Download our free cash flow statement template

Ready to get started on your new cash flow statement? Download our free template!

Download template

Effective cash flow management is one of the most important pillars of success for any small business. Having control over your cash flow can make or break you, down to everyday financial activities across your business, like paying vendors and employees, investing in growth opportunities, and covering your regular expenses. It’s also fundamental to your ability to plan for the future of your business in the long term.

A recent poll of small business owners from American Express Canada found that many were experiencing challenges due to cash flow issues. More than half of respondents said that cash flow issues were specifically impeding their growth, with 38% saying that they had to turn down a growth opportunity in the past year because of constraints on working capital.

If you’re not on top of your cash flow, you could be part of these statistics. Every stage from managing your business to planning for growth in the future requires getting your cash flow on track now.

Managing cash flow can be the difference between a surviving — or even failing — business, and one that’s thriving and poised to grow. Here is a guide to everything you need to know about cash flow management to ensure you’re prepared — no matter what’s ahead for your small business.

At its simplest level, cash flow is the movement of money in and out of a business. Businesses earn income from their investments or receive financing from outside sources. Money flows out when companies pay their bills, pay their employees, and invest in future expansion. Understanding cash flow allows business leaders to keep adequate funds on hand for basic needs while enabling them to take advantage of growth opportunities.

There are three main categories of cash flow for a small business:

This is cash flow from the expenses and income related to operating your business. It includes what you bring in from services and sales and what you spend on operating costs to facilitate those sales, like your physical workspace, technology and systems, and suppliers.

%201.svg)

Companies also generate cash flow from investment activities like purchasing speculative assets, investments in securities, and sales of securities. This is different from making strategic investments in the business itself, like building a new factory or upgrading technology systems, which would be included in cash flow from operations.

When your business takes out a loan or raises equity financing, that creates cash inflows. If your business pays a dividend or buys back its own shares, you generate cash outflows from financing.

In addition to the three basic forms of cash flow, you may encounter more nuanced types of cash flow, which are also important to understand.

Free cash flow: Free cash flow (FCF) measures the true profitability of a business. FCF shows you how much money you have left over to expand the business or return to shareholders, after paying dividends, buying back stock, or paying off debt.

Unlevered free cash flow: Unlevered free cash flow (UFCF) measures the gross FCF generated by a business before taking financial obligations like interest payments into account.

Discounted cash flow: Discounted cash flow (DCF) estimates the value of an investment — in this case, your company — based on the cash flow it will generate in the future. One reason it’s so critical to understand your company’s cash flow is that it helps quantify the value of your business if you ever decide to sell.

Getting a firm grip on your company’s cash flow makes it less likely that you’ll ever have to scramble to make payroll or to pay recurring expenses like rent and taxes. But maybe more importantly, understanding your cash flow gives you more confidence in planning your next steps. With detailed knowledge of your financial health, you have more information to make the best decisions, which means more control over what you do next — and ultimately more peace of mind.

If you know you have more than enough cash on hand to meet expenses and obligations, you can think about ways to invest the excess strategically. You can hire more people, add new distribution channels, develop new products and processes, build manufacturing capabilities, and even buy complementary businesses.

Conversely, if you’re worried about when or whether you’ll get paid by customers or whether your expenses will exceed your receipts, you know to wait before making any investments.

Either way, building sound cash management practices is the first step to success. And it starts with full visibility.

Measuring cash flow accurately, and in a timely fashion, is the first step toward managing it. After all, knowledge is power. In order to measure your cash flow, you need to look at two main things:

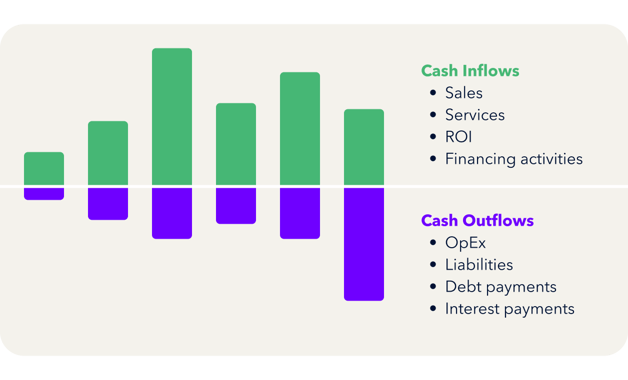

Cash inflows

These are all the sources of money coming into your business, including proceeds from sales and services, returns on investments, financing activities like loans and equity offerings, and interest earned.

Cash outflows

On the other side of the ledger, you’ll have all the items that take money out of your business, like operating expenses (including payroll, rent, raw materials, and other expenses), liabilities, debt payments, and the interest rates you pay to borrow money.

Your business’s cash flow is the difference between your inflows and outflows over a certain period of time. Positive cash flow means you’re taking in more money than you’re paying out. Negative cash flow occurs when you are spending more than you take in.

Cash flow statements

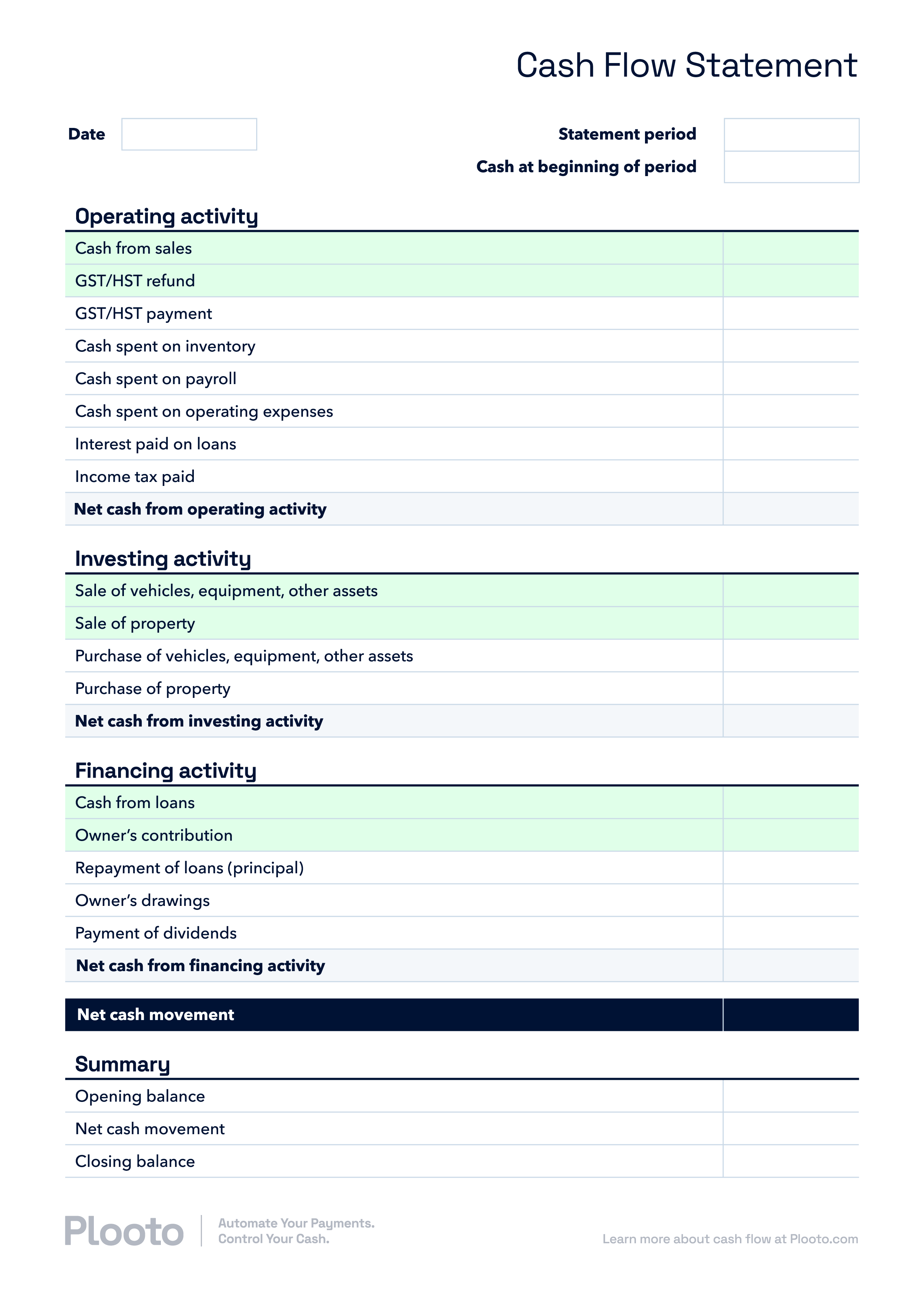

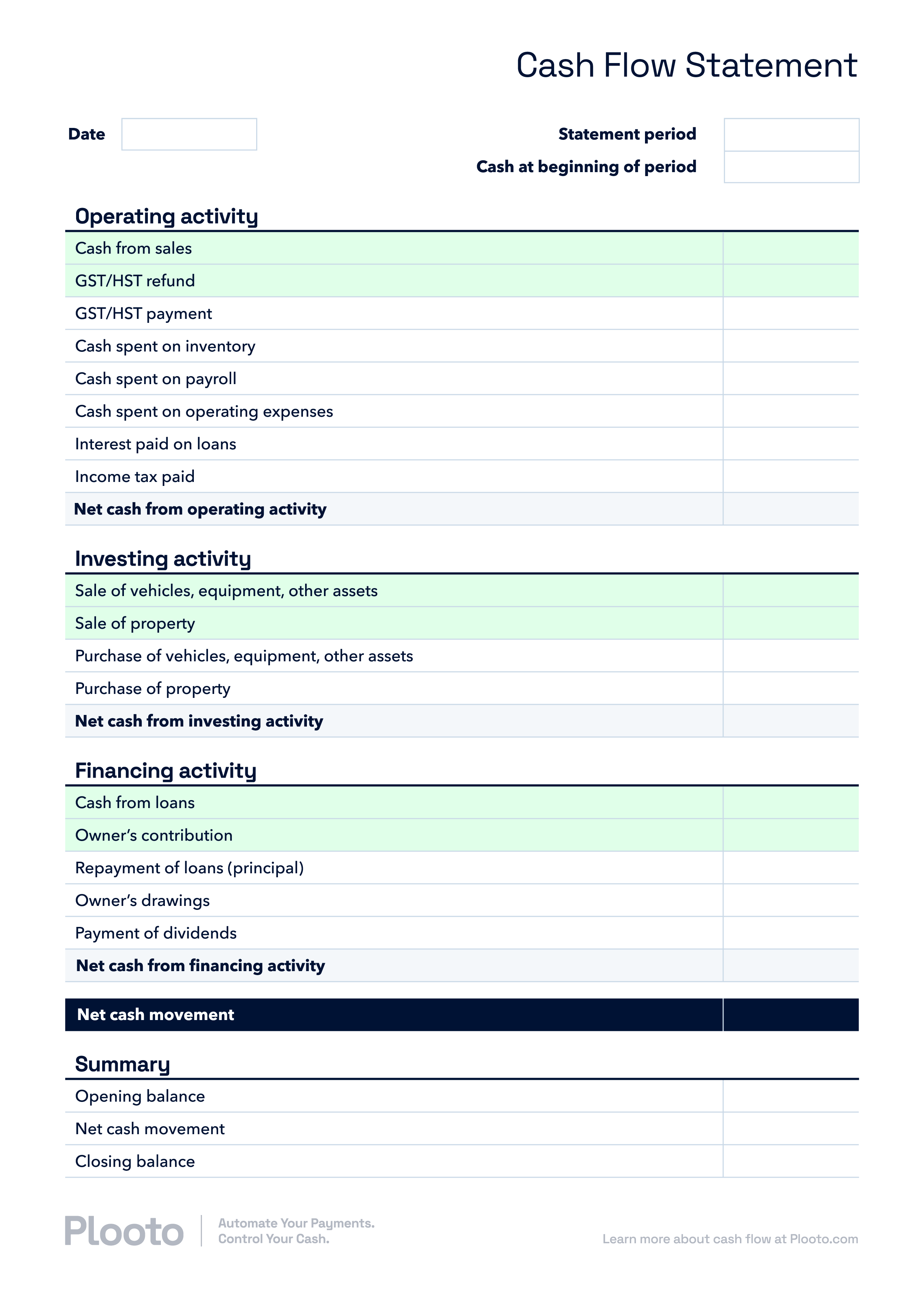

You can keep track of cash inflows and outflows with a cash flow statement. This important business document provides granular detail on all the money that has come in or gone out of your business over a certain period of time.

What can you learn from a cash flow statement?

In short, a cash flow statement can show how fast your company is growing and whether your income and expenses are in balance. Using a cash flow statement can help you identify which parts of your business are performing the best and which are struggling to generate the revenues you need. It can show you whether your cash flows are relatively steady, or if they fluctuate during certain times of the year when you have especially strong sales or particularly high expenses. This information can help you plan to improve cash flow and make better use of cash you have on hand.

A cash flow statement is generally generated for a specific period of time, like a month or a quarter. In this example, the cash flow statement has been divided into four main sections.

Ready to get started on your new cash flow statement? Download our free template!

Download template

Working capital

You can use your cash flow statement to calculate your company’s working capital, or how much you have left after expenses to run your business. Just take your total cash inflows and subtract your total cash outflows. What’s left is working capital.

Positive working capital is a critical indicator of a company’s health because it ensures that you have the liquidity to meet unexpected expenses without affecting operations. It also enables you to invest in your business, generating more growth down the road.

Cash flow projections

A cash flow statement gives you a snapshot of income and expenses at one point in time, but if you generate them regularly, you can observe trends and make projections about future business performance based on a statistical analysis of past data. This is an incredibly important tool for forward planning.

.png?width=820&height=386&name=Image%20(96).png)

Understanding and tracking your company’s cash flow is the first step toward managing it and providing your business with a strong foundation for growth. Next, you can use this information to manage cash flow better and make your company operate more efficiently.

Cash flow management means managing both incoming and outgoing money in a way that will best support your business. It begins with a detailed analysis of how cash comes in and goes out of your business and looks for ways to optimize these movements, whether by reducing expenses, accelerating B2B payments, making strategic investments, or reallocating resources to higher growth business areas.

The core purpose of cash flow management is to ensure that your business always has enough cash on hand to cover any expected — or unexpected — expenses.

Let’s dig a bit deeper into ways you can smartly manage business cash flow.

Managing payables strategically: Do all your bills come due on the same day? Staggering your payables so that they fall at different times can give you some breathing room. You may also be able to manage payment terms to add extra flexibility.

For instance, if you have 30 days to make a payment, you can time that expense around other, less flexible obligations. You may also be able to negotiate more favorable terms, for instance, get more time to pay bills or receive early payment discounts.

Consider the value to your business of lower costs versus more flexible payment terms. You should also look for areas where you can cut costs altogether, redirecting resources to high growth, higher margin areas.

Accelerating receivables: Even profitable businesses can have cash flow problems when they’re waiting too long for receivables. You can speed up the collection process by requiring credit checks for non-cash payees, charging late fees, and offering limited discounts for quicker payments. Offering multiple ways to remit payments — cash, check, credit card, and direct funds transfer — can accelerate receipts while providing your customers with flexibility.

You can also ask for a deposit to cover upfront costs and ease a lengthy receivable cycle. Once you’ve billed a customer, it’s important to stay on top of invoices, following up frequently with late payers. Online payment platforms can make it easier to track receivable activity while providing rapid funds transfer between accounts.

Inventory management: Optimizing inventory requires a tricky balance. Keep too little on hand, and you may lose business when you can’t meet customer demand. But tie up too much of your company’s capital in inventory, and you can’t invest it in anything else.

Read more: Why effective inventory management is beneficial

To make sure you have the right amount of inventory, take a good look at sales over time and keep enough product in stock to meet these needs. Be sure to take into account the cost of storing and maintaining unsold inventory. If you have older inventory that likely won’t sell, consider strategies for offloading the surplus.

Credit tools and borrowing: Ideally, you’d like to pay business expenses out of business income. But because cash inflows and outflows don’t always happen in sync, you may need alternative ways to meet your obligations, such as credit.

Even basic credit — for example, using a business credit card to cover immediate expenses — can help you weather temporary cash flow crunches. A business line of credit can also be a good tool to cover large, long-term expenses and pay them off over time. Be cautious about borrowing, however, since you will have to pay interest and principal payments.

Stay on top of bookkeeping: You can head off potential problems by keeping a close eye on your cash flow. When caught early, mismatches between inflows and outflows can be managed by cutting back expenses, renegotiating payment terms, tapping credit, or trying to increase income. As you begin to regularly review cash flow statements, you’ll spot these potential cash flow issues early and have more time to deal with them.

Use technology: Technology, like automated accounts payable and accounts receivable processing, can streamline cash flow management. You’ll be able to reduce payment times and will have easy access to data on incoming and outgoing payments. Plus you’ll save time and avoid costly errors that can come from manually entering data and reconciling accounts.

.png?width=820&height=410&name=Image%20(97).png)

Effective cash flow management empowers small businesses to take control of their payables and receivables and build a foundation for long-term financial stability and success. However, it’s a time and labor-intensive process, especially if your company relies on manual data entry and analytics to make sense of cash flow.

Automating parts of your cash flow process can save your company time, free employees from repetitive, manual data entry, and improve the accuracy of your cash flow reporting. No more endless plugging in numbers. No more waiting for physical checks to make their way through the postal system. Your company’s cash moves quickly across a digital system, creating a trail of data that you can integrate directly into your cash management reports.

Accounts payable and receivable automation tools are a powerful way for small businesses to bring new layers of efficiency into their day-to-day financial operations and to take control of their cash flow management.

Save time

When you don’t have to enter invoice and payment information manually, you save valuable time that you can spend on other parts of your business — or your life.

Streamline your workflows

Integrating AR/AP automation technology with your accounting software lets you streamline the entire payments process, from generating payment requests from your invoices to tracking them in real time. This means that your business can shorten the time between creating an invoice and receiving payment, while also auto-reconciling sent and received payments with your bookkeeping software.

Better understand your cash flow

Automation technology lets you take a snapshot of your finances at any time, with the most recent information already populated. That enables you to track payments and billing cycles more accurately and currently. This, in turn, enables you to control your cash flow by scheduling payments and choosing payment methods that put your cash where you need it, when you want it.

What does that mean for your business? Well, for starters, it allows you to see where your money is at any given point in time. And, most importantly, it positions your company for the future.

A continual flow of accurate, timely financial data gives you the insights that can build your business now and in the years ahead. You’ll know which business units are growing fastest — and which are lagging or headed for obsolescence. You can make informed decisions that maximize your company’s competitive strength, investing to expand high-potential business lines, for example, while managing expenses in less promising areas.

This heightened control and insight into your cash flow means that you are better positioned to plan for growth, supported by clear, data-based forecasting updated in real time.

Better budgeting

With automatic payments technology, businesses gain complete visibility of money coming in and out of their accounts, and pull reports on that cash flow quickly — taking the guesswork out of budgeting. You’ll also be able to budget for changing conditions, based on continually updated reporting that shows how costs and income fluctuate over time. Payment automation enables your company to prepare for whatever’s next, letting you know when it’s time to invest more and when to save and maintain cash on hand.

With more up-to-date information and real-time tracking of incoming and outgoing payments, businesses can identify trends in payment cycles, anticipate regular expenses and foresee potential cash flow gaps with much more certainty.

.svg)

Clear visibility into your cash flow also means that you can quickly assess whether you can afford to invest in a growth opportunity that presents itself to you. With access to accurate cash flow data, you have the intelligence needed to determine if you have the resources to take advantage of it.

Your small business thrives when it can weather short-term ups and downs while being poised to take advantage of long-term growth opportunities. Effective cash flow management, backed by automation technology, enables you to do both. Your day-to-day operations will function more smoothly, and you’ll be able to prepare and plan to navigate the future.

Accurate cash flow reporting lets you play out “what if?” scenarios. You can assess whether your business is ready to face a short-to-medium term financial setback or period of difficulty, and if not, what you can do to address it.

Small businesses can boost efficiency, improve overall decision-making, and accelerate growth by automating key operational functions like accounts payable and accounts receivable. Automation can help your business gain increased visibility over your day-to-day finances, which will in turn enable you to act on growth opportunities with confidence.

If you’re looking for a way to optimize cash flow now while positioning your business for the future, Plooto’s leading payment automation solution can help. Try Plooto free for 30 days to see how automation helps you better understand and manage your cash flow.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialTry Plooto free for 30 days to see how automation helps youbetter understand and manage your cash flow.

Start free trial