Special offer: Try Plooto free for 3 months

Get time back

when it matters most

Connect with our team to start a free trial before December 31, 2024, and you’ll receive three months of Plooto for free!

Click below to chat with our team and access this offer.

Which best describes your organization?

Businesses Accountants and clients

Running a business takes time—and during the holidays, every moment counts.

With Plooto, you can streamline your payment processing and reconciliation,

freeing up valuable time to invest elsewhere.

Sign up through December 31 and enjoy 3 free months of access to Plooto

and make it easy to manage your payment processes.

How it works

Connect with our team for a free trial

Get started in a few, simple steps, and our team is here if you need support along the way.

Subscribe to Plooto and get 2 more months free

After the first 30 days, you can subscribe to any of our plans, and we’ll waive your fees for two more months.

Make and receive payments in one place

Save time by automating your workflows,

so you have confidence in your cash flow.

Sending and receiving payments made easy and fast

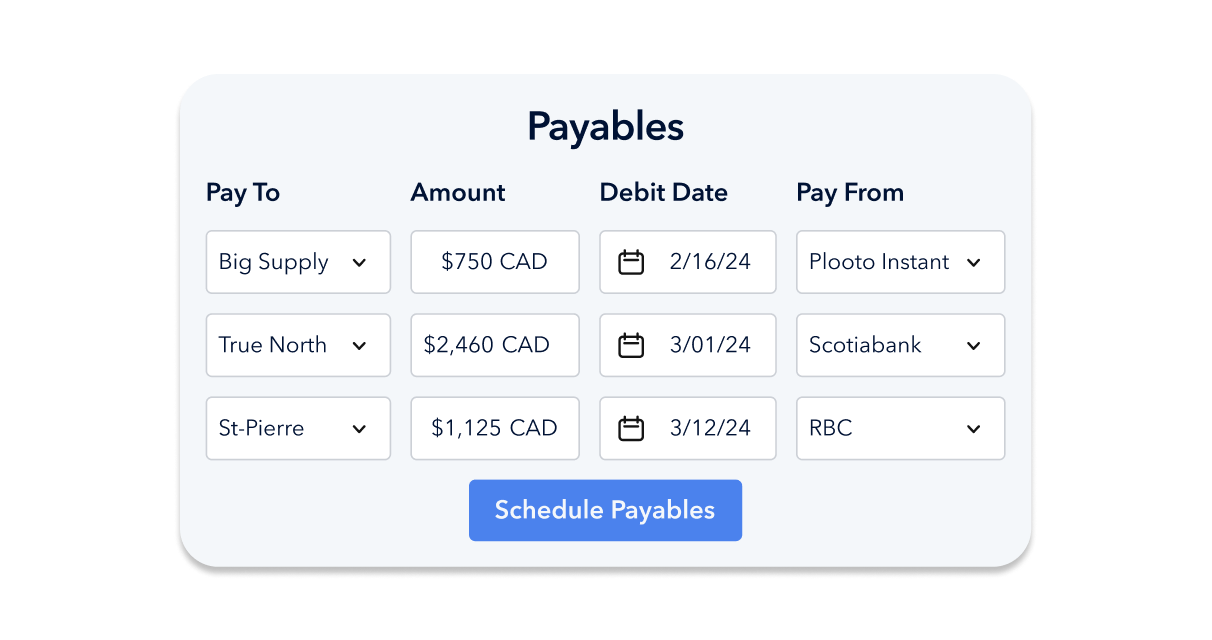

Accounts Payable

Plooto automates your approval process, eliminating the need to manually chase for check signatures and payment approvals.

Not every payable needs to go through the same approval workflow. Customize the approval workflow by setting approval tiers for different payable ranges.

![]() Approvers receive a notification — and can authorize payments — from anywhere in the world.

Approvers receive a notification — and can authorize payments — from anywhere in the world.

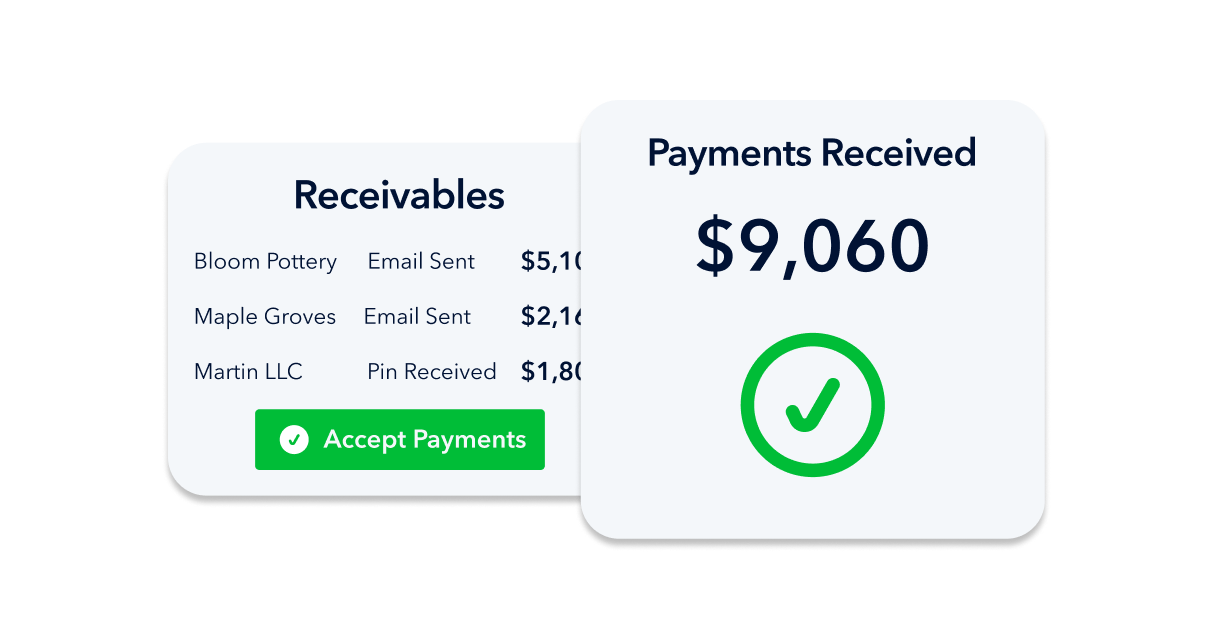

Accounts Receivable

![]() With Plooto's pre-authorized debit agreement (PAD), direct debit from the payer's bank accounts to expedite receivable payments.

With Plooto's pre-authorized debit agreement (PAD), direct debit from the payer's bank accounts to expedite receivable payments.

Have recurring payments? Go autopilot with Plooto and watch payments come in without the extra work.

More reasons why businesses love Plooto

Automatic two-way sync

Plooto automatically imports all bills and invoices from your QuickBooks or Xero. All payable and receivable payments are instantly reconciled in QuickBooks or Xero, while Plooto keeps an audit trail for you.

![]() Online check payments

Online check payments

Optimize your cash flow, track invoices, and know when your clients pay. Never worry about where your money is again.

![]() International payments

International payments

We do business where you do business. Easily send payments to over 30 countries across the world. With Plooto, you’ll always get a great exchange rate, while saving on expensive wire transfers with a flat fee of $9.99.

Made with accountants in mind

Whether you manage two clients or two hundred, Plooto makes it easy to oversee them without missing a beat. With Plooto’s account dashboard, you're always in the know about your clients' payments and all outstanding activities.

-1.png)

10k+ businesses trust Plooto

Plooto is the last payment solution you’ll ever need. Try it risk-free.

Send 10 domestic transactions for free.

Start free trialG2 Reviews

-

"Simple, connected, and secure!"

Easy, secure access for multiple users without giving bank access. Fully customizable approval process. Integration with my accounting software saves time marking bills paid.

-

"Integrates great with QB Online"

Plooto makes it easy to have PDF invoices, multiple signing authorities, and payment details stored in one central location!

-

"Amazing experience with Plooto"

With Plooto we can build scalable workflows, manage approvals, and enjoy automatic reconciliation.

FAQs

Don't see your question answered here? Contact us today.

How long does it take to get started?

It only takes a few minutes to create an account and set up your payments. Take full advantage of our 30-day free trial to explore all the ways you can streamline your payment processes and automate your workflows.

How can I redeem the referral reward I received?

Once you've completed your free 30-day trial and continue with a subscription, you'll automatically get 4 months of your subscription for free. It's our way of showing you appreciation for joining Plooto.

What is included in my free trial?

Our trials include 10 free domestic transactions and have no restrictions, allowing you to explore the full functionality of Plooto on the subscription plan that best fits your business. No credit card required. Change or cancel your plan anytime during the trial.

Is Plooto secure?

Yes, Plooto invests heavily in security. We provide multiple layers of protection by adopting the same security standards that governments and banks use worldwide, from data encryption to secure infrastructure and trusted partners. Learn more about Plooto’s commitment to data protection and data security here.