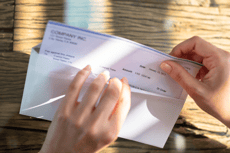

When was the last time that you as a consumer wrote a check to pay for something you bought from a store? While checks are rather antiquated for B2C transactions, they remain a common form of payment in B2B sales. In an environment where disruption is the norm, business payments have mostly remained the same. According to the PYMNTS, 64% of B2B payments are made by check.

Some still believe that checks have their place in business, providing benefits in the payment or accounting cycle, but the downsides are really starting to shine through. The possibility of human error alone should be enough to make a business cut out checks from their process. There can be errors in writing the check, errors in delivering it, errors in cashing it – not to mention the long delay in clearing time for check payments.

Why are online payment services necessary?

B2B payments are payments made between two vendors in exchange for products or services, where one vendor pays the other in the form of a digital payment. Online (digital) payments are gaining a lot of traction thanks to their convenience, time saving, and added security benefits.

Why should a business accept online payments?

Accepting online payments saves you time. Posting an online payment form on your website or emailing a link to your clients is much quicker than manually printing invoices, stuffing and mailing envelopes. It also cuts costs. You reduce your paper, supplies, and postage costs by offering online payments. You improve your cash flow when you offer online payments: Customers can make payments 24/7/365, so you receive your money faster than waiting for checks to come in and clear the bank.

What do you need to accept online payments?

You’ll need a payment processor and a payment gateway to accept customer payments online. Payment processors enable you to accept credit and debit cards and other payment methods. The two major processor options are merchant account provider and payment service provider. Merchant account providers provide a dedicated merchant account and a merchant ID. Payment service providers combine multiple business accounts with a shared merchant ID under a single umbrella. Payment gateways are software applications that accept or decline electronic payments.

Why is cloud-based payments processing essential right now?

Cloud-based payment processing is essential because it allows businesses to process transactions quickly and securely without having to invest in expensive hardware or software. It also provides an easy way for small business owners to accept payments from customers online.

What area the most common online B2B payment types?

ACH

An ACH is essentially the electronic version of writing a check. The transaction is simple, the payment is pulled from one bank account and deposited into another. This works well with scheduled recurring payments between businesses. The only caveat is that this method requires both parties providing their bank information – which some businesses (those still preferring checks) are not yet comfortable doing.

The benefits of ACH appear in the fact that once the set up between payer/payee is made, it doesn’t have to be made again. This one-time set up means that going forward the payment happens with little to no effort for either party.

Credit cards

Credit cards payments have long been an accepted form of payment. This payment type tends to be a reliable way to ensure payment can be accepted, however credit cards are notorious for two things; one, high fees and two, high fraud rates. Credit cards also have spending limits, which can be a problem for high-volume business sales.

Wire transfer

Very similar to ACH payments, wire transfers involve money moved from one bank account to another through a “wire”. The main benefit of wire transfers is the speed in which they can be executed. That is, after its all set up! Wire transfers require many steps to set up and execute. But, once set up, the funds are transferred almost immediately.

Electronic funds transfer

EFT stands for Electronic Funds Transfer, and they are an electronic payment type that allows you to debit from or deposit payments straight into another bank account. No different to ACH or wire transfers, EFT Payments let you send payments directly to your vendors and suppliers via bank transfer or collect payments directly from your clients and customers without sending anything through the mail. You can set up EFT payments for single-entry or recurring payments.

How to accept online payments for your business

- Set up a bank account to accept payments

If you haven’t already, ensure you have a secure bank account opened for your business in order to receive any payments sent to you. You’ll need some documentation, including your name, business address, proof of revenue, and some time for the bank to verify all your details.

- Provide your account details to customers

Provide all your account details to your vendor, including name, address and account number so that they can set you up as a payee in their payment software. If receiving money internationally, you may need to provide a Swift Code / BIC / IBAN code, and international Routing Number, if applicable.

- Send the invoice

Include the payment terms for your vendor, such as date the invoice was created, due date, any discounts for early payment if applicable and noting the fees for late payment.

- Set up reminders for payment

Depending on your accounts receivable software, you may be able to set up automated payment reminders to your vendor as the due date approaches. Otherwise you can manually send or schedule payment reminders by email.

- Receive payment

You should receive a notification that payment has been made by your vendor so that you can begin reconciling the payment in your books. Depending on the method the payment was made, you should see the funds in your account within 1 to 5 business days.

- Reconcile with your accounting software

Once funds have been received, reconcile the payment with your accounting software to keep an accurate record of your balance sheet. Many cloud-based payment solutions integrate seamlessly with existing account software to help make this process quick and easy.

How can B2B online payment solutions get you paid Faster?

Cash flow is the difference between paying your employees in money and paying them in promises. Long payment cycles can severely impact and hinder a company’s cash flow.

Online payment solutions allow for faster payment cycles in a number of ways. For example, these types of software allow for emailed invoices to customers as soon as a job or service is complete. The customer can then pay with a single click and the funds are transferred electronically. The result? The time it takes to get paid drops drastically ensuring you have funds to keep the lights on.

How Can B2B Online Payment Solutions Make the Payment Process Easier?

You’ll save time. You’ll save money. The difference in time saved between producing and receiving paper checks versus just clicking a button is a surprisingly big one. Not to mention, processing paper checks is extremely expensive, whereas online payments have low transaction fees.

Are you still not convinced? It’s easy to think about it as if you are a consumer shopping for shoes online. You do your research, you put the shoes in your cart, you input your credit card information and the funds automatically are debited from your bank account. On the other side, the retailer selling you those shoes didn’t have to mess around with checks, the funds from your bank are automatically deposited into their bank account. Simple as that.

The same theory applies for B2B online payments, the process is similar, just different services/products offered/purchased and there are different types of online payments available.

Getting started with online payments

We've got a complete article on transitioning to online payments, but the first step to getting started with online payments is to try it out. You do not need to move all of your payments at once, and you do not need to disrupt all of your existing processes.

Why not start a free trial with Plooto today and see how online payments can transition your business for the better!

.png?width=2240&name=Interested%20in%20taking%20advantage%20of%20a%20B2B%20payment%20solution_%20(1).png)