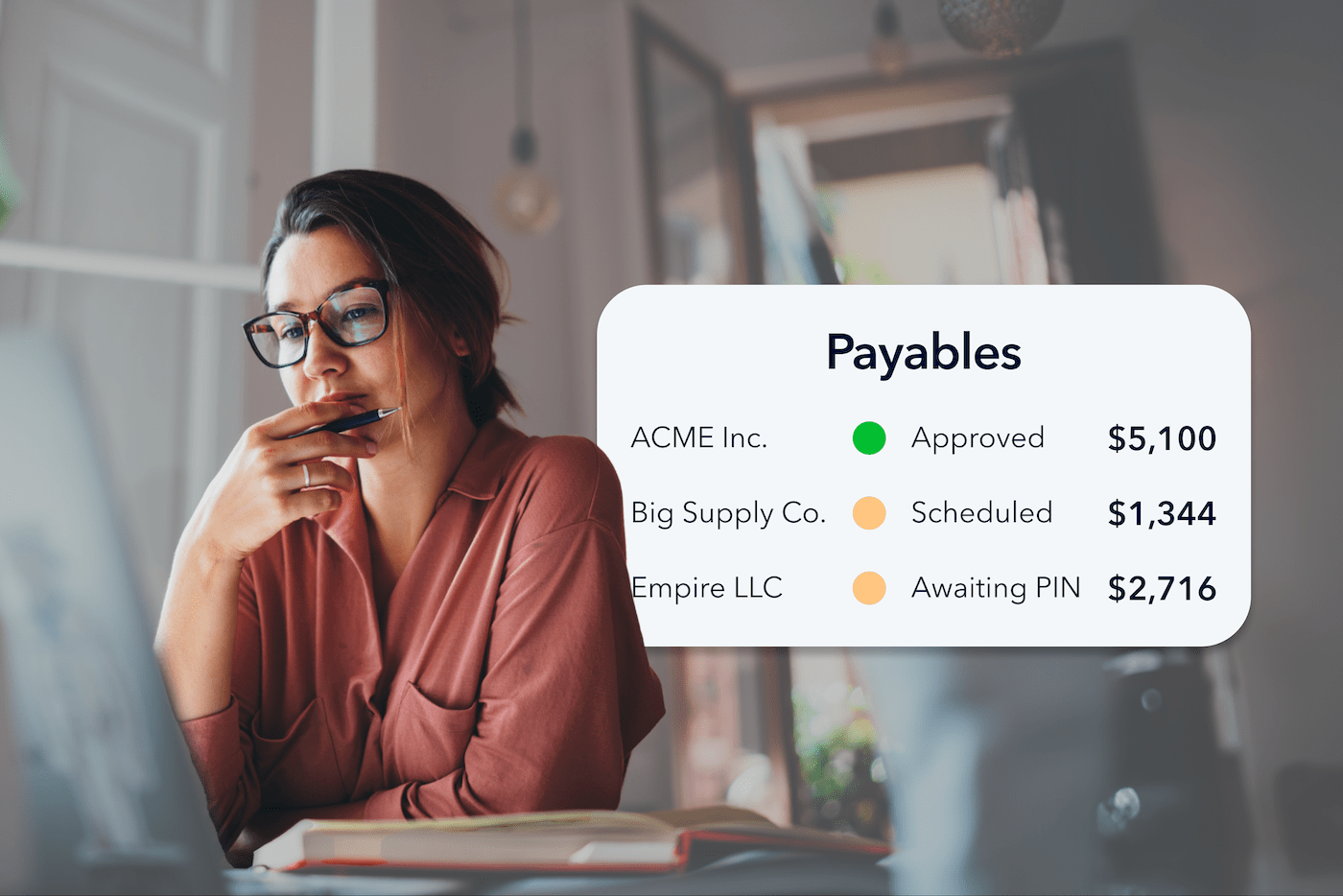

Accounts payable automation: 19 best practices

When it comes to accounting processes,accounts payable (AP) automation emerges as a vital tool for enhancing accuracy and efficiency.

Your full guide: Accounting software for midsize businesses

What is accounting software for midsize businesses? Accounting software is a computer program that maintains accounting books to assist bookkeepers...

The accounts payable process: Everything you need to know

Accounts payable represents the money you owe. Managing your AP becomes a process of receiving and recording invoices all while preparing and..

Accounts receivables vs. accounts payables: What’s the difference?

Both accounts receivable and accounts payable are essential to your company’s finances and cash flow.

Out Of Balance: Countering The Crisis Of Accountant Burnout

Finance professionals are experiencing an unprecedented exodus. Over the last two years, more than 300,000 U.S. accountants and auditors left their..

The 3 keys to scaling efficiently for forward-thinking CFOs

As a CFO, watching your business evolve and grow is an incredibly rewarding experience, but italso presents new challenges to overcome to keep that..

How Payments Automation Helps Real Estate Companies Optimize Cash Flow And Build Trust With Clients

Real estate is a complicated industry, with complicated accounting needs. From international payments and purchases, to collecting rents and paying..

Cash flow clarity: Your secret to making better strategic decisions that grow your business

When it comes to running a small business, cash is king – well, cash flow at least. From paying vendors, suppliers, partners, and employees, to..

AI and automation aren’t coming for your accounting job – they’ll make it better

Ever follow Google or Apple Maps directions? Watch movie recommendations from Netflix? Use autocorrect in a document? Or ask Siri, Alexa, or Google..

5 business-building benefits of digitized cash management

Last year, faced with rising inflation and payroll expenditures, 57% of small businesses slashed costs. But how did they decide what to cut — and how..