As a business owner or entrepreneur, running and growing your business is your priority. But it’s all too easy to get sucked into administrative tasks, that, while necessary, eat up a considerable amount of your time without adding a lot of additional value.

One way to maximize efficiency is to find ways to save time balancing the books.

There are several strategies you can adopt into your business to save time on bookkeeping.

- Keep business and personal finances separate

- Carve out a few minutes every week to go through your finances

- Automate your payroll

- Use cloud accounting software and apps

- Work with a CPA

Keep business and personal finances separate

It may seem more comfortable to keep track of expenses if you have just one credit card for your business and personal life. But as an entrepreneur, going through your monthly credit card bill and extracting business expenses from costs of day-to-day living will be more time-consuming and laborious than keeping them separate from the start.

Simplify the process by always carrying two credit cards. Open separate savings accounts and checking accounts at your bank. This way, you will be able to tell exactly how much you have spent on your business each month, without having to sift through a combined bank statement or credit card bill.

Carve out a few minutes every week to go through your finances

Make it a habit of blocking off time every week to go through that week’s finances.

Your expenses from the week will be fresh in your head, and by taking a little time to manage them weekly, you will avoid a potential frantic scramble of having to process expenses at the end of each month.

Automate your payroll

Save the time that you would once have spent going through and processing employee paychecks one at a time.

Once your payroll is automated, you only have one step to worry about: approving the payment. Everything else, including the tasks associated with printing, signing, and dating payments is done automatically. Not only will it save you time that you can put back into your business, but you will be able to pay your employees faster too.

Use cloud accounting software and apps

It's important to view the amount of money you spend and time you spend getting the hang of accounting software as an investment. Soon, your accounting software will save you time because you will no longer need to worry about creating manual reports for your business.

Not only that, but you can also use apps and software in other ways. Some apps let you scan important documents, like receipts and business cards, and save them in your accounting software program to make sure you have a record of everything. Plooto integrates with your accounting software and helps you manage your payments quickly and easily. There are many software packages and apps out there, so be careful choosing software for your business.

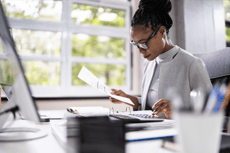

Work with a CPA

It is worthwhile to meet with a CPA at least once every six months to go over your financials. By doing so, you will know that the strategies you are using to balance your books are either working or not working. Your CPA will be able to give you guidance on what you can improve on going forward, and will also help by providing tax advice that you would otherwise have to spend time researching on your own.

Bookkeeping, while sometimes a daunting task, can be made much easier by putting some habits, processes, and tools into practice. Focus on the strategies that work best for you, and you will be able to put more time and energies into growing your business than balancing the books.