What is accounts receivable? The complete guide

Accounts receivable is a vital aspect of business finance. Learn what accounts receivable are and how they're used.

Key takeaways

- Accounts receivable (AR) refers to money owed, but not yet paid, to a business from another party.

- AR is important because it provides insight into cash inflow, liquidity, and working capital — plus, it helps you make accurate projections.

- There are 2 key types of AR: Notes receivable, which are tied to a promissory note, and trades receivable, which are accounts regarding the sale of goods and services.

- A streamlined AR process involves clear credit terms and guidelines, prompt invoicing, and consistent tracking and accounting.

- You can improve your accounts receivable by incentivizing customers to pay on time, prioritizing communication, and investing in AR automation software like Plooto.

What is accounts receivable?

Accounts receivable is an item on your business's general ledger sheet listing the money owed to you from other parties.

Every transaction is an agreement, and each side has to hold up its end. If you've held up your end — i.e. you're a vendor or supplier who delivered a good or service — but your customer hasn't yet paid you, that's reflected in accounts receivable.

It's important to note that accounts receivable is considered an asset, not a liability. Because these outstanding payments are expected to be collected soon, they're considered "working capital" in business terms.

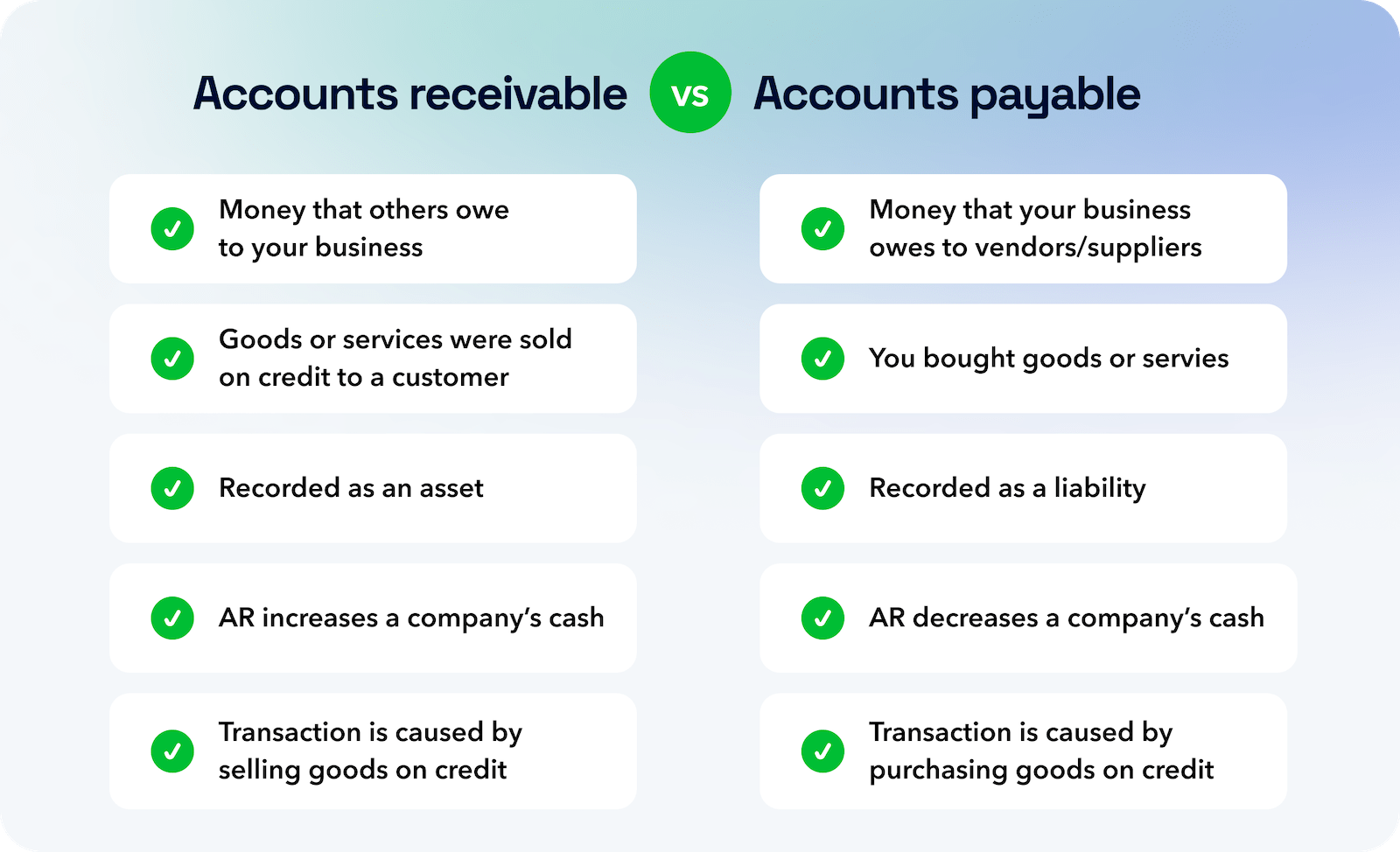

Accounts receivable vs. accounts payable

Accounts receivable and accounts payable are basically opposites. Accounts receivable refers to money that other parties owe your business. Accounts payable, on the other hand, refers to money that your business owes other parties.

Accounts receivable are recorded as assets, while accounts payable are recorded as liabilities.

Let's say you run a business selling bespoke furniture to clients. If a customer has several payment installments left on a chair they've already picked up, that's an example of accounts receivable.

But if you owe funds to a lumber wholesaler for raw materials, that's accounts payable. (For the lumber provider, though, it's accounts receivable).

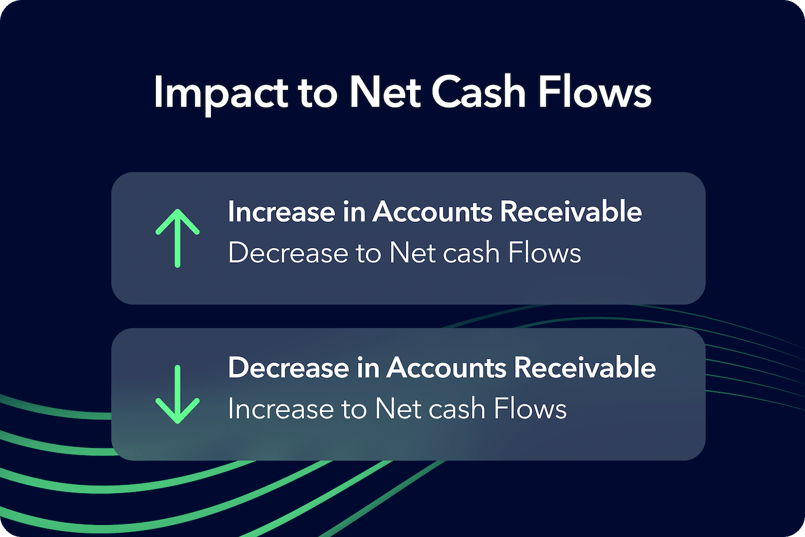

Impact on cash flow

Just like accounts payable, accounts receivable absolutely have an impact on your absolutely cash flow.

Accounts receivable are recorded as assets and indicate a future influx of cash.

However, letting your accounts receivable balance get out of hand can also negatively impact your cash flow. Why? A receivable figure that's too high means that you don't have that liquid cash to invest in your business. After all, it's still owed to you.

One way to prevent this is to establish a quick-moving and reliable AR process for customers. With a streamlined, easy, and well-planned process means increased payments that are also made on time.

Accounts payable, on the other hand, indicates a future outflow of cash. It also means that certain liquid assets currently in your possession are, in reality, tied up in future payments.

Why accounts receivable is important

Accounts receivable is crucial to understanding the financial condition of your business, including for:

- Measuring liquidity. AR are a good indicator of future cash inflow.

- Managing working capital. Funds that you expect to receive indicate working capital that you'll be able to use in the future.

- Accurate forecasting. A company balance sheet without AR would not paint a clear financial picture of your business. Why? Without AR, you haven't accounted for all your current assets.

What accounts receivable can tell you

In addition to cash flow insights, AR can help you understand how customer behavior is impacting your bottom line — and potentially help you streamline your process.

Let's consider two businesses: Business A and Business B. In a given month, Business A and Business B make the same amount of money in sales: $40,000.

However, Business A's AR currently sits at $12,000, while Business B's accounts receivable is at $6,000. This difference is likely due to customer behavior — Business B's customers are more likely to pay promptly.

What does this mean?

One possibility: Business B's collections process is more streamlined than Bussiness A's. If you're Business A in this scenario, you might need to improve your process.

Why do companies have accounts receivable?

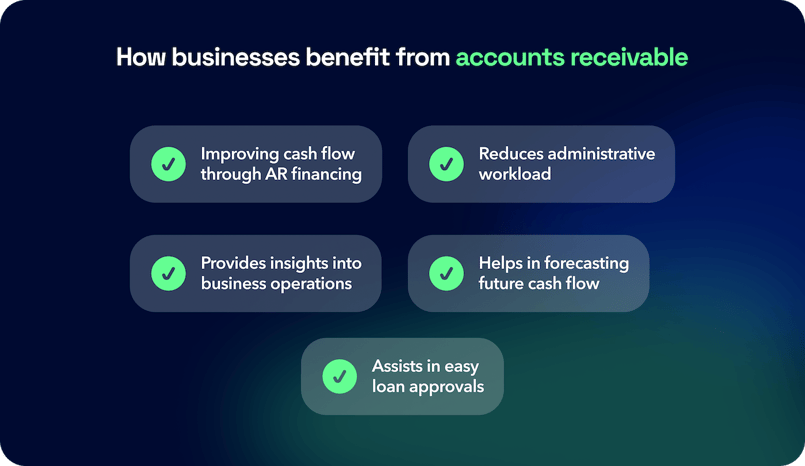

Companies have AR for a few reasons — including advantages for the customer and higher-quality information for the business.

First, let's look at the benefits to the customer. Having AR means that a company can offer payment options like installments (and in some cases, discounts). This flexibility is often attractive to customers, making it a valuable marketing tool.

Then there's business accounting. As mentioned above, AR help the company assess its ability to meet its short-term obligations, making planning easier and forecasting more accurate.

Risks of outstanding accounts receivable balances

If customers fail to pay their invoices, your accounts receivable balance runs the risk of impacting your company's cash flow and your business relationships.

According to a study from LLCBuddy, businesses eventually write 4% of their unpaid accounts off as bad debt. Sure, that's not a high percentage, but once applied to a business's yearly revenue, it can have a troubling effect.

Cash flow and accounting challenges

The most obvious risk of an outstanding AR balance is the availability of less cash — cash that you anticipated having on hand.

Not only does this jeopardize your ability to meet your short-term commitments, but it can also throw off your forecasts.

Damage to business relationships

It's challenging to maintain good relationships with customers who aren't paying you! If you've provided a contracted service and haven't been compensated, you might not be willing to work with that client in the future.

AR's impact on cash flow and financial modeling

As we've learned, accounts receivable can have a powerful impact on cash flow. When your customers pay on time, you'll have the cash you need to meet your short-term commitments and plan for longer-term goals.

Comparing your business's net revenue to its operating cash flow — that is, the cash left over after paying operating expenses — can help you determine the quality of your accounts receivable system. For example, if your operating cash flow is far lower than your net revenue at the end of the month, you likely have an issue with the efficiency of your accounts receivable system. Not enough customers followed through with their payments!

Cash flow can also affect your business's ability to attract investors, who may look at a business's accounts receivable to decide if they want to invest.

For instance, if a company is owed too much money and isn't turned what its owed into liquid cash, that company might struggle to collect payments from its customers — a potential red flag.

Examples of accounts receivable

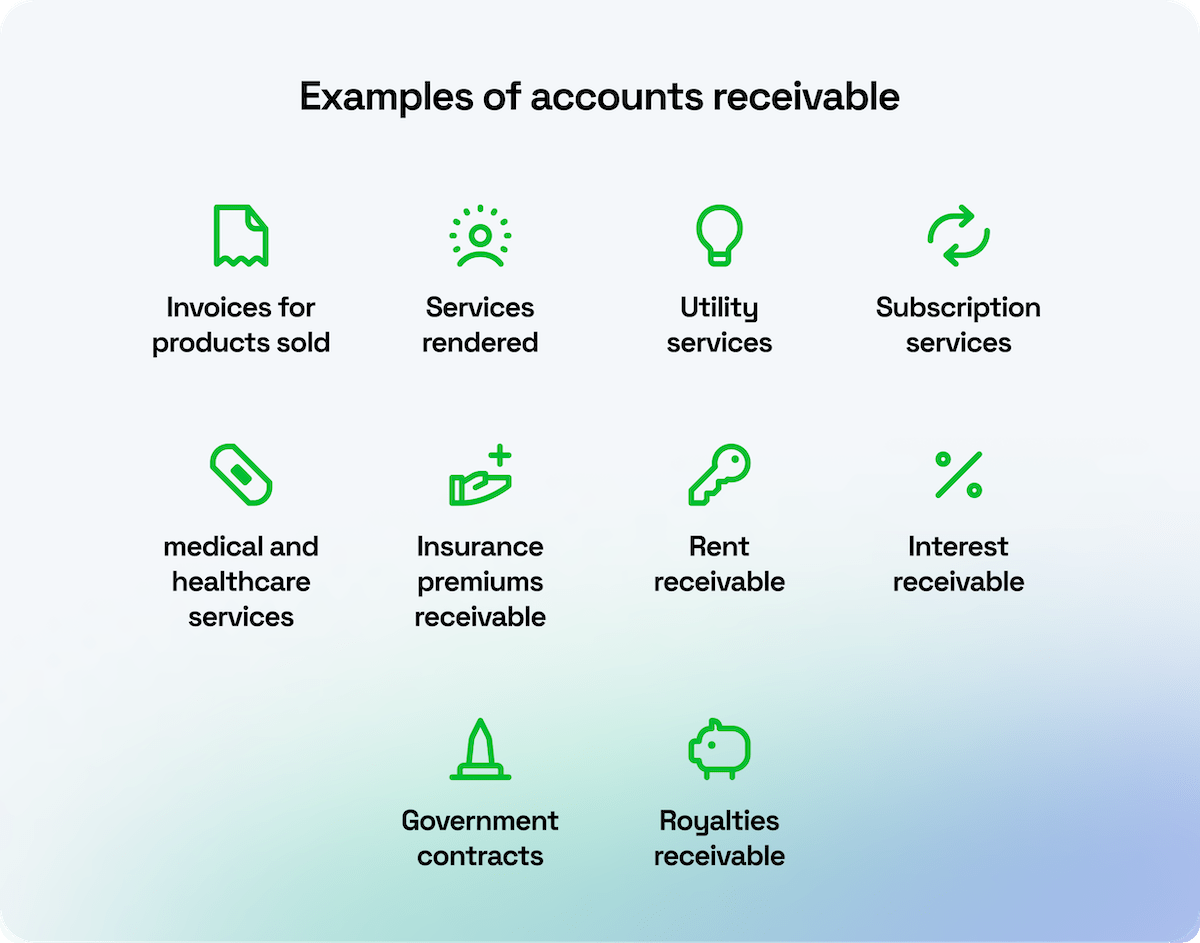

When it comes to accounts receivable, there are a few other terms you should know, including notes receivable, trade/accounts receivable, and other receivables.

What are notes receivable?

Notes receivable are a type of accounts receivable tied to a promissory note, which spells out the amount and terms of the credit agreement. These types of agreements are also likely to involve interest.

What are trade accounts receivable?

Trade accounts receivable refer to accounts related to the sale of goods or services. However, the terms "trade accounts receivable" and "trades receivable" are often interchangeable with AR when it comes to business records.

What are other receivables?

Other receivables are other asset accounts not related to the sale of goods or services. These could include...

- Loans the company has issued

- Insurance claims

- Interest payments

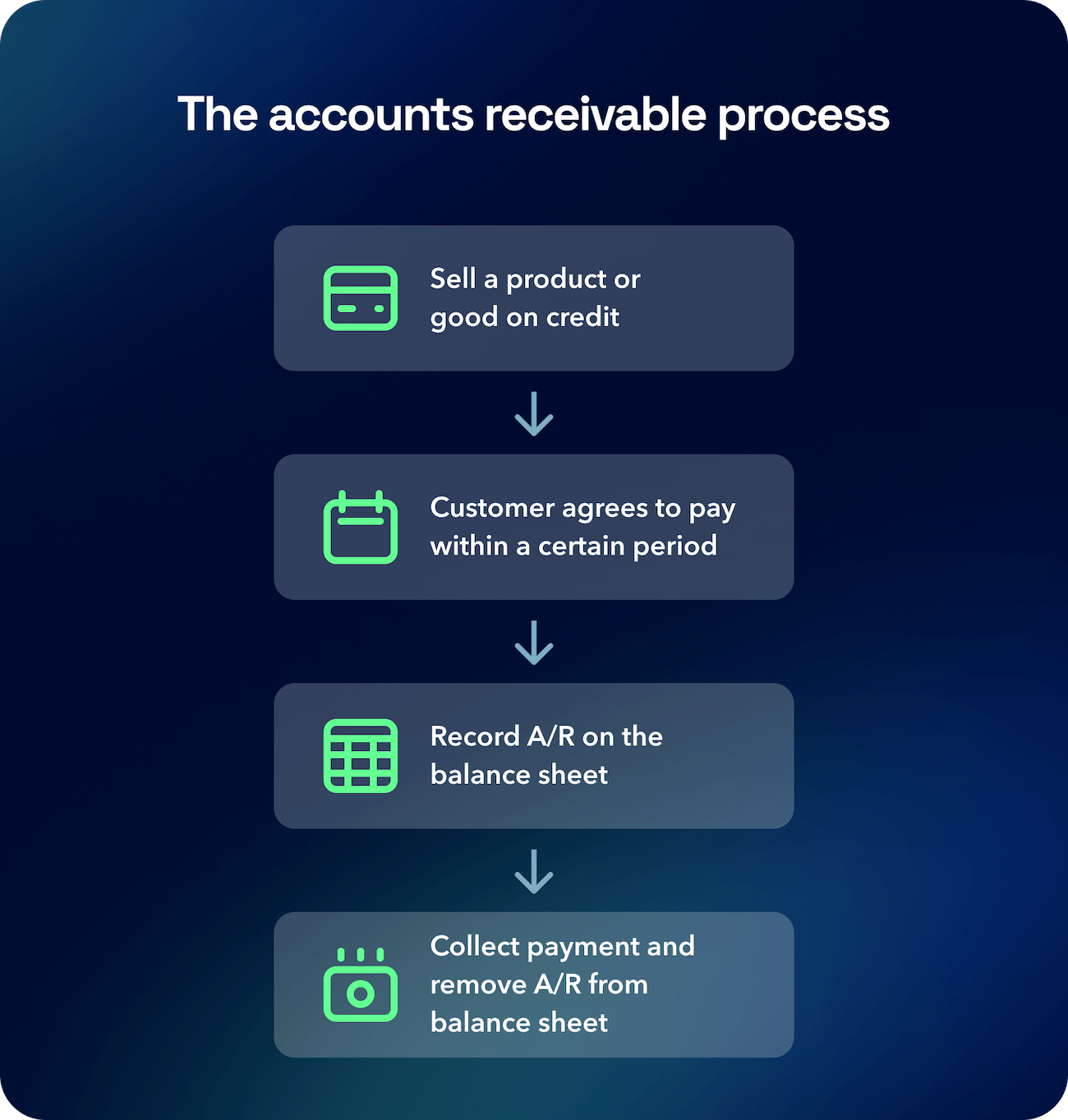

The accounts receivable process

For a smooth and efficient accounts receivable process, follow these guidelines.

Establish clear credit practices

The key to a successful transaction is clarity. This means establishing — and communicating — clear terms when you issue credit to customers.

Some questions to consider:

- What payment terms are you comfortable with? Common terms are 30, 60, and 90 days.

- What payment methods will you accept?

- Will you charge interest on late payments? Late fees? If so, how will you make this clear to your customers?

- Do customers have an easy way to contact you with questions?

Sending invoices to customers

Be sure to invoice customers promptly after delivering the goods or services you agreed upon. Your invoice should include the following elements:

- The current date

- Both parties' contact info

- The payment term (30, 60, or 90 days)

- The amount due

- The payment due date

- A description of the goods or services rendered

Various software offer automated invoice generation, like Plooto and QuickBooks.

It's good to send invoices electronically if possible. This cuts down on delivery, processing time, and labor.

Tracking your accounts receivable

A good tracking process for your accounts receivable means more financial awareness and better projections.

To do this, you'll want to create and maintain an accounts receivable aging report, which tracks the due date and status of each account. (It's helpful to sort accounts by the number of days they're overdue.) Be sure to periodically provide customers with balance statements to ensure they're aware of what they owe.

Accounting for accounts receivable

When dealing with accounts receivable, you'll want to follow the principles of a type of bookkeeping called accrual accounting. This means treating accounts receivable as revenue — even before they're settled.

You'll record accounts receivable transactions in your general ledger, or the primary record of your business's financial history.

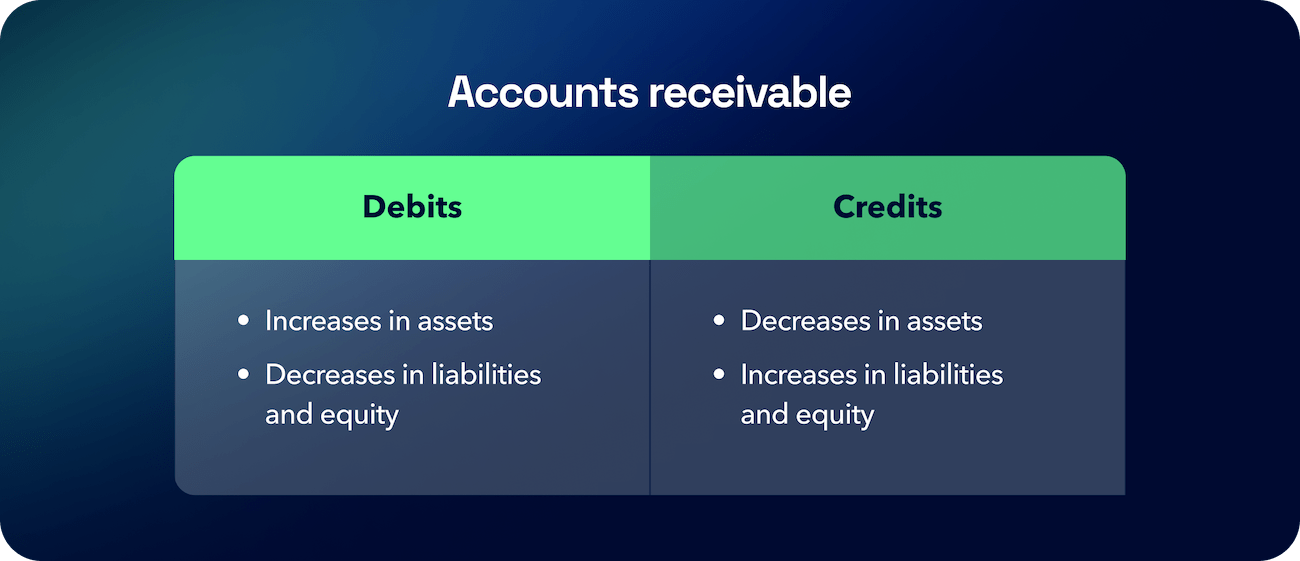

How to record accounts receivable

Once you've sent the invoice, you'll record your accounts receivable balance in the current assets section of your general ledger as a debit amount. As your customer makes payments, you'll record each as a credit amount.

Your past-due accounts may become doubtful accounts: accounts that you no longer expect to be paid. These balances will eventually become bad debt expenses.

It's also important to track bad debt, or the cash you missed out on because customers didn't pay.

This means reviewing your AR status over time and then estimating an "allowance for doubtful accounts" based on that data. This way, a few customer mishaps will be built into your plan, and you won't anticipate funds that you won't collect. This also helps forecast cash flow.

Use this formula: Let's say your business's average accounts receivable are $100,000 per year, and you usually aren't able to collect about 1% of your accounts receivable. In this case, your allowance for doubtful accounts should be (100,000 x 0.01), or $1,000.

Who negotiates the terms of payment?

Terms of payment are generally set and negotiated by the seller's sales and finance teams. However, since the customer service team liaises between the company and the customer, they're likely to be involved in fielding questions and resolving accounts receivable disputes.

The accounts receivable turnover ratio, explained

One valuable way to evaluate accounts receivable is through the lens of the accounts receivable turnover ratio. This refers to the approximate number of times a business collects — or "turns over" — its accounts receivable balance during a given period.

You can calculate this figure by dividing the total net credit sales for that period by the average balance of your accounts receivable across the same period.

.png?width=1750&height=644&name=Accounts%20Receivable%20Turnover%20Ratio%20Formula%20(1).png)

Let's say Business C's net sales last year totaled $400,000. Throughout the year, the average amount in its accounts receivable was $40,000. Its AR turnover ratio, then, would be 10, or (400,000 ÷ 40,000).

What is a good accounts receivable turnover ratio?

Generally, a higher accounts receivable turnover ratio means that your business is collecting its revenue efficiently and has solid credit processes. A lower ratio often means that your collections process is lacking.

It's useful to track the ratio over multiple years, and then reflect on the circumstances under which the business operated most efficiently.

Limitations of the accounts receivable turnover ratio

The accounts receivable turnover ratio is not a perfect metric (the same thing goes for AP turnover, too). It doesn't account for:

- Seasonality. If your business booms in the winter and slows in the summer, for example, your ratio won't be a good representation of turnover.

- Net vs. gross sales. The ratio is often calculated using net sales, which can inflate your numbers considerably. Make sure you know which figure you're using!

- Customer credit risk, credit worthiness, and retention. The ratio does not capture how likely a customer is to return, nor how financially capable they are of making another purchase order.

How to improve your accounts receivable: tips and best practices

There are many ways to improve your AR, but there are a fwe that usually apply to any business.

Offer customers a discount for paying faster

One easy motivator? Offer customers a lower price in exchange for a speedy payment.

Penalize customers that don't pay on time

Charging interest or penalties to late customers can also motivate them to pay on time. However, good communication can negate this problem before it starts — in 2022, 78% of executives "believed better communication could have solved accounts receivable disputes," according to a study from Wakefield and Versapay.

Consider accounts receivable financing

With accounts receivable financing, you might be able to collect early payments on your outstanding invoices. This is a quick process, but it does come with fees and some risk: If customers default, for instance, you risk struggling to pay back your loan.

Use accounts receivable automation software

To make things maximally simple, consider accounts receivable automation software like Plooto. You'll be able to automate your accounts receivable, get notified when invoices are paid, track everything in one place, and enjoy perks like secure credit card transactions.

FAQs

Don't see your question answered here? Contact us today.

Are accounts receivable assets or liabilities?

Accounts receivable are assets — they represent revenue that will be paid out to you shortly.

What are the 4 types of accounts receivable?

The four types of accounts receivable are trade receivables, or accounts reflecting the sale of goods or services; non-trade receivables, or accounts not related to the sale of goods or services, like loans, insurance claims, and interest payments; secured receivables, which are backed by collateral and enshrined by a promissory note; unsecured receivables, which are not backed by collateral.

How do you record accounts receivable?

Accounts receivable should be recorded in the current assets section of your business's general ledger.

Further reading

Learn more about accounts receivable and its its importance to any business.

Get started with Plooto's simple, secure, and accurate AP automation platform — for free

Manage your invoices, automatically sent payment reminders, and stay on top of your cash all in one spot. Start today.

Start free trial