2025’s best bet: Follow the leaders

Match your peers’ top four investment priorities

Asked about their 2025 plans, Canadian business leaders say they aren’t cutting back; they’re opening their wallets. Their top four investment priorities reveal a clear growth strategy.

Here's where they're placing their bets (and where you should, too).

Increasing marketing to attract and retain customers

Companies plan to spend more on digital marketing, doubling down on tools, channels, and platforms that attract new customers and strengthen relationships with existing ones. And because client transactions can signal future needs, businesses are also exploring the revenue-driving potential of integrated marketing and financial data.

Expanding teams to meet projected demand

Expanding teams to meet projected demand

Canadian businesses are hiring staff so they can confidently say "yes" to more customers, expand service offerings, and extend operating hours. They’re also upskilling current employees to deliver enhanced advisory services, specialized expertise, and premium offerings.

Banking on new equipment as a growth lever

Banking on new equipment as a growth lever

From new kitchen equipment and warehouse space to vehicles and technology, additional equipment investments help organizations scale their production and seize new opportunities. Modern infrastructure enables businesses to serve more customers and operate more efficiently, driving both revenue and profitability.

Going all in on growth-driving technology

Going all in on growth-driving technology

Why is technology the single largest investment pick? Not only does it improve day-to-day operations, but it gives businesses time to focus on their other leading priorities.

Increased technology investment also creates significant, sustainable operational efficiency. Businesses looking to improve and grow are seeking solutions that deliver immediate ROI, and 60% reported being likely to implement platforms that consolidate multiple features and functions.

In a survey of accountants, respondents ranked tools for making and accepting payments as two of the top three most valuable solutions in their clients’ tech stacks. These are top picks because they eliminate time-intensive manual tasks, allowing leaders to dedicate more time and attention to business-building strategies. Plus, implementing them isn’t time-intensive or disruptive.

Carolyn’s Model & Talent Agency President Carolyn Nikkanen confirms, “New technology platforms can sometimes have a large learning curve and be difficult to integrate into the business. With Plooto, I found the platform was very easy to use and saw the benefits of automating our payments immediately.”

Carolyn’s Model & Talent Agency President Carolyn Nikkanen confirms, “New technology platforms can sometimes have a large learning curve and be difficult to integrate into the business. With Plooto, I found the platform was very easy to use and saw the benefits of automating our payments immediately.”

Finding the right fintech stack for your business

Canadian businesses have more fintech options than ever.

Check out our map from Canadian fintech expert Tal Schwartz of the

best fintech on the market for:

-

Complete overview of Canadian fintech solutions — from

payments to tax filing

-

Detailed outline of AP/AR tools, expense management, and

treasury solutions

-

Clear breakdown to help finance teams build their ideal tech stack

Read the guide to building the perfect fintech stack.

Beyond the basics: What to automate in 2025

Businesses are already using tools like AI to automate the most tedious tasks — things like managing expenses, creating reports, processing payments, and reconciling transactions.

Why? Automation removes manual work to free up employees and eliminate time-consuming, error-prone tasks. If you’re not already managing these processes with technology, you’re leaving hours on the table.

So what’s the most effective place to begin? Accounts payable and receivable. One of the reasons AP/AR solutions stand out is because of their immediate impact. They quickly transform financial operations by eliminating manual (but necessary) processes, eliminating data entry errors, improving cash flow management, and supporting stronger vendor and customer relationships.

Just ask Sean Freedman, President and Founder of Freightzy. His team switched to automated AP and AR and isn’t looking back. “Making manual payments made it hard for us to track and reconcile our payments… I now have clarity on cash flow, which has allowed us to make more informed decisions for the business.”

Just ask Sean Freedman, President and Founder of Freightzy. His team switched to automated AP and AR and isn’t looking back. “Making manual payments made it hard for us to track and reconcile our payments… I now have clarity on cash flow, which has allowed us to make more informed decisions for the business.”

The biggest payment pain points

Not only are payment challenges a giant hassle, but they also erode efficiency, profitability, cash flow visibility, and customer relationships. That’s why they’re inspiring our respondents to accelerate digital transformation.

Your 2025 digital priority: Automate payment operations

More than half of businesses in Canada (60%) will increase their use of fintech in 2025. And while there are many areas they could invest in, over three-fourths (77%) say they’ll prioritize making real-time payments, and more than half (53%) are likely to switch from traditional payment methods to digital ones.

Clearly businesses know that digitizing this simple (but pervasive) process is an important part of making the most of 2025 and of being poised to attain the success they predict. Why is it such a great place to start your digital transformation?

- Fastest time to value, with results in days, not months

- Minimal disruption to existing processes

- Immediate cost and time savings

- Creates a foundation for other automation initiatives

- A proven path to success

The shift from traditional payment methods like checks signals a strategic evolution. Organizations recognize that digital payments deliver multiple advantages: enhanced security, simplified tracking, and streamlined reconciliation.

The real-world impact of payment automation

"Time is everything in our business, and anything that saves time and makes things more efficient is helpful. Before Plooto, we sent checks, and our suppliers would have to wait a month to get paid. Plooto automates those supplier payments and automatically reconciles them with our accounting software. This saves me and our team a lot of time, prevents errors, and helps us focus on higher-value tasks."

Jonathan Tebeka, Founder & CEO of Shelving Mate

Read Jonathan's story

Top considerations when shopping for

payment technology

Fast payments

Fast payments

Seek technology that features real-time processing and fund transfers. Quick payment turnaround improves cash flow and vendor relationships.

Easy implementation

Easy implementation

Choose user-friendly platforms that your team can adopt quickly. The best solutions require minimal training and integrate seamlessly with your existing systems.

Low fees

Low fees

Dig below the bottom line. Are there hidden fees? Charges for each transaction? Make sure you understand all costs upfront.

Transparent pricing

Transparent pricing

Clear pricing structures help you budget accurately and maximize value. Look for transparent pricing models with minimal transaction costs and no hidden charges.

Accelerating your growth in 2025

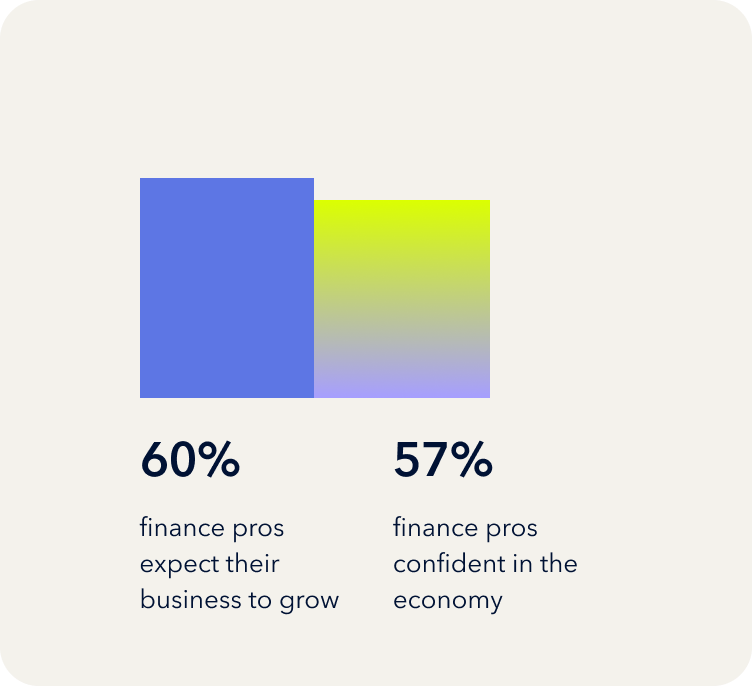

Canadian financial professionals are optimistic about what's ahead and are backing that optimism with action toward growth. They're investing in their businesses, expanding their teams, and upgrading their capabilities to seize new opportunities.

Don’t get left behind; follow their lead. Start by implementing technology that will give you hours and energy back to invest in business growth.

For many businesses, automating payment processing and reconciliation is the first step to:

- Eliminating time-consuming manual tasks

- Freeing up resources for strategic initiatives

- Immediate cost and time savings

- Creates a foundation for other automation initiatives

- A proven path to success

As MBF's Allen discovered, "It's like magic." Manual processes become automated, data entry disappears, and reconciliation happens seamlessly.

Fast payments

Fast payments Easy implementation

Easy implementation Low fees

Low fees Transparent pricing

Transparent pricing Four reasons Canadian businesses are optimistic about 2025

Four reasons Canadian businesses are optimistic about 2025