“You’re eliminating a manual process with an electronic tool.”

Gain Control with Fast, Secure Payments

Customize, automate, and schedule your payments—all from one place.

Start free trialStay on top of your cash. And get ahead—way ahead.

Handle your workflow the way you want.

Use custom rules to automate, route, and customize payment approvals to the right team member at the right time.

Focus your attention on the big picture.

Using a seamless accounts payable automation software eliminates the tedious paperwork and manual tasks of accounts payable workflows, so you can focus on higher value work to move your business forward.

Get smart about your money.

Time your payments to better manage your cash and ensure you are taking advantage of all early-payment discounts.

Do it all with total, seamless integration.

Maximize efficiency with your own accounting software, your bank, and your Plooto account all seamlessly integrated.

.png)

Make the most of accounts payable automation with:

- Powerful approval workflows

- Customizable approval tiers

- Complete audit trails and record-keeping

- Cash flow visibility

- Automatic invoice processing

- Secure ACH/EFT payments

- Seamless accounting integrations

- International payments across 40+ countries

Still have questions?

How Plooto saved the Influence Agency hours.

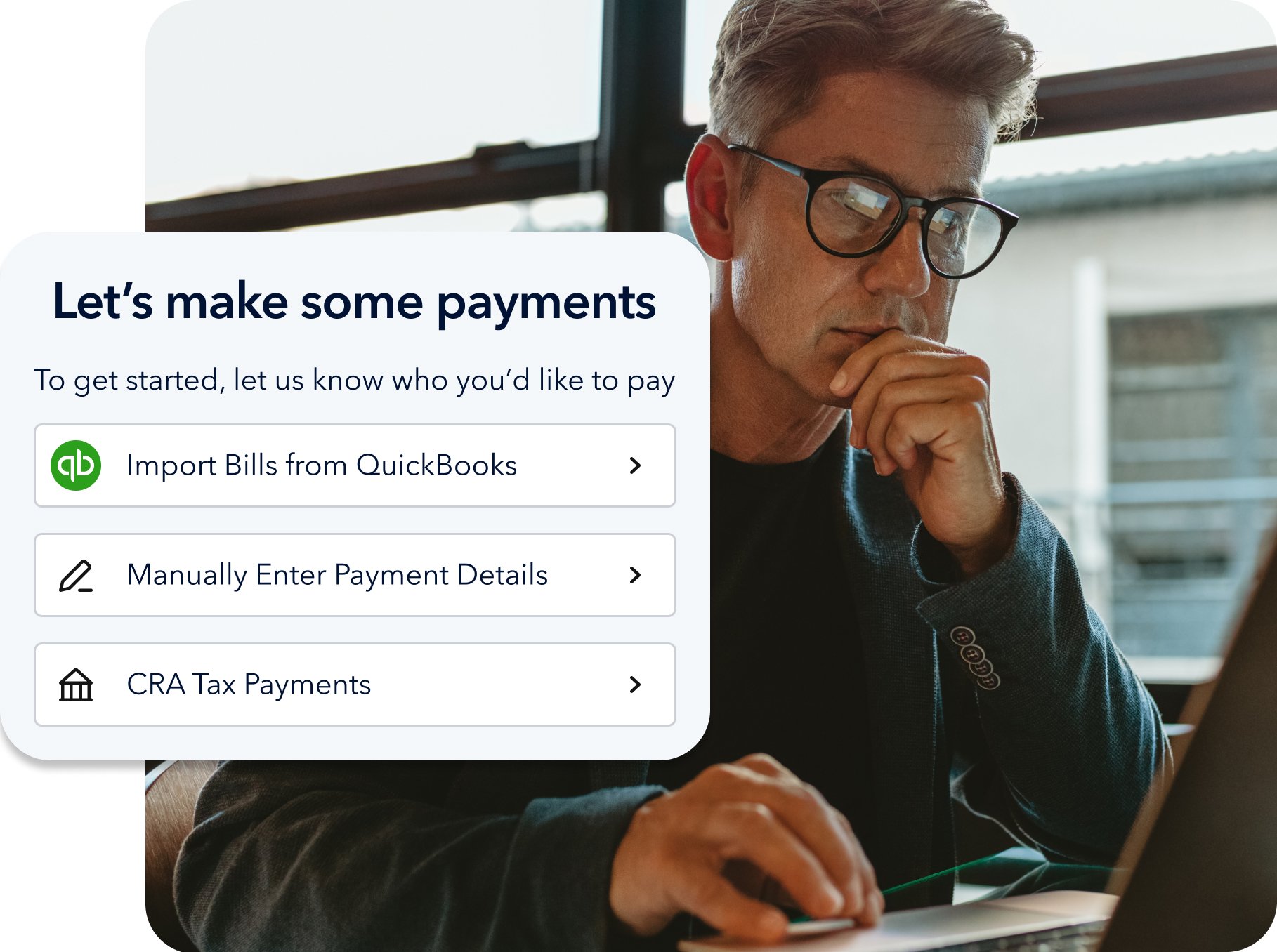

How it works

Cut the time it takes to send payments by half, and never worry about running late on bills and invoices again.

Pre-fund your account

-2.svg)

Select Plooto Instant

-1.svg)

Send Payments Faster

Smart integrations with accounting software

Two-way sync with top accounting software like QuickBooks, Xero and Netsuite to eliminate data entry errors and gain more accurate books.

.png)

Even more options. Even more payment flexibility.

CRA Remittance

Canadian customers can pay government remittances in one place from payroll deductions to tax payments.

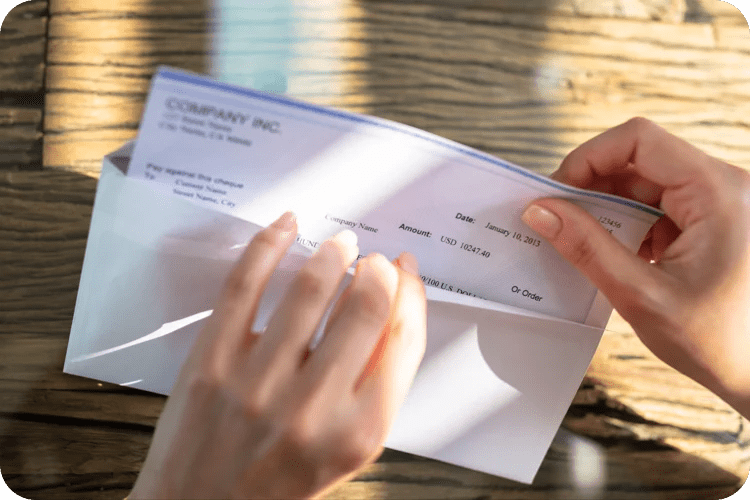

Online Checks

Skip the in-person signatures and approvals when you pay via check. Full-service includes printing and mailing.

International Payments

Make payments around the world and enjoy competitive exchange rates without the transfer fees*.

Learn more >

*Excludes fees on non foreign exchange, check, and same-currency transactions. Industry and discretionary rates apply, and are subject to change. A complete conversion cost estimate is viewable when payment is created or via our foreign exchange calculator.

.png)

10,000+ businesses trust Plooto

See what businesses like yours are saying

.png?width=64&height=64&name=replace-image-here%20(9).png)

David DiNardo

CEO

Envolta

.png?width=64&height=64&name=replace-image-here%20(10).png)

Emily Ahier

Finance Manager

Greenhouse

“Using the Plooto platform we save approximately 40+ hours a month.”

.png?width=64&height=64&name=replace-image-here%20(11).png)

Tom Yawney

Director of Business Development

The Influence Agency

“We can send everything in a moment, very, very simple!”

FAQs

Don't see your question answered here? Contact us today.

How does Plooto streamline accounts payable processes for businesses?

Plooto simplifies the accounts payable process through centralized automation, consolidating bills and invoices. Our user-friendly AP automation software optimizes workflows and improves the efficiency of finance teams by, enabling efficient scheduling, tracking, insights, and payment, reducing the need for manual tasks.

Can Plooto assist in efficient bill and invoice management?

Yes, Plooto efficiently manages multiple bills and invoices with its comprehensive AP automation software and invoice capture. This solution organizes payables, simplifying invoicing needs and minimizing manual processes associated with invoice management.

What payment options does Plooto's AP automation software offer for settling accounts payable?

Plooto's AP automation software provides diverse payment options, including secure bank transfers and electronic payments. Users choose preferred methods, giving them flexibility and accuracy in the settlement process and reducing reliance on manual data entry.

How does Plooto ensure secure and reliable payments for accounts payable processes?

Plooto ensures secure accounts payable transactions by employing industry-standard encryption and strict security protocols within its AP automation software. Users can trust the reliability of payments, minimizing risks associated with manual processes.

Can I automate recurring payments for regular bills using Plooto's AP automation software?

Yes, Plooto's advanced AP automation solution lets users set up recurring payments for regular bills and invoices. This time-saving feature automates payments for monthly expenses, reducing manual efforts and preventing late fees associated with manual data entry.

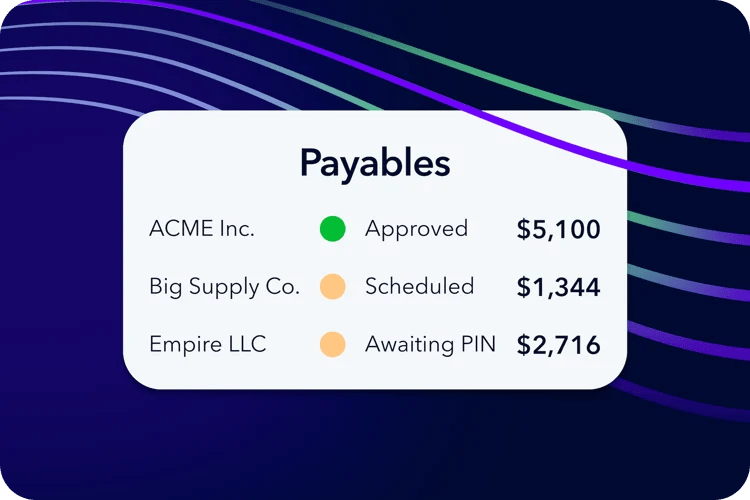

Can I track payment statuses in real-time using Plooto's AP automation software?

Absolutely! Plooto's accounts payable automation software provides real-time tracking of payment statuses, offering immediate visibility into accounts payable progress.

Users monitor initiation, processing, and completion, enhancing transparency and control over financial transactions, minimizing reliance on manual processes.

Being able to track also means accounting teams, finances teams, and businesses can more easily forecast cost savings from early-payment discounts.

What industries does Plooto best serve?

Our accounts payable automation software is purposely versatile and designed to support a range of industries and financial operations, automating payments across the board. By streamlining their AP processes, companies can improve efficiency in invoice processing and reduce manual errors. This leads to more reliable and less labor-intensive financial management.

Industries like manufacturing, retail, healthcare, non-profit organizations, and more benefit from our payable automation.

How does Plooto integrate with existing financial systems?

With Plooto, integrating with your existing financial systems is a straightforward process. Our AP automation system is built to seamlessly connect with popular accounting systems like QuickBooks, Xero, and NetSuite, facilitating a two-way sync that optimizes your accounts payable process.

This integration minimizes data entry errors while eliminating manual processes and keeps financial records current, improving the efficiency of your accounting operations.

What measures does Plooto take to ensure data privacy and compliance with regulations like GDPR or CCPA?

Plooto emphasizes data security and regulatory compliance. To protect AP data privacy and meet strict regulations like GDPR and CCPA, Plooto uses strong encryption, secure data storage, and thorough access controls. These safeguards help prevent unauthorized access and ensure the entire AP process — including invoice data — meets high data protection standards. We also routinely audit our systems and update our practices to stay current with new regulations.

How can Plooto help improve supplier relationships?

Plooto enhances vendor relationships through efficient and accurate payable automation. By automating invoice processing and payments — as well as predictable payment scheduling — our software ensures that vendors are paid accurately and on time, reducing disputes and building trust.

Plus our transparent tracking system lets both businesses and their vendors monitor the status of payments in real time, fostering transparency. This level of reliability and communication reinforces strong vendor relationships and accurate payments, which are crucial for the smooth operation of any business.

Additional learning resources

Insights, strategies, and knowledge to support your business.

What is accounts payable? The complete guide

Understanding the ins and outs of AP is critical to financial health for any business, big or small.

The AP turnover ratio: An introduction

Getting familiar the accounts payable turnover ratio for improved cash management and financial forecasting.

Accounts payable automation: 19 best practices

Automation requires quality maintenance moving forward as well as effective setup at the start.

The accounts payable process: Everything you need to know

Streamlining the AP process means teams can be more efficient and accurate while potentially saving money with early-payment discounts.

How does accounts payable affect cash flow?

Improving AP strategies to improve cash flow and gain an edge in business operations.

Is accounts payable a debit or a credit? Explained simply

Understanding how accounts payable is recorded and its role in financial balancing means improved accuracy and planning.