What is accounting software for midsize businesses?

Accounting software is a computer program that maintains accounting books to assist bookkeepers. Capabilities of an accounting software can include recording transactions, expense tracking, reporting, reconciling, and real-time insights.

Accounting software is becoming more and more common: in 2019, Sage reported a cultural shift in accountancy recognized by 90% of global accountants.

Accounting software can be tailored specially for the financial management of midsize businesses. This technology can focus on sustainable growth while being flexible enough to suit the needs of midsize businesses.

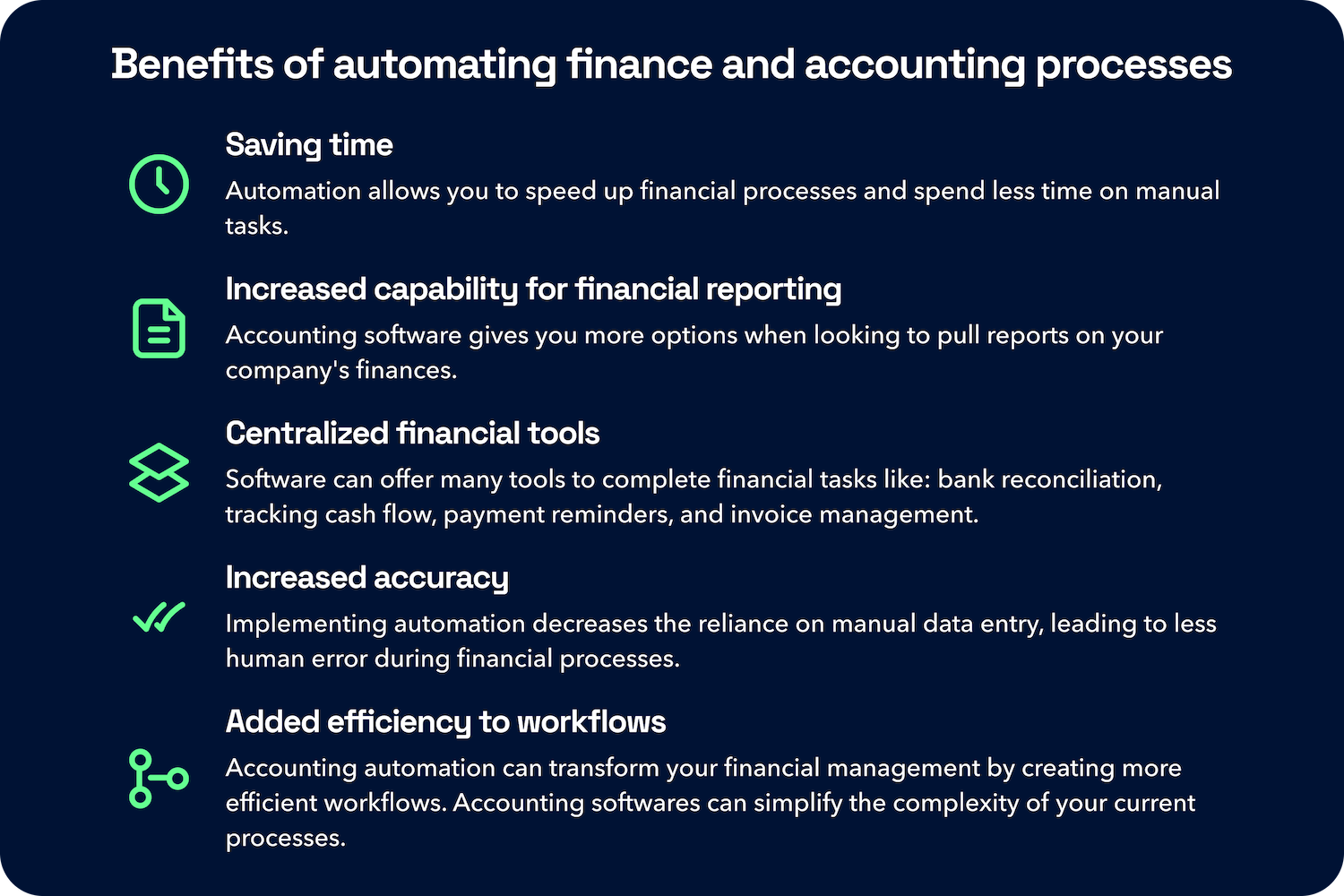

Benefits of automating finance and accounting processes

There are multiple benefits to implementing AP and AR automation in your accounting processes:

Saving time

Automation allows you to speed up financial processes and spend less time on manual tasks.

Increased capability for financial reporting

Accounting software gives you more options when looking to pull reports on your company's finances.

Centralized financial tools

Software can offer many tools to complete financial tasks like bank reconciliation, tracking cash flow, payment reminders, and invoice management.

Increased accuracy

Implementing automation decreases the reliance on manual data entry, leading to less human error during financial processes.

Added efficiency to workflows

Accounting automation can transform your financial management by creating more efficient workflows. Accounting software can simplify the complexity of your current processes. This means improved AP turnover and AR turnover.

Factors to consider when shopping for accounting tools

Selecting the right accounting platform is paramount, especially for small business owners looking to scale their financial growth.

When considering an accounting software consider its integration capability to your existing software, and its security and compliance.

Top accounting tools and what they can do

Intuit QuickBooks

QuickBooks is a versatile financial management tool catering to midsize businesses. Offers robust monitoring of sales, expenses, and revenue, as well as sophisticated payroll systems. Discover more about QuickBooks' capabilities and functionalities, or consider doing a 30-day free trial.

Xero

Xero stands out as a cloud-based accounting software designed for medium-sized businesses. Their cloud-based system means no downloaded software is needed — just an internet connection.

Xero has strong security through encryption and is easy to learn and use. Its multi-currency accounting capability makes it a preferred choice for businesses with global financial transactions.

Zoho Books

Ideal for medium-sized businesses managing multiple entities, Zoho Books offers robust core accounting functions. Zoho has strong invoice processing functionality and offers integration for advanced analytics for informed decision-making.

NetSuite

Oracle NetSuite is recognized as the best enterprise management planning tool (ERP) for medium-sized businesses.

Netsuite ERP is designed for fast-growing companies with ranging revenues. It offers core accounting functions like accounts payable, accounts receivable, general ledger, billing and invoicing, payroll, and tax compliance. It can facilitate multiple currencies and support multiple users.

FreshBooks

FreshBooks caters to on-the-go medium-sized businesses, offering a user-friendly, intuitive interface. It excels in invoicing, time, and attendance tracking. Ideal for small to medium-sized businesses and freelancers, FreshBooks covers core accounting functions efficiently.

SAP Business One

SAP Business One is a flexible and scalable accounting solution with key features like supply chain management, multi-currency capabilities, and local language support.

Available in both cloud and on-premise versions, it offers options for businesses seeking that kind of flexibility.

What accounting system do most companies use?

We encourage you to not necessarily just pick the accounting software that most companies use but, instead, the one that best fits your goals, size, tech stack, and overall business processes. But for more information about the most popular, explore the most popular ones here.

The best accounting software for your company combines user-friendly interfaces, integration capabilities, and robust security measures that make it faster and easier for you to conduct business without sacrificing compliance and data protection.

As you explore the many available accounting tools, consider your business's current needs and what tools you'll need to grow. If a free trial is available, test it out. Then make an informed decision that aligns with your financial and operational goals.

Once you select your accounting software, complete your setup by choosing tools or integrations that automate your accounts payable and accounts receivable processes.