Latest Blog Posts

5 must-have fintech categories, from our customers and experts

With challenges like inflation, labor shortages, and lack of access to capital, it’s no wonder business owners are turning to technology to alleviate..

Keeping your data safe in cloud-based solutions

As your business grows, you’ll be responsible for managing more and more business information and customer data. Even though growth is positive, k..

Financial reporting made easy for NGOs

Thames Valley Family Health Team (TVFHT) provides primary health care to more than 160,000 patients through a network of 120 physicians. As the team..

5 ways automation breaks the capacity barrier for finance teams

When your business is growing rapidly, there’s a lot to celebrate. But growth also brings its challenges — especially when growth is outpacing your..

6 signs you need to hire your first financial professional for your SMB

Whether you’ve been in business for a while or are preparing to open your doors for the first time, owning your own business can be an overwhelming..

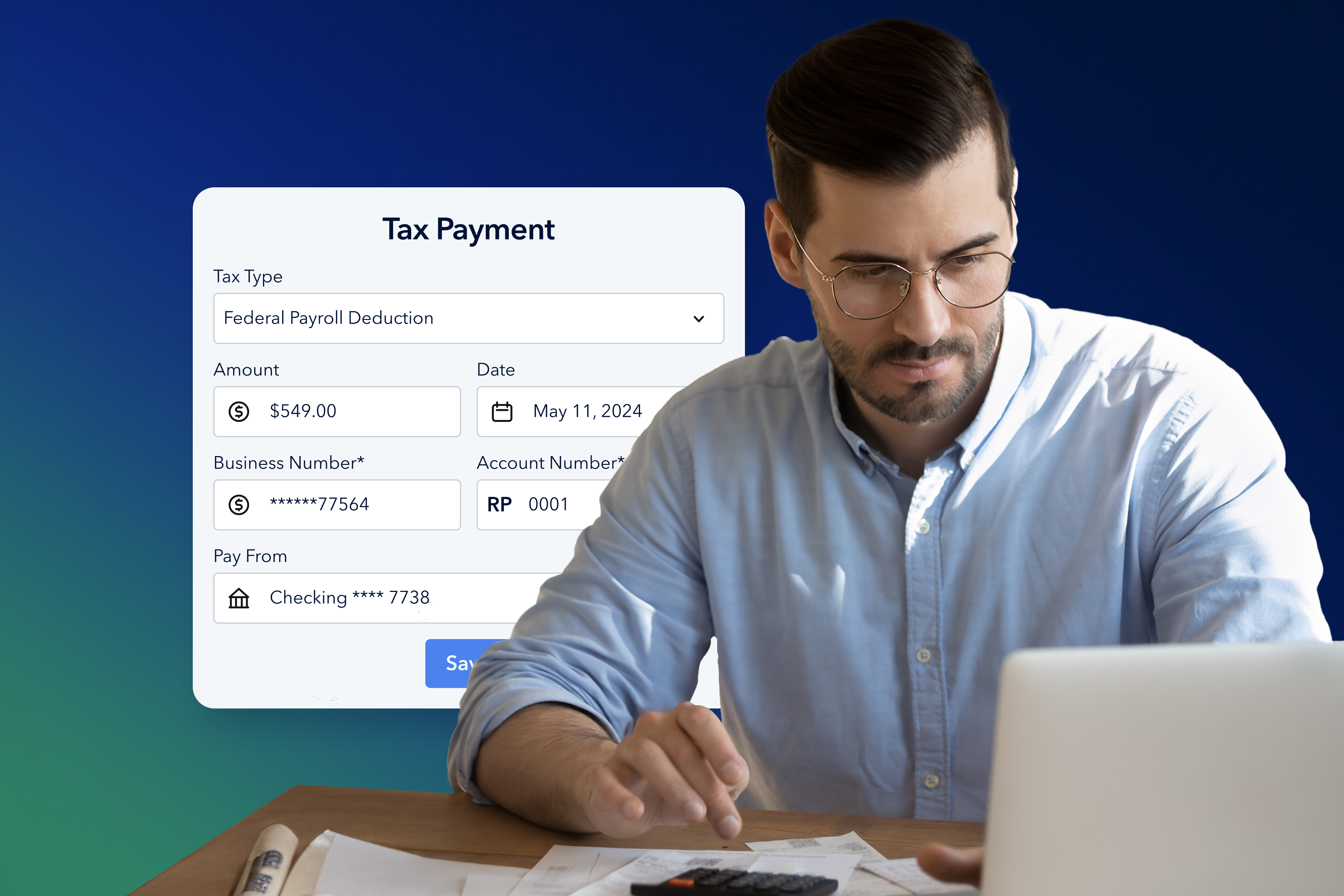

Adopting financial automation for easier tax seasons

Tax season can be extremely intimidating for small business owners. The weighty task of sorting through a year's worth of financial transactions,..

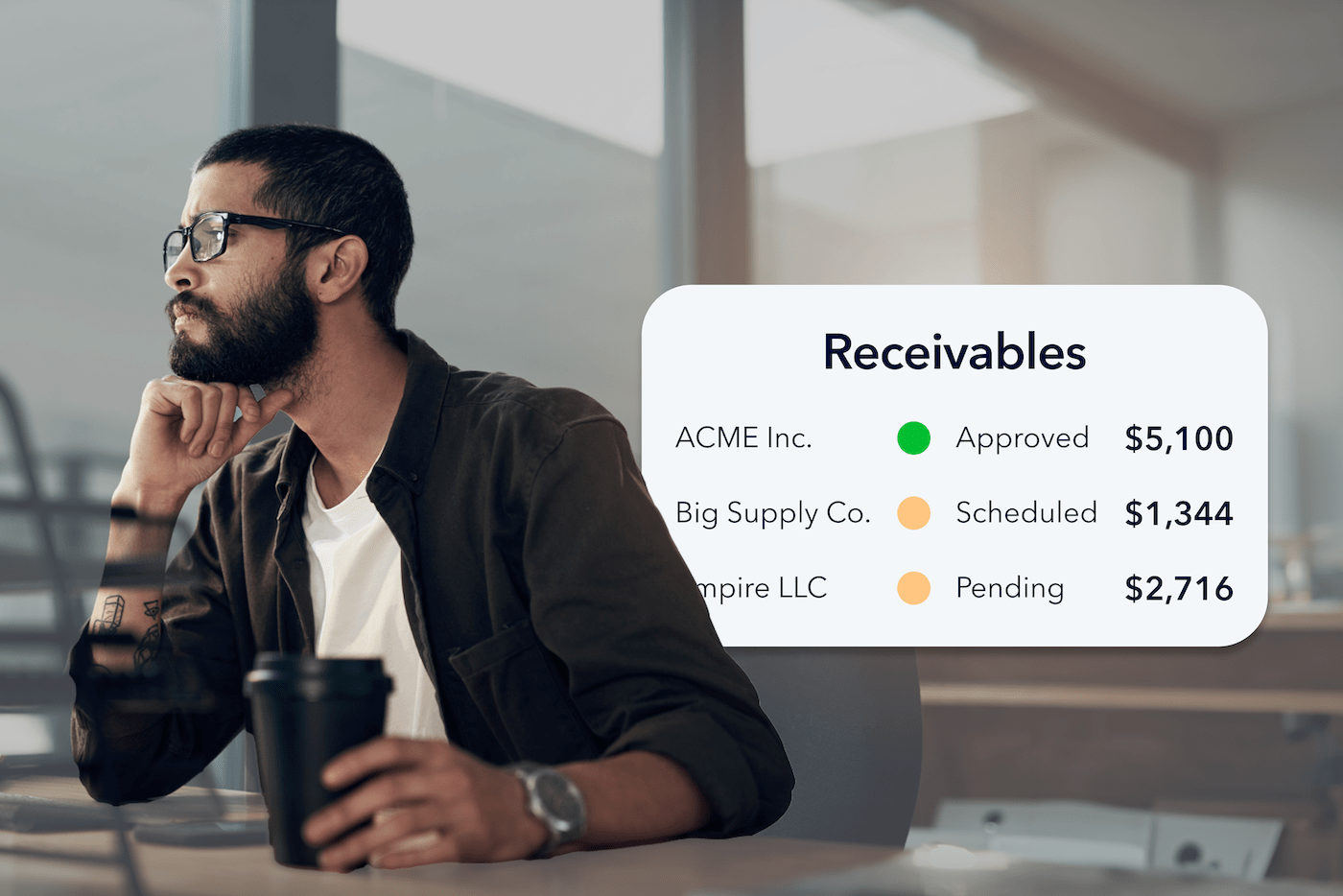

Is accounts payable a debit or a credit? Explained simply

Understanding the role and purpose of accounts payable (AP) is crucial for your company's financial health. Efficiently managing your AP can help you..

6 steps to maximize and secure your tech stack

In today's rapidly evolving digital landscape, new technology is helping even the smallest businesses play big. But without an internal team to help..

5 emerging trends to future-proof your accounting firm

The future of accounting is coming fast, as firms race to integrate new technologies into their practices. In fact, a staggering 96%of accountants..