For businesses of all sizes, managing an organization’s cash flow is an essential ingredient for success. For a business to successfully manage its cash flow, it must first understand its current cash flow standing and consequently project how cash flow will look in the future.

In this blog post, we’ll be discussing everything from what is cash flow, what is a cash flow projection, why projections are important, and how you can calculate these projections for your business.

Sign up for a Free Trial today

SHORTCUTS

• Why Cash Flow Projections Can Make or Break a Business

• Benefits of forecasting your business cash flow

• Common cash flow forecasting challenges

• How to calculate your financial projection

• Cash flow projection in business plans

• Cash flow projection for a start-up

• 5 Tips for making an accurate cash flow projection

But before we get into the specifics, let's discuss what cash flow is and why cash flow projections are important.

Why cash flow projections can make or break a business

Cash flow in basic terms is the difference between the amount of cash a business has and receives versus how much it spends. Now a business may easily figure out the current period’s cash flow by comparing how much cash it spent versus how much cash it received; however, that is just a snapshot in time of the current cash flow. In many cases it is not enough to keep the business in a comfortable cash flow position.

When a business understands the importance of cash flow management, it starts to think about how its cash flow will change throughout the next month, quarter, and year. To accomplish this, businesses must first understand future cash flows and to do this they must create cash flow projections.

If a business does not create these projections, it may have liquidity issues in the future where an unexpected or unaccounted-for expense creates a sustained net negative cash flow balance. If this occurs, a business may not be able to stay in business.

Now that we’ve covered why it’s essential to project your future cash flow, let’s talk about the benefits you can achieve from using cash flow projections.

Benefits of forecasting your business cash flow

The first and most obvious benefit is that your cash flow projections will help you more accurately forecast the expected inflows and outflows of your business. This will help you understand where your business stands in terms of liquidity.

After understanding your general cash position , you can dive deeper into potential cash shortages or cash surpluses . This can help you address potential bottlenecks and take advance of opportunities.

By reaping the benefits of forecasting you will contribute to the overall health of the organization. You can use this information to create longer-term plans that benefit for the organization and its employees.

Now that we’ve discussed the benefits let's discuss some of the challenges with forecasting.

Common cash flow forecasting challenges

One of the most common forecasting challenges is that companies may be too optimistic with their projections. Secondly, businesses may not account for specific scenarios that may come up or are unable to predict these gaps preemptively. Lastly, there is the two-pronged issue of data entry error (which automation can help with) and a failure to reassess the forecast periodically.

Now that’ve covered most of the basics let’s get into how your future cash flow can be calculated.

Projected cash flow formula

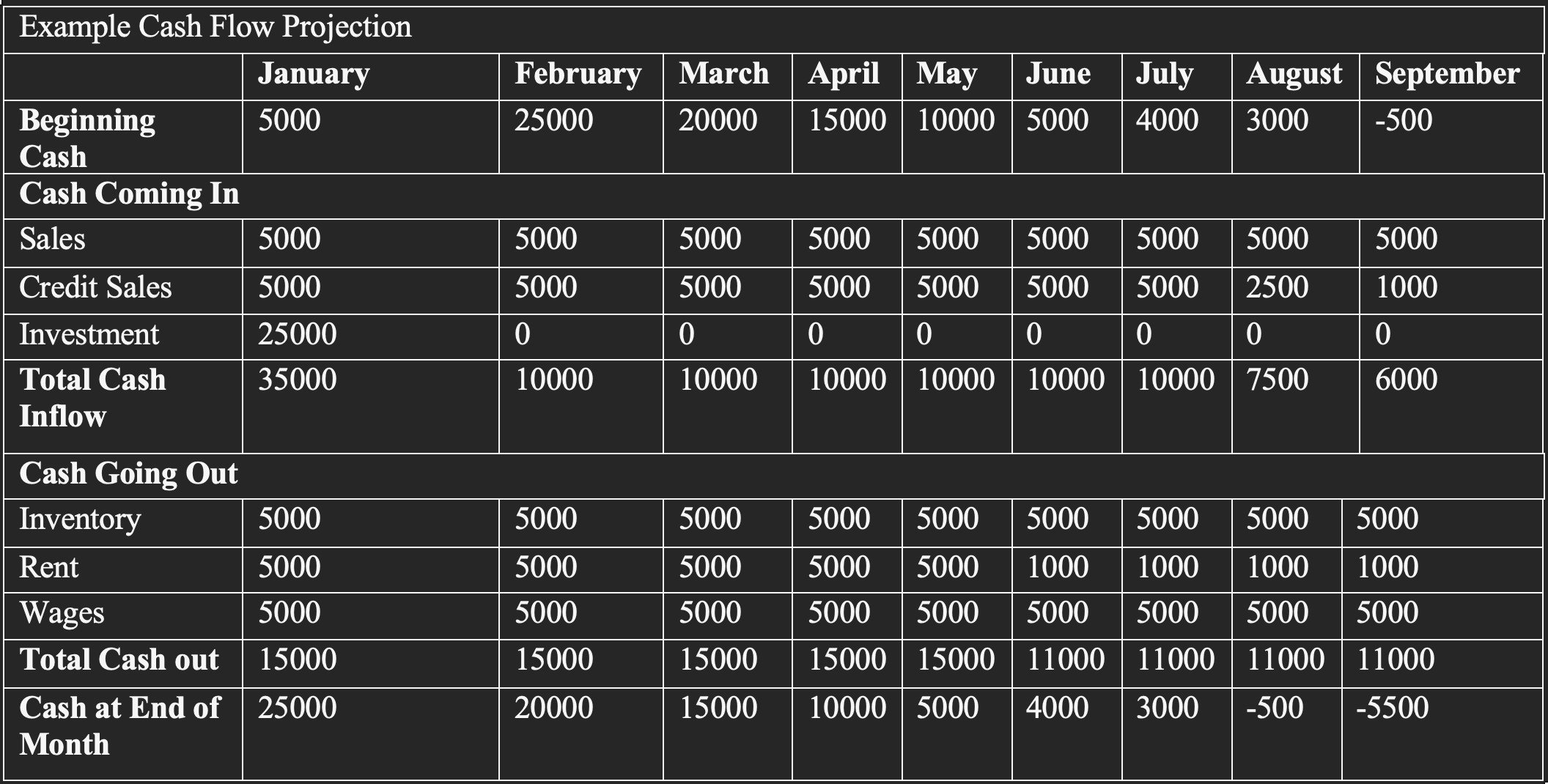

Below you can see a basic formula for calculating future cash flow projections:

Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash

Now, let’s break this down even further and get into what each of these sections represent and how you can calculate these numbers for your business.

How to calculate your financial projection

The first thing you must account for is beginning cash or in other words the cash you have in the bank before your projection.

After this, you calculate the inflow of cash. Cash can come in multiple forms and different payment types can have different caveats to them. For example, an organization that has a subscription fee can most likely account for that cash being received with more certainty whereas if you are a vendor who sells products a delay or a naturally longer period to pay may affect your cash flow. With that being said, cash inflows can include:

- Payments Received

- Collections of credit sales

- New loans

- New Investment

After you’ve calculated inflows, you must calculate outflows. This aspect of your forecasting may also vary at different times. You may start renting a new building mid-year, taxes may go up, and miscellaneous expenses can come up without notice. Some of the common cash outflows are:

- Wages/Salaries

- Rent

- Inventory

- Utilities

After you have these three components: 1. Beginning cash, 2. Cash flowing in 3. Cash flowing out, you use the formula and land at your forecast for that specific period. After you do this for a particular month you repeat the process using the previous cash flow as your beginning cash balance.

And that’s it! You have an ongoing projection for your business. Make sure to adjust your forecasting as you progress throughout the months so that you can account for any changes in your business .

This brings us to how you use cash flow projections in business planning.

Cash flow projection in business plans

Cash flow projections, as we mentioned before, can help a business understand potential future cash shortages, future cash inflows, and potential cash avenues for a business. Using this forecasting method businesses can create a more agile financial environment where continuous forecasting and reassessment can help businesses stay profitable and be financially sound in the long run.

Cash flow projection for a start-up

Forecasting especially benefits small to medium-sized businesses for a variety of reasons. Let’s discuss one of the biggest benefits of cash flow projections for start-ups. According to a CB Insights report, “running out of cash” is mentioned as one of the core reasons a start-up fails. Therefore, using cash flow projections is an essential practice for start-ups to stay financially healthy and avoid failure due to a lack of cash.

Using projections, a start-up can gain insights into its current and future financial position and can adjust its plans accordingly. These projections can help a startup find gaps and opportunities, which can be leveraged to maximize cash flows. If a start-up is executing well, it would stay solvent and could use their positive cash flow projection to attract new talent and investment.

Let’s now get into our final section and leave you with some tips on how to make an accurate cash flow projection, no matter the size of your business.

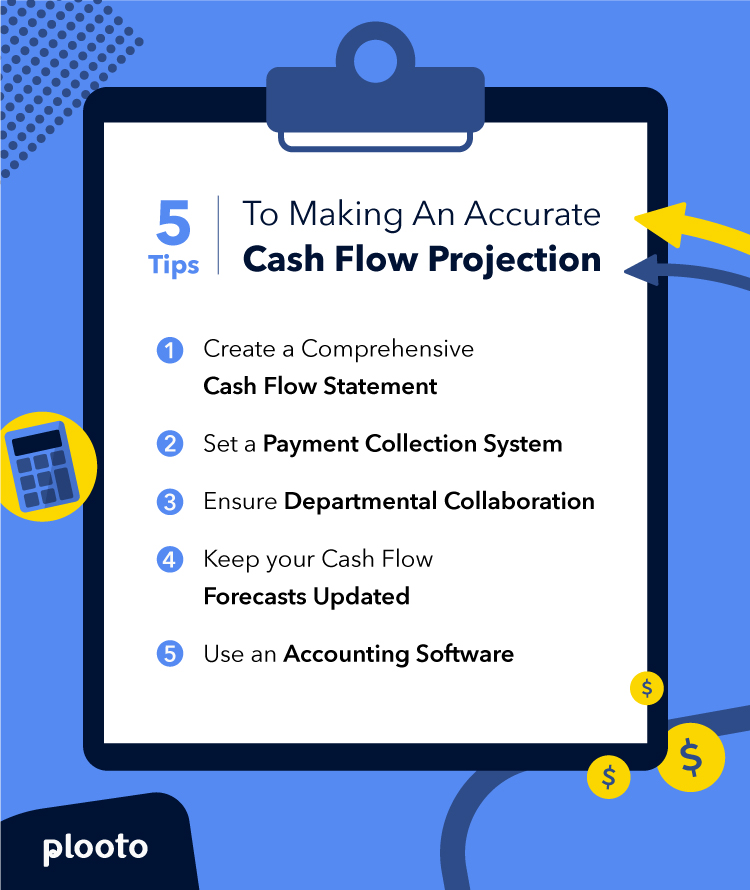

5 tips for making an accurate cash flow projection

- Create a comprehensive cash flow statement

It is important to ensure that your cash flow statement is comprehensive. This tip is related to the challenge that organizations are not realistic enough with their projections. It is important to not only be realistic with inflow and outflow projections, but it is essential to note all the variables in your organization's specific circumstances and ensure there is still a buffer if you do miss anything. You and your finance/accounting team are the most aware of your financial health so make sure that you account for all possible cash flows. - Set a payment collection system

One of the bigger issues with cash flows can be delayed payments. If your organization develops a payment collection system that has a repeatable and reliable process for your organization to receive funds, then there will be less uncertainty in your cash inflows and outflows. One example of how your business can achieve this is through Pre-Authorized Debit (PADs). - Ensure departmental collaboration

Collaboration among finance, accounting, human resources, and other departments is key to maintaining a healthy cash flow. The organization's department heads must understand the organization's resources. If there is cross-collaboration between departments, it leads to an efficient use of resources, transparency, and a more fostering environment for the employees and the business. - Keep your cash flow forecasts updated

When running a business, situations can change at any moment. Your biggest customer may miss their payment date, a large change in management may affect immediate sales, or an investment may come in at the last moment. All of these situations require the organization to reassess their forecasts . Thus businesses must create forecasts and keep updating them as new information becomes available. - Use an accounting software

As cash flow deals solely with the ins and outs of cash, using accounting software can help balance those books more efficiently and accurately. Organizations can use accounting and payment automation software to streamline their data and ensure that cash movement is being accurately compiled. Plooto integrates seamlessly with QuickBooks and Xero; however, you may use any accounting software for your cash flow data.

And that’s everything! We hope our article has given you a better understanding of how your business can use cash flow projections effectively to better understand and improve your organization’s financial situation.

Frequently Asked Questions

Here are some of the frequently asked questions we thought readers may have on our topic:

What are cash flow projections?

When a business understands the importance of cash flow management, they start to think about how its cash flow will change throughout the next month, quarter, and year. To accomplish this, businesses must be able to understand future cash flows and to do this they must create cash flow projections. A cash flow projection projects the ins and outs of cash for a set amount of time in the future.

What should be included in a cash flow projection?

In simple words, cash flow projections must include the cash you had on hand before the projection (beginning cash), the cash you expect to get in any given month(s) (inflows), and the cash you expect to spend (outflows). After you do this for one month you may repeat the process for the future months and get a projection for the year.

Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash

What is an example of a cash flow projection?

An example of a cash flow projection can be that an organization had 5000 beginning cash and expected inflows of 10000 and outflows of 10000. This means that the cash flow projection for that specific month would be 5000.

Here is a basic example of a cash flow projection: