Tax season can be extremely intimidating for small business owners. The weighty task of sorting through a year's worth of financial transactions, ensuring accuracy, and meeting deadlines — all while continuing to day-to-day operations — can be stressful enough.

But for businesses still relying on manual accounting processes, this time of year can be overwhelming. How can small businesses transform tax preparation from a burden into a manageable, and even streamlined, process? In a word: automation.

Why automation is crucial for tax prep

Automation ensures accuracy

Manual invoice management and data entry provide ample opportunities for human error, even in the best of circumstances. That’s why automation can be a true game-changer when it comes to year-long accuracy and streamlined tax preparation.

Not only can an automated software solution integrate with your existing financial systems, but it will categorize transactions, flag potential issues, and simplify your tax prep. Additionally, automated systems create a detailed digital paper trail, ensuring your books are always proactively prepared for an audit.

Financial automation helps with more than just data-entry mistakes; it’s also a huge time saver. Your team will be freed up for more high value activities when they no longer need to spend hours on redundant tasks which automation handles efficiently.

Guesswork and mistakes can be eliminated from financial transactions and tax filings, and automation can help you scale. By keeping clean records, you’ll always be positioned for current and future team members to access the latest and most accurate information.

Automation streamlines processes

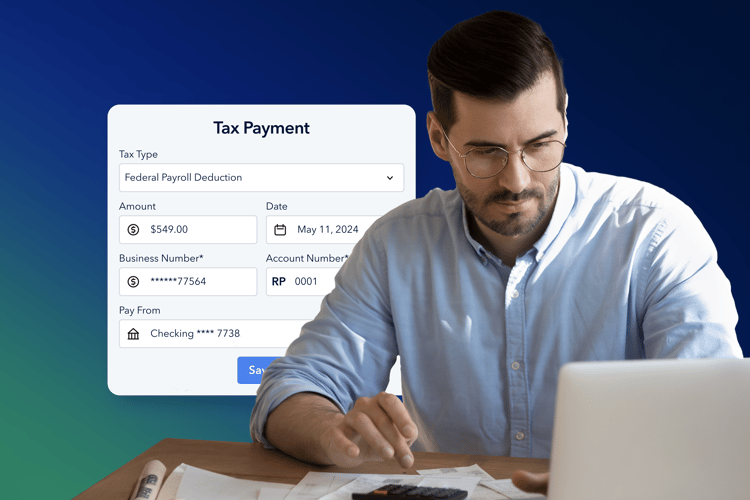

Platforms like Plooto offer direct online tax payments, streamlining the process, ensuring timeliness, and helping avoid penalties. Additionally, these systems provide instant confirmation and digital records of all transactions to make tracking and management easier.

6 steps to implement financial automation

- Evaluate current processes: Begin by identifying common manual tasks that consume significant time. This may include data entry like transactions and invoice numbers, reconciling payment records across different accounts and platforms, and reporting monthly, quarterly or annual financial results.

- Consider software solutions: Automation tools can streamline these repetitive tasks and free you up to focus on other things. Look for software integrates seamlessly with your legacy systems and offers features like automatic categorization and real-time reporting.

- Seek professional guidance: Consult with your CPA, fintech experts, or a tech-savvy accountant to identify and implement the best solutions for your operations. These professionals can provide valuable insights and recommendations based on your specific requirements now and as your needs evolve, especially if your business is required to make quarterly tax payments rather than waiting until year-end.

- Start small and scale gradually: Begin by automating a single financial process, such as invoicing or expense tracking. Once you're comfortable with the new system, you can gradually expand automation efforts to other areas of your business. Solicit feedback to determine if there are bottlenecks or blind spots that may not have been addressed, that way they can be mitigated.

- Invest in training: Ensure that your team is well-versed in using the new tools. Offer training sessions, resources and ongoing support to address any questions or concerns that may arise during the transition. Pay attention to the observations of the people who’ll use the system most.

- Monitor and adjust: Regularly review the effectiveness of your automated processes and adjust as needed to optimize efficiency and accuracy. Besides feedback from your team and stakeholders, be sure to ask third-party vendors for their input to identify areas for improvement and relationship management.

Automation for Peace of Mind

Tax preparation is a necessary function when running a company. But it doesn’t have to be more arduous than necessary. Automation is the key to simplification for small businesses, providing improved accuracy, a reliable digital record, and an easier way to keep your financial house in good order.

Instead of spending hours trying to collect information and crunch numbers, avoid the overwhelm with software designed to help companies like yours. Not only will you gain the peace of mind of more easily keeping up with new requirements in an ever-changing tax landscape, but you’ll be able to remain focused on nurturing your business—even through the demands of tax season.

Plooto helps businesses automate payments and workflows to eliminate manual data entry. Try Plooto for free for 30 days to see how much time and money automation can save.